Market move ‘smells like intervention,’ strategist says

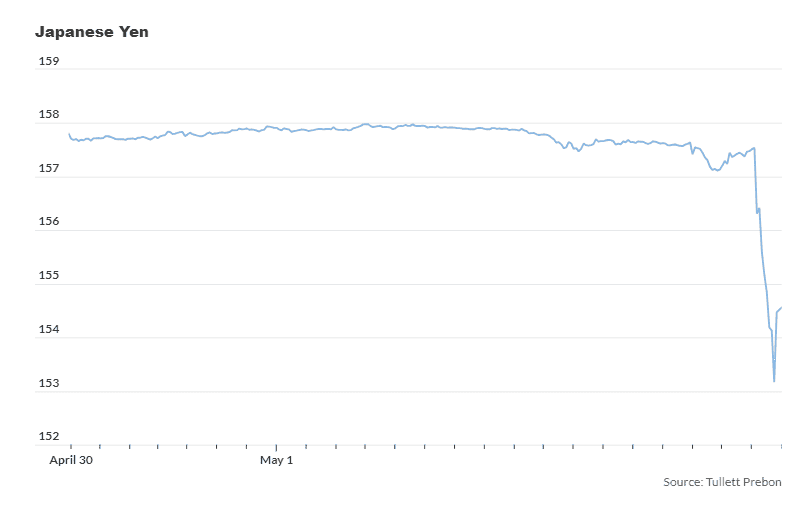

The yen moved violently higher versus the U.S. dollar toward the end of the North American trading day Wednesday, as traders weighed the possibility of further intervention by Japanese authorities to support the currency.

The U.S. dollar was down 2.1% versus the Japanese currency USDJPY, 1.05% to fetch 154.51 yen just before 5 p.m. Eastern time. The dollar slumped hard versus the yen after the 4 p.m. closure of the U.S. stock market, with the greenback trading near 157.44 yen around 4:10 p.m., according to FactSet data.

The sharp move “smells like intervention,” said Marc Chandler, managing director at Bannockburn Global Forex, in an email to MarketWatch.

A surge by the yen on Monday was widely suspected to mark long-threatened intervention aimed at halting the currency’s long slide, though such a move hasn’t been confirmed by authorities. Data released by the Bank of Japan on Tuesday suggested it may have spent $5.5 trillion yen ($35 billion) boosting the currency the day before.

If authorities were stepping in Wednesday, it would mark a more aggressive move, Chandler said, in that such intervention would be taking place outside of Japan’s time zone and wasn’t “reactionary.” Monday’s moves came as the dollar pushed above the 160-yen level for the first time since 1990.

Chandler reiterated that “the only thing worse than no intervention would be failed intervention” — noting that the 158-yen level would mark a 61.8% Fibonacci retracement of Monday’s decline by the dollar/yen pair.

“A move above there and the market may have become more emboldened to challenge Tokyo,” he said.