Shares of Cencora, Inc. (COR Quick QuoteCOR – Free Report) scaled a new 52-week high of $201.48 on Nov 24, 2023, before closing the session marginally lower at $201.30.

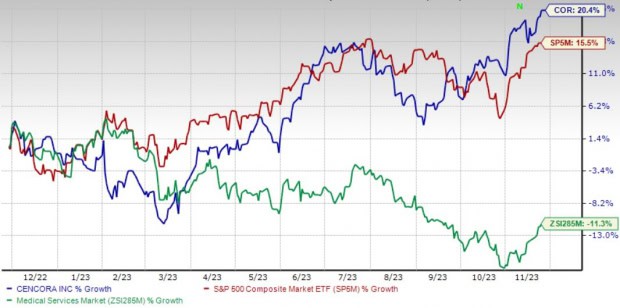

Over the past year, this Zacks Rank #3 (Hold) stock has gained 20.4% against a 11.3% decline of the industry. The S&P 500 has witnessed 15.5% growth in the said time frame.

Over the past five years, the company registered earnings growth of 13% compared with the industry’s 12.8% rise. The company’s long-term expected growth rate of 8.9% compares with the industry’s growth projection of 15.3%. Cencora’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 3.9%.

Cencora is witnessing an upward trend in its stock price, prompted by its strength in the U.S. Healthcare Solutions business. The optimism led by a solid fourth-quarter fiscal 2023 performance and generics and new product launches are expected to contribute further. However, stiff competition and generic deflation persist.

Let’s delve deeper.

Key Growth Drivers

Generics and New Product Launches to Drive Growth: Cencora is expected to benefit from generics growth in the long run, raising investors’ optimism. Cencora is well-positioned to help ensure products get to market as efficiently as possible. Strong organic growth rates in the U.S. pharmaceutical market, improving patient access to care, improved economic conditions and population demographics, introduction of new innovative drugs like hepatitis C drugs, and a continued good brand pricing environment should drive growth. Moreover, the company’s focus on specialty drugs has boded well.

Strength in U.S. Healthcare Solutions Business: The U.S. Healthcare Solutions consists of the legacy Pharmaceutical Distribution Services reportable segment (excluding Profarma), MWI Animal Health, Xcenda, Lash Group, and ICS 3PL. The segment benefits from increasing volume and an expanding customer base, raising investors’ optimism. Strong organic growth rates in the U.S. pharmaceutical market, improving patient access to medical care, enhanced economic conditions and population demographics are likely to favor the segment in the quarters to come.

In the fiscal fourth quarter of 2023, revenues in this segment reflected a rise of 13% on a year-over-year basis on the back of an increase in specialty product sales coupled with overall market growth.

Strong Q4 Results: Cencora’s impressive fourth-quarter fiscal 2023 results buoy optimism. The company’s strong segmental performance on the back of growth in all markets and strong demand for specialty products, especially GLP-1 drugs, were encouraging. Per management, Cencora delivered a solid performance by playing a crucial role in the healthcare system while maintaining efficiency throughout its business. The company remains focused on its strategic priorities and thoughtful capital deployment to deliver long-term growth.

Downsides

Generic Deflation: Generic deflation has been higher than historic norms for several quarters for Cencora, creating a headwind for the business. Generic deflation is still mid to high single-digits for the company.

Stiff Competition: Cencora operates in a highly competitive pharmaceutical distribution and related healthcare services market. The generic industry is facing consolidation of customers and manufacturers, globalization and increasing quality and regulatory challenges. The company faces additional competition from manufacturers, chain drugstores, specialty distributors and packaging and healthcare technology companies.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. (DVA Quick QuoteDVA – Free Report) , Cardinal Health, Inc. (CAH Quick QuoteCAH – Free Report) and Integer Holdings Corporation (ITGR Quick QuoteITGR – Free Report) .

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 18.3%. DVA’s earnings surpassed estimates in all the trailing four quarters, with an average surprise of 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 37.7% compared with the industry’s 5.2% rise in the past year.

Cardinal Health, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 15.2%. CAH’s earnings surpassed estimates in all the trailing four quarters, with an average of 15.7%.

Cardinal Health’s shares have gained 35.4% compared with the industry’s 11.8% rise in the past year.

Integer Holdings, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 11.9%.

Integer Holdings’ shares have rallied 25.9% against the industry’s 3.8% decline in the past year.