The stock is on pace for its largest daily percentage decline since Nov. 8

Shares of Virgin Galactic Holdings Inc. tumbled 8.2% Wednesday after Morgan Stanley downgraded the stock to underweight.

The stock is on pace for its largest daily percentage decline since Nov. 8, when it fell 10.3%. Of 10 analysts surveyed by FactSet, two have a buy rating, four have a hold rating, and six have an underweight or sell rating for Virgin Galactic (SPCE).

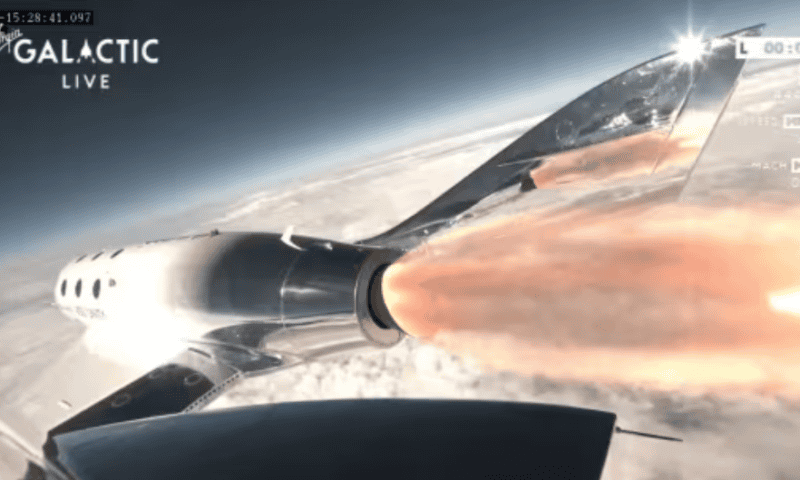

The company completed its Galactic 05 research mission earlier this month, marking its sixth spaceflight in six months.

Virgin Galactic also fleshed out its near-term growth strategy when it reported third-quarter results this month, laying out the roadmap for its new Delta Class spacecraft.

The Delta spacecraft will begin flight tests in 2025 and enter service in 2026. Unlike the company’s current Unity spacecraft, which has four seats for paying passengers, the Delta spacecraft will have six seats, and will be capable of making up to eight spaceflights a month, significantly more than Unity’s one spaceflight a month.

This will increase Virgin Galactic’s monthly revenue per spacecraft from the current maximum of $2.4 million to $28.8 million, the company said.

But in a note released earlier this month, Truist Securities analyst Michael Ciarmoli said that for Virgin Galactic “faster revenue generation is coming … just not anytime soon.” Truist has a sell rating for Virgin Galactic.

Shares of Virgin Galactic have fallen 43.8% in 2023, compared with the S&P 500 index’s SPX gain of 18.8%.