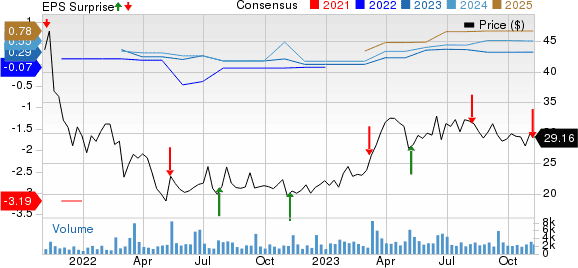

Squarespace (SQSP Quick QuoteSQSP – Free Report) shares fell 1.6% to close at $29.16 on Nov 8, following its third-quarter 2023 results. It reported a loss of 12 cents per share against the Zacks Consensus Estimate of earnings of 12 cents per share. The company had reported earnings of 7 cents in the year-ago quarter.

The company’s third-quarter earnings suffered from a larger income tax provision despite strong top-line growth.

Revenues increased 18.1% year over year to $257.1 million, which beat the consensus mark by 1.96%. At constant currency (cc), revenues increased 16% year over year.

The top line benefited from the strong contribution of the Presence and Commerce segments.

Squarespace, Inc. Price, Consensus and EPS Surprise

Top-Line Details

The Presence segment contributed 69.8% of the revenues compared with 68.9% in the year-ago quarter. Revenues increased 19.6% year over year to $179.5 million. At cc, revenues increased 17% year over year.

The Commerce segment contributed 30.2% of the revenues compared with 31.1% in the year-ago quarter. Revenues increased 14.6% year over year to $77.6 million. At cc, revenues increased 14% year over year.

Total bookings grew to $267.0 million in the reported quarter, up 18% year over year.

Total unique subscriptions increased 5% year over year to more than 4.4 million at the end of the third quarter, compared with 4.2 million at the end of the year-ago period.

Annual run rate revenue (ARRR) grew 18% year on year to $1.014 billion at the end of the third quarter, up from $861.4 million reported at the end of the year-ago period.

Average revenue per unique subscription (“ARPUS”) increased 10% year over year to $226.05 at the end of the third quarter, up from $206.38 at the end of the year-ago period.

Operating Details

In third-quarter 2023, GAAP gross margin contracted 230 basis points (bps) year over year to 79.9%.

Operating expenses increased 6.3% year over year to $177.7 million. The rise in operating expenses was primarily attributed to higher research & development expenses (up 11.4%) and marketing & sales expenses (up 9.1%), offset by a decline in general and administrative expenses (down 6.1%).

Adjusted EBITDA surged 52% year over year to $66.5 million. Adjusted EBITDA margin expanded 580 bps year over year to 25.9%.

GAAP operating margin expanded 540 bps year over year to 10.8%.

Balance Sheet

As of Sep 30, 2023, cash & cash equivalents were $216.5 million compared with $92.7 million as of Sep 30, 2022.

Net debt, as of Sep 30, 2023, was $580.7 million, up from $494 million as of Jun 30, 2023.

Unlevered free cash flow, as of Sep 30, 2023, was $54.1 million, representing 20.7% of total revenues in the reported quarter, compared with $42.1 million as of Sep 30, 2022.

Guidance

For fourth-quarter 2023, Squarespace expects revenues to be between $261 million and $264 million.

Unlevered free cash flow is expected in the range of $56-$60 million in the fourth quarter of 2023.

For 2023, revenues are expected between $1.002 billion and $1.006 billion, up 15% to 16% from 2022.

Zacks Rank & Stocks to Consider

Squarespace currently carries a Zacks Rank #3 (Hold).

Anterix (ATEX Quick QuoteATEX – Free Report) , ASANA (ASAN Quick QuoteASAN – Free Report) and Snowflake (SNOW Quick QuoteSNOW – Free Report) are some better-ranked stocks that investors can consider in the broader sector, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Anterix’s shares have declined 6.4% year to date. ATEX is set to report its second-quarter fiscal 2024 results on Nov 13.

ASANA shares have gained 44.6% year to date. ASAN is set to report its third-quarter fiscal 2024 results on Dec 5.

Snowflake shares have returned 10.8% year to date. SNOW is set to report its third-quarter fiscal 2024 results on Nov 29.