Shares of Rithm Capital Corp. (RITM Quick QuoteRITM – Free Report) have gained 10.1% since it reported better-than-expected third-quarter 2023 results on Oct 26. The quarterly results were aided by higher net servicing revenues, a significant increase in interest income as well as the solid contribution from Servicing as well as Residential Securities, Properties and Loans units. However, the upside was partly offset by an elevated expense level. The amended Merger Agreement announced by Rithm Capital, relating to its acquisition of Sculptor Capital, on Oct 27, 2023, further drove its stock price higher.

Per the Amended Agreement, the updated transaction value was roughly $719.8 million and Sculptor Class A shareholders are now entitled to receive $12.70 per share, up 13.9% from the original bid of $11.15 per share announced by RITM on Jul 24, 2023. Prior to this, the agreement had also been earlier amended on Oct 12, 2023. The transaction is likely to conclude soon post the Sculptor stockholders’ meeting, which is likely to be held on Nov 16 of this year.

Now let’s delve deeper into the third-quarter results.

RITM reported third-quarter 2023 adjusted earnings of 58 cents per share, which surpassed the Zacks Consensus Estimate by a whopping 70.6%. The bottom line soared 81.3% year over year.

Revenues improved 19.6% year over year to $1,089.4 million in the quarter under review. The top line outpaced the consensus mark by 18.2%.

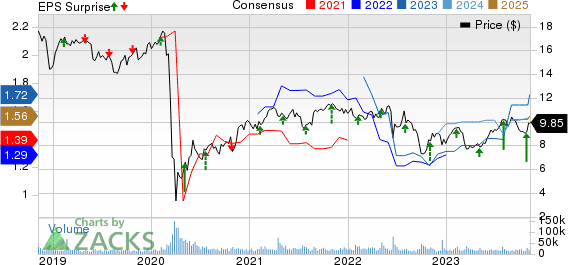

Rithm Capital Corp. Price, Consensus and EPS Surprise

Q3 Operations

Net servicing revenues of Rithm Capital amounted to $463.6 million, which rose 6.8% year over year in the third quarter and beat the Zacks Consensus Estimate of $396 million. Interest income surged 74.3% year over year to $476.6 million, higher than the consensus mark of $389 million.

Gain on originated residential mortgage loans, held for sale, net, fell 26.7% year over year to $149.2 million, which beat the consensus estimate of $140 million.

Total expenses of $759.2 million increased 4.9% year over year in the quarter under review due to higher interest expenses and warehouse line fees.

RITM’s pretax income climbed 55.3% year over year to $273.8 million in the third quarter. Net income of $221.2 million rose 43.5% year over year.

Segmental Update

Origination

The segment’s interest income dropped 30.4% year over year to $29.1 million in the third quarter. Total revenues of $156 million fell 39.2% year over year. The unit incurred a pre-tax loss of $12.5 million, narrower than the prior-year quarter’s loss of $57.2 million.

Servicing

Net servicing revenues amounted to $468.5 million, which grew 23.7% year over year. The segment’s revenues of $613.2 million climbed 39.2% year over year in the quarter under review. Pre-tax income surged 59.2% year over year to $425 million.

MSR Related Investments

The segment’s revenues of $30.4 million plunged 57% year over year in the third quarter. The unit incurred a pre-tax loss of $21.9 million, wider than the prior-year quarter’s loss of $21.8 million.

Residential Securities, Properties and Loans

Interest income of $164.1 million soared 70.8% year over year. The segment’s revenues amounted to $169.2 million in the quarter under review, which more than doubled year over year.

Consumer Loans

The segment reported revenues of $58.9 million, which increased nearly four-fold year over year. Pre-tax income climbed 40.3% year over year to $21.6 million.

Mortgage Loans Receivable

Revenues of $59.5 million advanced 40.5% year over year in the third quarter. The unit’s pre-tax income declined more than two-fold year over year to $19 million.

Corporate

Revenues declined nearly three-fold year over year to $2.1 million in the quarter under review.

Financial Update (as of Sep 30, 2023)

Rithm Capital exited the third quarter with cash and cash equivalents of $1,217.3 million, which decreased 8.9% from the 2022-end level. Total assets of $34.7 billion rose 7% from the figure at 2022 end.

Debt amounted to $24.1 billion, up 10.1% from the figure as of Dec 31, 2022.

Total equity of $7,268 million advanced 3.7% from the 2022-end figure.

RITM generated net cash from operations of $1,667.5 million in the first nine months of 2023, which declined more than four-fold from the prior-year comparable period.

Book value per share was $12.32 in the quarter under review, which grew 1.8% year over year.

Capital-Deployment Update

Rithm Capital did not buy back any shares in the reported quarter. Management also paid out a quarterly common dividend of 25 cents per share.

Zacks Rank

Rithm Capital currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Finance Sector Releases

Of the other Finance sector players that have reported third-quarter results so far, the bottom-line results of Synchrony Financial (SYF Quick QuoteSYF – Free Report) , M&T Bank Corporation (MTB Quick QuoteMTB – Free Report) and Morgan Stanley (MS Quick QuoteMS – Free Report) beat the respective Zacks Consensus Estimate.

Synchrony Financial reported third-quarter 2023 adjusted earnings per share of $1.48, which beat the Zacks Consensus Estimate by 2.8%. The bottom line rose 0.7% year over year. Net interest income improved 11% year over year to $4,362 million, beating the consensus mark by 1.6%. Other income amounted to $92 million, which surged 109.1% year over year in the third quarter. Total loan receivables of SYF grew 14% year over year to $97.9 billion. The purchase volume advanced 5% year over year to $47,006 million in the third quarter. Interest and fees on loans of $5,151 million improved 21% year over year. New accounts of 5.7 million slipped 2% year over year.

M&T Bank’s third-quarter 2023 net operating earnings per share of $4.05 surpassed the Zacks Consensus Estimate of earnings of $3.94 per share. The bottom line compared favorably with the earnings of $3.83 per share earned in the year-ago quarter. Net income available to common shareholders was $664 million, which increased 6.9% from the prior-year quarter. MTB’s quarterly revenues were $2.34 billion, beating the consensus estimate of $2.32 billion. Also, the reported figure increased 4% year over year. Total non-interest income was $560 million, down marginally year over year. The efficiency ratio was 53.7%, up from 53.6% in the year-earlier quarter.

Morgan Stanley posted third-quarter 2023 earnings of $1.38 per share, which surpassed the Zacks Consensus Estimate of earnings of $1.27 per share. However, the bottom line reflects a decline of 6% from the year-ago quarter. Fixed-income trading revenues decreased 11%, while equity trading income was up 2% year over year. While equity underwriting fees of MS increased 9%, fixed income underwriting income was down 31% and advisory fees tanked 35%. Therefore, total IB fees (in the Institutional Securities division) decreased 27% from the prior-year quarter. Net revenues were $13.27 billion, up 2% from the prior-year quarter. The top line also beat the consensus estimate of $13.08 billion. Total non-interest revenues of $11.3 billion increased 8%.