Shares of Employers Holdings, Inc. (EIG Quick QuoteEIG – Free Report) declined 3.6% since it reported third-quarter 2023 results on Oct 25. Investors might be concerned about an elevated expense level, which resulted from increased compensation-related expenses, policyholder dividends and bad debt expenses. Geo-political pressure and continued inflationary headwinds may also have spooked the investors.

The downside from rising expenses in the third quarter was offset by new business growth and strong renewal rates as well as a strong contribution from the Employers segment.

EIG reported third-quarter 2023 adjusted earnings per share (EPS) of 68 cents, which outpaced the Zacks Consensus Estimate by 6.3%. The bottom line advanced 21% year over year.

Total revenues amounted to $203.5 million, which dipped 0.4% year over year in the quarter under review. The top line fell short of the consensus mark by 5.9%.

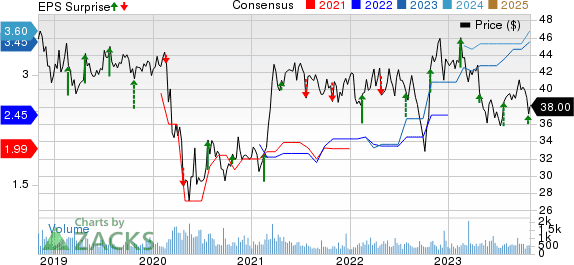

Employers Holdings Inc. Price, Consensus and EPS Surprise

Q3 Update

Gross premiums written improved 4% year over year to $196.2 million. Net premiums written of $194.5 million rose 4% year over year in the third quarter.

Employers Holdings’ net premiums earned grew 3% year over year to $184.6 million but missed the Zacks Consensus Estimate of $190 million.

Net investment income of $25.9 million advanced 9% year over year in the quarter under review, attributable to improved bond yields. However, the metric lagged the consensus mark of $26.3 million.

Total expenses increased 3% year over year to $186.1 million. Losses and loss adjustment expenses witnessed a 2% year-over-year rise, while commission expenses escalated 6% year over year. Underwriting and general and administrative expenses increased 4% year over year.

EIG reported an adjusted net income of $17.7 million, which climbed 14% year over year.

Policies in force was 126,120 as of Sep 30, 2023, which grew 5% year over year.

Segmental Update

Employers: The unit recorded net premiums earned of $182.7 million, which grew 2.7% year over year in the third quarter. Net investment income of $23.4 million rose 9.3% year over year. Pre-tax income declined 20% year over year to $20.8 million.

Underwriting income climbed 28.1% year over year to $4.1 million in the quarter under review. The combined ratio improved 50 basis points (bps) year over year to 97.8% and also came lower than the Zacks Consensus Estimate of 103%.

Cerity: Net premiums earned amounted to $1.9 million in the segment, which more than doubled year over year. Net investment income climbed 33.3% year over year to $1.6 million in the third quarter. The unit incurred a pre-tax loss of $1.9 million, narrower than the prior-year quarter’s loss of $2.4 million.

Underwriting loss of $3.1 million came narrower than the prior-year quarter’s loss of $3.3 million.

Corporate and Other: Investment income fell 18.2% year over year to $0.9 million in the quarter under review. The unit incurred a pre-tax loss of $1.5 million against the prior-year quarter’s pre-tax income of $0.1 million.

Financial Update (As of Sep 30, 2023)

Employers Holdings exited the third quarter with total investments of $2,333.9 million, down 9.1% from the figure at 2022 end. Cash and cash equivalents of $108.8 million climbed 22% from the 2022-end level.

Total assets of $3,527 million slipped 5.1% from the figure at 2022 end.

Total stockholders’ equity slid 2.7% from the 2022-end level to $919 million.

EIG generated net cash from operations of $21.8 million in the first nine months of 2023, which declined more than three-fold from the prior-year comparable period.

Adjusted book value per share was $45.72, which improved 5% year over year.

Annualized adjusted return on stockholders’ equity improved 80 bps year over year to 6% in the quarter under review.

Capital Deployment Update

Employers Holdings bought back shares worth $14.4 million in the third quarter. It had a leftover capacity of $36.4 million under its repurchase authorization as of Sep 30, 2023.

Management paid out regular quarterly dividends of $7.3 million.