Caesars Entertainment, Inc. (CZR Quick QuoteCZR – Free Report) reported impressive third-quarter 2023 results, with earnings and revenues surpassing the Zacks Consensus Estimate. Also, the top and the bottom lines increased on a year-over-year basis.

The company’s uptrend was primarily driven by the solid performance of the Regional segment on the back of the opening of two temporary gaming facilities, which are Caesars Virginia and Harrah’s Columbus Nebraska, as well as the reopening of Horseshoe Lake Charles. Also, gaming revenues from the Caesars Digital segment, attributable to additional state launches of its online and retail Caesars Sportsbooks, added to the growth momentum. Additionally, improvements in the year-over-year hotel occupancy rates within the Las Vegas segment bode well, despite the ongoing economic uncertainties.

Following the results, shares of this diversified gaming and hospitality company increased 4.8% in the after-market trading session on Oct 31.

Earnings & Revenue Discussion

During the quarter, the company recorded adjusted earnings per share (EPS) of 34 cents, beating the Zacks Consensus Estimate of earnings of 27 cents per share by 25.9%. In the prior-year quarter, the company reported an adjusted EPS of 24 cents.

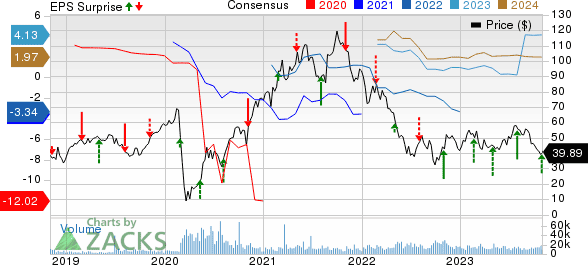

Caesars Entertainment, Inc. Price, Consensus and EPS Surprise

Net revenues during the quarter were $2,994 million, beating the consensus estimate of $2,913 million by 2.8%. In the prior-year quarter, the company generated net revenues of $2,887 million.

Segmental Performance

During the third quarter, net revenues in the Las Vegas segment were $1,120 million, up from $1,077 million reported in the year-ago quarter. This segment’s net revenues were lower than our model’s expected value of $1,148.5 million. The segment’s adjusted EBITDA amounted to $482 million compared with $480 million reported in the prior-year quarter.

In the Regional segment, quarterly net revenues were $1,565 million, up from $1,530 million reported in the year-ago quarter. This segment’s net revenues were higher than our expected value of $1,516.7 million. The segment’s adjusted EBITDA reached a record value of $575 million compared with the $570 million reported in the prior-year quarter.

Third-quarter net revenues in the Caesars Digital segment were $215 million, up from $212 million reported in the prior-year quarter. Our estimate for this segment’s net revenues was $158.4 million, which was on the lower side of the reported figure. The segment’s adjusted EBITDA totaled $2 million compared with the $(38) million reported in the year-ago quarter.

In the Managed and Branded segment, net revenues during the quarter were $98 million, up from $70 million reported in the prior-year quarter. Our estimate for the metric was $77.8 million. The segment’s adjusted EBITDA was $20 million compared with the $22 million reported in the prior-year quarter.

Net revenues in the Corporate and Other segment in the third quarter were $(4) million compared with $(2) million reported in the prior-year quarter. Our model predicted the value to be $(0.5) million. This segment’s adjusted EBITDA totaled $(36) million compared with the $(22) million reported in the year-ago quarter.

Balance Sheet

As of Sep 30, 2023, Caesars Entertainment’s cash and cash equivalents were $841 million, down from $1,038 million reported as of Dec 31, 2022.

Net debt, as of Sep 30, 2023, was $11,614 million, down from $12,047 million as of Dec 31, 2022.