Shares of F.N.B. Corporation (FNB Quick QuoteFNB – Free Report) gained 1.1% in the after-market trading following the release of its third-quarter 2023 results. Adjusted earnings per share of 40 cents outpaced the Zacks Consensus Estimate of 36 cents. The bottom line reflects a rise of 2.6% from the prior-year quarter.

The results were primarily aided by a rise in net interest income (NII) and solid loan demand. Higher interest rates supported growth in margins. However, increased expenses, significantly higher provisions and lower non-interest income were the undermining factors.

After considering significant items, the net income available to common stockholders was $143.3 million, up from $135.5 million in the year-ago quarter. Our estimate for the metric was $124.1 million.

Revenues Improve, Expenses Rise

Net revenues (GAAP basis) were $408.2 million, up 7.5% from the year-earlier quarter. The top line also beat the Zacks Consensus Estimate of $403.1 million.

Quarterly NII was $326.6 million, up 9.9% from the year-earlier quarter. Our estimate for NII was $316.6 million.

The net interest margin (FTE basis) (non-GAAP) expanded 7 basis points (bps) year over year to 3.26%.

Non-interest income was $81.6 million, down 1.1% year over year. The fall was primarily due to lower mortgage banking income, capital markets income and service charges. Our estimate for the metric was $78.9 million.

Non-interest expenses were $218 million, up 11.8% year over year. Our estimate for the same was $214.4 million.

As of Sep 30, 2023, the common equity Tier 1 (CET1) ratio was 10.2% compared with 9.7% in the prior-year quarter.

At the end of the third quarter, average loans and leases were $31.7 billion, up 2.2% sequentially. Average deposits totaled $34.1 billion, up marginally from the previous quarter.

Credit Quality Worsens

F.N.B. Corp’s provision for credit losses was $25.9 million, which increased significantly from the prior-year quarter. Our estimate for provisions was $22.5 million.

The ratio of non-performing loans and other real estate owned (OREO) to total loans and OREO increased 4 bps to 0.36%. Total delinquency increased 4 bps to 0.63%.

In the reported quarter, net charge-offs to total average loans were 0.47%, up 43 bps year over year.

Our Take

F.N.B. Corp’s solid liquidity position bodes well for the future. The company’s top line is expected to continue to benefit from its efforts to increase fee income and opportunistic acquisitions. However, given the challenging operating backdrop, the company’s asset quality is likely to remain under pressure going forward. Additionally, persistently rising expenses, owing to digitization and strategic buyouts, will likely hurt profits in the near term.

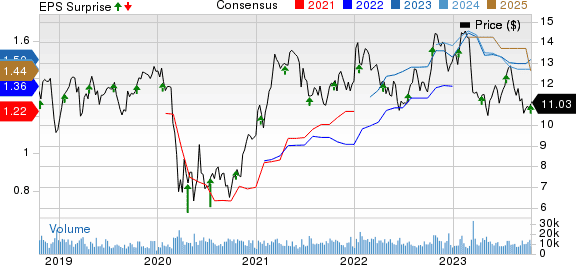

F.N.B. Corporation Price, Consensus and EPS Surprise

Performance of Other Banks

Bank of New York Mellon Corporation’s (BK Quick QuoteBK – Free Report) third-quarter 2023 adjusted earnings of $1.27 per share surpassed the Zacks Consensus Estimate of $1.14. The bottom line reflects a rise of 5% from the prior-year quarter.

BK’s results were primarily aided by a rise in net interest revenues, marginally higher fee revenues and lower expenses. The assets under management (AUM) balance witnessed a rise, which was another major positive for the company. However, the credit quality was relatively weak in the quarter for BK.

Wells Fargo & Company’s (WFC Quick QuoteWFC – Free Report) third-quarter 2023 adjusted earnings per share of $1.39 outpaced the Zacks Consensus Estimate of $1.25. The figure improved 6.9% year over year. The adjusted figure excludes the impact of discrete tax benefits relating to the resolution of prior period’s tax matters.

WFC’s results benefited from higher net interest income and non-interest income. An improvement in capital ratios and a decline in expenses were other positives. However, worsening credit quality and a dip in loan balances were the undermining factors for WFC.