State Street’s (STT Quick QuoteSTT – Free Report) third-quarter 2023 adjusted earnings of $1.93 per share surpassed the Zacks Consensus Estimate of $1.77. The bottom line was 6% higher than the prior-year quarter level.

Shares of STT gained 2.2% in pre-market trading on a better-than-expected quarterly performance. However, the full day’s trading session will depict a clearer picture.

Results have primarily been aided by an increase in fee revenues. Also, the company did not record any provisions in the quarter, which was a positive. However, lower net interest revenues (NIR) and higher expenses have hurt results to some extent.

In the reported quarter, the company recorded a loss on sale related to a previously disclosed investment portfolio repositioning. However, in the year-ago quarter, it recorded acquisition and restructuring costs. Net income available to common shareholders (after considering the notable items) was $398 million, down from $669 million in the year-ago quarter. Our projection for the metric was $533.5 million.

Revenues Decline, Expenses Rise

Total revenues of $2.69 billion declined 9.1% year over year. Also, the top line missed the Zacks Consensus Estimate of $2.92 billion.

NIR was $624 million, down 5.5% year over year. The decline was due to lower average deposit balances and deposit mix shift, partially offset by the impacts of higher interest rates. The net interest margin rose 1 basis point year over year to 1.12%. Our estimates for NIR and NIM were $585.5 million and 1.05%, respectively.

Total fee revenues increased 2.7% year over year to $2.36 billion. The rise was driven by an increase in servicing fees, management fees, software and processing fees, and other fee revenues. We estimated the metric to be $2.39 billion.

Non-interest expenses were $2.18 billion, up 3.3% year over year. The rise was due to an increase in almost all cost components. In the reported quarter, the company did not record any costs related to acquisition and restructuring. Our estimate for the metric was $2.20 billion.

In the third quarter, STT did not record any provision for credit losses, just like the prior-year quarter. Our prediction for provision for credit losses was $12.8 million.

The common equity Tier 1 ratio was 11.0% as of Sep 30, 2023, compared with 13.2% in the corresponding period of 2022. The return on common equity was 7.3% compared with 11.2% in the year-ago quarter.

Asset Balances Increase

As of Sep 30, 2023, total assets under custody and administration were $40.02 trillion, up 12.1% year over year. The rise was driven by higher quarter-end equity market levels and net new business. We had projected the metric to be $39.3 trillion.

Assets under management were $3.69 trillion, up 12.9% year over year, primarily driven by higher quarter-end market levels. Our estimate for the metric was $3.7 trillion.

Share Repurchase Update

In the reported quarter, State Street repurchased shares worth $1 billion.

Our Take

Persistently rising expenses due to the company’s strategic buyouts and investments in franchise will likely hurt the bottom line to an extent. A tough operating backdrop is another major concern. Nonetheless, higher interest rates and solid business servicing wins are expected to keep supporting State Street’s financials.

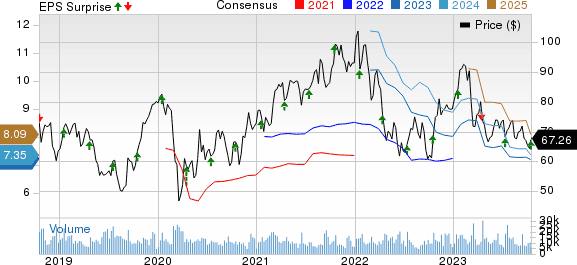

State Street Corporation Price, Consensus and EPS Surprise

Performance of Other Banks

Citigroup Inc.’s (C Quick QuoteC – Free Report) third-quarter 2023 earnings per share (excluding divestiture-related impacts) of $1.52 outpaced the Zacks Consensus Estimate of $1.26.

In the quarter, Citigroup witnessed a rise in revenues, driven by higher revenues in the Institutional Clients Group, as well as the Personal Banking and Wealth Management segments. The higher cost of credit was a spoilsport for C.

Support from higher interest rates, the First Republic Bank deal, robust consumer and commercial banking businesses and solid loan balance drove JPMorgan’s (JPM Quick QuoteJPM – Free Report) third-quarter 2023 earnings to $4.33 per share. The bottom line handily outpaced the Zacks Consensus Estimate of $3.89.

The results included net investment securities losses and legal expenses. After excluding these, JPM’s quarterly earnings were $3.94 per share.