Two Federal Reserve officials have suggested that the central bank may leave interest rates unchanged at its next meeting in three weeks

WASHINGTON — Two Federal Reserve officials suggested Monday that the central bank may leave interest rates unchanged at its next meeting in three weeks because a surge in long-term interest rates has made borrowing more expensive and could help cool inflation without further action by the Fed.

Since late July, the yield, or rate, on the 10-year U.S. Treasury note has jumped from around 4% to about 4.8%, a 16-year high. The run-up in the yield has inflated other borrowing costs and raised the national average 30-year mortgage rate to 7.5%, according to Freddie Mac, a 23-year high. Business borrowing costs have also risen as corporate bond yields have accelerated.

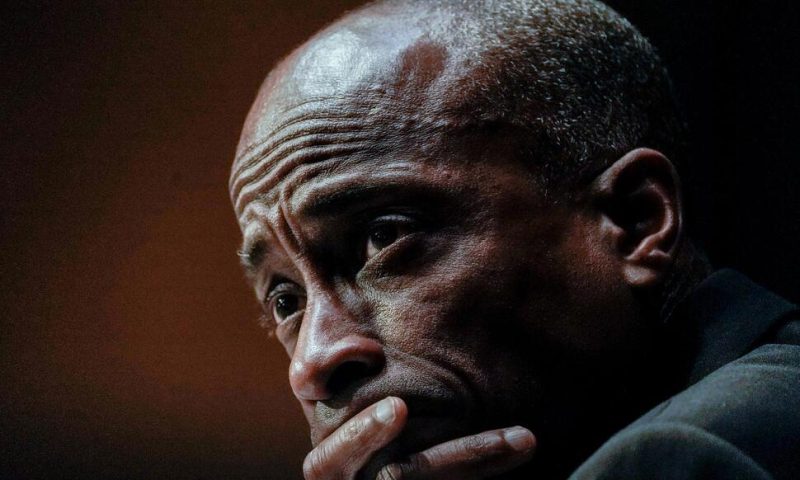

Philip Jefferson, vice chair of the Fed’s board and a close ally of Chair Jerome Powell, said in a speech Monday to the National Association for Business Economics that he would “remain cognizant” of the higher bond rates and “keep that in mind as I assess the future path of policy.”

U.S. stock prices reversed their losses after Jefferson’s comments. The S&P 500 was up 0.5% in late trading.

Jefferson’s comments followed a speech to the NABE earlier in the day by Lorie Logan, president of the Federal Reserve Bank of Dallas and a voting member of the Fed’s rate-setting committee. She also indicated that higher long-term bond rates could help serve the central bank’s efforts to slow inflation to its 2% target.

Since March of last year, the Fed has raised its benchmark short-term rate 11 times, from near zero to roughly 5.4%. The rate hikes have been intended to defeat the worst bout of inflation in more than 40 years. But they have also led to much higher borrowing rates and sparked worries that they could trigger a recession.

“If long-term interest rates remain elevated” because investors are increasingly concerned about the risks of holding long-term bonds, “there may be less need to raise the fed funds rate,” Logan said, referring to the Fed’s benchmark rate. Bond rates rise when investors find them riskier to buy or hold.

And last Thursday, Mary Daly, president of the San Francisco Fed, said that if longer-term interest rates remain high, “the need for us to take further action is diminished.”

The Fed officials’ remarks coincide with increasing expectations in financial markets that the Fed will skip rate hikes at its meeting Nov. 1, as well as at the following meeting Dec. 13, and simply leave its benchmark rate at its current high level through the end of this year. Futures markets have priced in only a 12% chance of a rate hike in November and 26% in December, both significantly lower than on Friday, when a surprisingly robust jobs report was released.

Fed officials have not pushed back against those expectations in their remarks, a sign they may not disagree with them at the moment.

“There’s this growing sense of comfort among Fed officials with the July rate hike having been the last one in this tightening cycle and now focusing on how long to keep monetary policy at the current restrictive level,” said Gregory Daco, chief economist at EY, the accounting and consulting firm.

One issue that economists and Fed officials are trying to determine is what factors are pushing longer-term rates higher. The Fed’s rate hikes themselves don’t automatically translate into higher longer-run borrowing costs, such as the 10-year Treasury yield. Market forces, expectations for future inflation and for future economic growth also affect yields.

Logan noted that if longer-term rates are rising mostly because investors expect the economy to grow more quickly in the future, the Fed might have to keep lifting their short-term rate to cool the economy. But analysts increasingly think that the 10-year rate is rising because investors see greater volatility in inflation and the economy and consider holding longer-term bonds to be more risky. In that case, the Fed doesn’t necessarily have to do more to cool the economy.

Another issue bedeviling Fed officials is how long it may take from the time they hike short-term rates until those higher rates impact the economy. The economist Milton Friedman said in the 1960s that the Fed’s policies work with “long and variable lags,” and yet now Fed officials disagree with how long they are.

Logan, like Fed governor Christopher Waller, said she thinks much of the impact of the Fed’s rate increases have already occurred, as businesses have reacted quickly because Powell and other Fed officials issued clear warnings that rates were likely to rise quickly.

But Jefferson noted the large amount of corporate debt that was refinanced at very low interest rates during the pandemic, and said that businesses would have to refinance it in coming years at higher rates, potentially slowing growth.

Jefferson said that when thinking about future interest rate decisions, he would have to keep in mind all the rate hikes the Fed has imposed, that have yet to hit the economy, “and that could influence what I think should happen next.”