The stock market’s extended rout turned the Dow negative for the year Tuesday and intensified the focus on a closely watched level for the S&P 500.

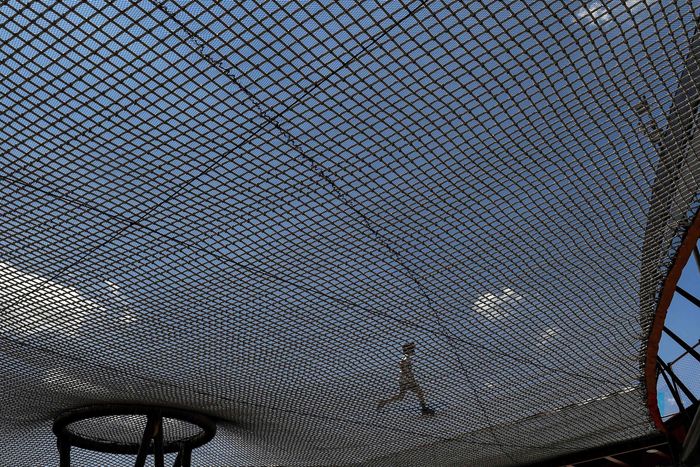

“S&P 500 quickly approaching cluster of support at 4,200,” said technical analyst Mark Arbeter, president of Arbeter Investments LLC, in a note and on X:

Analysts have been flagging the 4,200 level as an important test of support. The S&P 500 SPX was down 1.2% near 4,237 early Tuesday afternoon, while a drop of nearly 350 points, or 1%, for the Dow Jones Industrial Average DJIA erased the blue-chip gauge’s 2023 gain. The S&P 500 remains up more than 10% for the year to date, buoyed by gains for megacap tech stocks.

As Arbeter notes, the 200-day moving average stands near 4,202 on Tuesday. And 4,200 is also near both a 38.2% Fibonacci retracement of the stock market rally off the October 2022 low and a 50% retracement of the rally seen off the March low.

“Should get at least a bounce from this region,” Arbeter wrote.