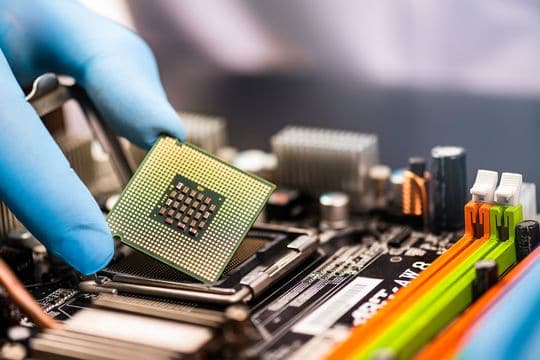

Makers of computers, smartphones and other products are designing semiconductor chips in-house

The world is experiencing a multi-trillion-dollar shift in the semiconductor industry. The semiconductor revolution (which I have discussed for years) has enabled much of the technological progress we have witnessed over the past 50 years.

More powerful semiconductors give more computing power, which allows us to complete ever-challenging and more complex tasks. For example, the advances in artificial intelligence, from large-language models to self-driving cars, are possible because companies such as Nvidia NVDA, +1.47% and Tesla TSLA, +0.86% have developed chips with enough computing power to process and analyze the massive amounts of data needed for AI to work.

The largest tech companies are among the fastest-growing buyers of semiconductors. Companies including Apple AAPL, +0.74%, Alphabet GOOG, +0.70%, Microsoft MSFT, +0.17% and Meta Platforms META, +0.59% purchase billions of dollars of chips each year to run phones, PCs, servers and more. Big tech companies including Intel INTC, +0.32%, Nvidia, Broadcom AVGO, +0.58%, Qualcomm QCOM, +2.55% and Advanced Micro Devices AMD, +1.23% purchase chips from an array of semiconductor designers that make chips for different applications.

Almost all of these chip designers are “fabless” — meaning they outsource the manufacturing of the chips to a third-party foundry, such as Taiwan Semiconductor Manufacturing TSM, +0.70% or GlobalFoundries GFS, +0.76%.

So here is the multi-trillion dollar shift: big tech and the other major semiconductor buyers are designing more and more of their own semiconductors in-house, rather than pad high margins at the fabless semis.

Why? The big tech companies have the scale and capability to design application-specific chips, at lower cost, that also significantly improve the quality of their products when compared to the same product built around the generic off-the-shelf chips designed by third parties.

This trend has already started and will only continue to accelerate. For example, almost all of Apple’s products come with chips designed by Apple in California. Apple cut Intel and its x86 architecture from the Mac starting in 2021. A decade earlier, Apple cut Samsung’s chip out of the iPhone. Apple has also tried to cut Qualcomm’s Snapdragon modem from the iPhone, but has signed a new contract with Qualcomm to supply the iPhone with 5G modems through 2026 (at least in part). Tesla also designed its own CPU to control its cars as well as its own AI chip, known as the D1, which powers the Dojo Supercomputer (more info here).

The value provided by the fabless semis is diminishing as big tech grows in scale and capability.

Many other major tech companies design more of their own chips, including Alphabet, Meta Platforms, Microsoft and Amazon.com AMZN, +1.67%.

As this trend continues to accelerate, many, if not most, of the fabless chip designers may lose their biggest customers. But really, what value do the fabless semis offer to their customers? These four key attributes of the fabless semis encompass their value proposition:

- Intellectual Property

- Software/Integration

- Talent/Know-How

The reason that the big tech companies are starting to replace third-party chips with in-house silicon is that the value provided by the fabless semis is diminishing as big tech grows in scale and capability. Apple, for instance, clearly has enough talented engineers and capital to design chips itself.