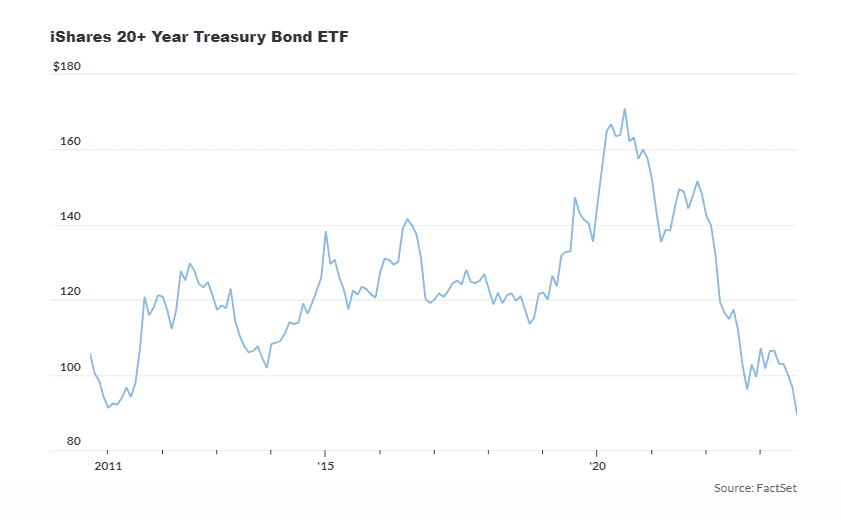

One of the most heavily-traded exchange-traded funds tracking performance in the U.S. Treasury market has just fallen to its lowest level in more than 12 years.

The iShares 20+ Year Treasury Bond ETF TLT, better known by its ticker TLT, broke below $90 a share on Monday and was trading at $89.52 in recent trade.

If it finishes at or below this level, it would mark its lowest close since March 8, 2011, when it closed at $89.68. If it closes below $89.49, it would mark its lowest close since Feb. 18 of that year.

The ETF has fallen nearly 50% from its all-time closing high of $171.57, reached on Aug. 4, 2020, according to Dow Jones Market Data. It’s down 5.1% since the start of September, and 10.4% since the start of the third quarter, according to FactSet data.

The ETF has been falling for weeks as Treasury yields have trended higher, but it was rocked last week as yields on the 10-year Treasury note and 30-year Treasury bond shot higher following Wednesday’s Federal Reserve press conference, where the central bank and its chairman, Jerome Powell, unveiled plans to keep interest rates higher for longer than investors had previously expected.

The yield on the 10-year note BX:TMUBMUSD10Y broke above 4.50% earlier to trade at its highest level in 16 years. The yield on the 30-year bond BX:TMUBMUSD30Y is trading at its highest level in more than 12 years, up 13 basis points on Monday at 4.648%.

Hedge-fund manager Bill Ackman and other investors have recently called on investors to bet against the 30-year, with Ackman saying in early August that his firm had taken a large bet against the bonds, believing that the yield could soon rise to 5.5%. Bond yields move inversely to prices, rising as prices fall and vice versa.

According to FactSet, TLT has more than $38 billion in assets, making it the largest Treasury bond ETF of its type. It aims to track performance of Treasury bonds with a duration of more than 20 years, according to an iShares fact sheet published in June.