The S&P 500 began a rally off its cyclical bottom 11 months ago, after the consumer-price index showed hotter-than-expected inflation. A similar move following Wednesday’s data is unlikely, according to Jonathan Krinsky, chief market technician at BTIG.

Data released Wednesday showed U.S. consumer price inflation rose 0.6% in August, the biggest monthly increase in 14 months, but in line with forecasts. The so-called core inflation, which excludes food and energy prices, rose 0.3% in August, a tick above Wall Street expectations.

The S&P 500 SPX closed up 0.1% on Wednesday, after swings between gains and losses earlier, according to FactSet data.

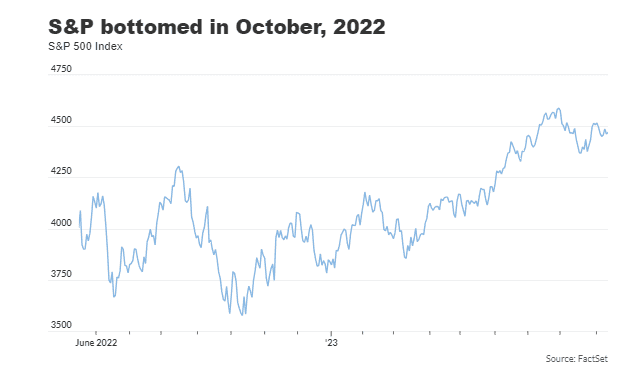

In October 2022, the gauge of large-cap U.S. equities put in a cyclical bottom at 3,577, according to FactSet data. Since then, the S&P 500 has gained 25%.

The S&P 500 was 14% below its 200-day moving average 11 months ago, while the index is now 7% above its 200-day moving average, Krinsky said in a Wednesday note.

Still, the percentage of S&P 500 components above their 200-day moving average was only 48% as of Wednesday, well below the historical average, suggesting limited market breadth, according to Krinsky. Market breadth refers to measurements of how many stocks are participating in a move.

Since 1990, the average reading of such a metric 11 months after a major low has been 76%, noted Krinsky.

“The current landscape is either the slowest/ weakest start to a new bull we have ever seen, or it’s one of the longest/strongest bear market rallies we have ever seen,” said Krinsky. “We side more with the latter and do not expect today’s move to result in anything like what we saw 11 months ago,” he said.