A popular gauge of the dollar’s value is nearing its highest level in 6 months

The U.S. dollar is proving its haters wrong.

Not only is the buck defying the expectations of Wall Street strategists who had anticipated that it would weaken this year, it’s also proving once again that talk of de-dollarization has been over-hyped.

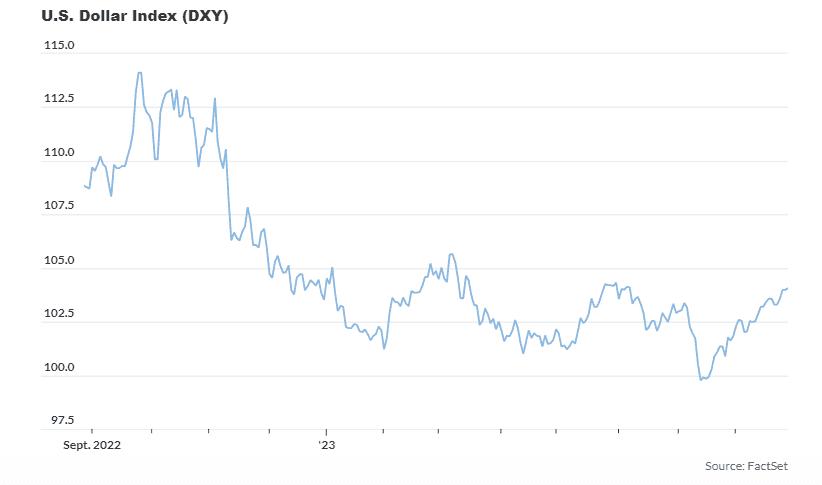

In financial markets, a gauge of the dollar’s value against its biggest rivals is nearing its highest level in six months. The ICE U.S. Dollar Index DXY, a gauge of the dollar’s strength against the euro EURUSD, 0.13% and other major currencies like the Japanese yen USDJPY, -0.10% and British pound GBPUSD, 0.21%, traded at its highest level since early June on Friday after Federal Reserve Chairman Jerome Powell helped catapult it higher by talking up the possibility of more interest-rate hikes.

The index was adding to those gains on Monday, trading 0.1% higher at 104.13, according to FactSet data. A break above 104.70 would put it at its highest intraday level since March 16. The index is up 0.5% since the start of the year, having erased earlier year-to-date losses over the past six weeks.

Earlier this year, dollar weakness occurred against the backdrop of U.S. rivals like China and Russia making strides in their efforts to wean themselves off the buck.

But despite their efforts, data released last week by SWIFT, the nexus of international interbank financial transactions, showed that the dollar has never been more popular as a means of settling international trade and transactions.

SWIFT’s data showed that 46% of interbank payments conducted on the platform in July involved the U.S. dollar, a record high. The data also showed that the Chinese yuan’s share of international payments had ticked higher while the euro’s declined.

As if to underscore this point, the data from SWIFT arrived late last week just as a summit hosted by the BRICS nations in Johannesburg, South Africa, was breaking up.

Rather than being a watershed event for opponents of the U.S. dollar, as some had feared, statements from the group’s members revealed internal disagreement on the subject of a BRICS currency intended to offer an alternative to the greenback.

What’s more, while the economic alliance announced plans to admit a spate of new member nations in its first expansion in 13 years, one notable holdout seemed to spoil the party.

Indonesian President Joko Widodo opted to keep his country, one of the world’s most populous, with a fast-expanding economy, out of the economic alliance, at least for now.

To be sure, as MarketWatch reported back in April, talk of de-dollarization is hardly a new phenomenon, but it has received renewed attention as China, Russia and others have redoubled efforts to try and push for countries to conduct more trade in their own currencies as opposed to the dollar.

But Russia and China aren’t alone in their disappointment at the dollar’s resilience.

A compilation of 2023 year-ahead outlooks produced by Bloomberg News back in December showed investment houses in Europe and the U.S. widely expected the buck to weaken this year, with some reasoning that the two-decade high reached by the dollar index in late September likely marked its peak for the cycle.

The ICE index traded as high as 114.78 on Sept. 28, its highest level since May 2002, according to FactSet data. The milestone marked the peak of a torrid rally that saw the buck emerge as one of the few havens from a punishing selloff in stocks and bonds that defined global markets in 2022. But the gauge has fallen 9.3% since then.

Now, with real yields in the U.S. pushing higher and Federal Reserve Chairman Jerome Powell hinting at the possibility of more interest-rate hikes later this year, strategists say the conditions are ideal for the U.S. dollar to climb even higher.

“Interest-rate differentials and relative economic strength are the foundation [of dollar strength],” Matt Miskin, co-chief investment strategist for John Hancock Investment Management, said during a phone interview with MarketWatch.

China’s struggles to revive its flagging economy have helped bolster the dollar while pushing the Chinese yuan USDCNY, -0.09% toward its weakest level since late last year. The offshore yuan traded at 7.29 to the dollar on Monday, near its weakest level since November.

A weakening eurozone economy has weighed on the euro and boosted the dollar. PMI survey data released earlier this month showed Europe’s services sector weakening alongside manufacturing. GDP data released by Eurostat, Europe’s official economic statistics agency, has been tepid compared to the U.S. The latest reading on second-quarter GDP put it at 0.3%.

Right now, the dollar will be tough to beat given the twin tailwinds created by rising real interest rates and still-robust economic growth.

The yield on the 10-year Treasury Inflation-Protected Security note 912828B253 was trading north of 2.2% Friday, according to data from the St. Louis Fed. The 10-year TIPS yield hit its highest level since 2009 earlier this month when it broke north of 2%. The inflation-protected security is often cited as a proxy for U.S. “real” yields, which refers to the return bond investors receive after adjusting for inflation.

On the growth side of the equation, the Atlanta Fed’s GDPNow forecast estimated the rate of growth for the third quarter at 5.9% according to its latest reading dated Thursday. A year ago, even the most optimistic economists on Wall Street were expecting growth of about 2%, and top Fed officials had a median projection of 1.2% growth for 2023, according to projections released in September.

“It’s hard to beat the dollar when it is a high yielder among safe havens in a risk-off environment,” Steve Englander, head of North America macro strategy at Standard Chartered, said in comments emailed to MarketWatch.