Fast fashion retailers Shein and Forever 21 are going into business together

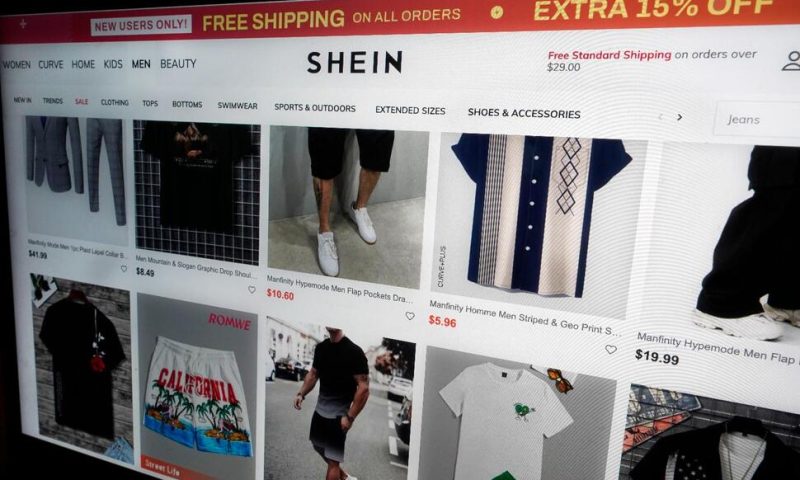

NEW YORK — Fast fashion retailers Shein and Forever 21 are going into business together.

Under a partnership agreement announced Thursday, the Chinese-founded Shein will acquire about one-third interest in Sparc Group, Forever 21’s operator. Sparc will also become a minority shareholder in Shein.

The deal is expected to expand Forever 21’s distribution on Shein’s global e-commerce platform, which has attracted 150 million online users. In turn, the partnership “also offers the opportunity to test” Shein product sales and returns in physical Forever 21 stores across the U.S., the companies said in a joint release.

Forever 21 has more than 540 locations worldwide and online. The announcement did not disclose financial details of the deal.

The Wall Street Journal first reported the deal between Shein and Sparc Thursday.

Sparc is a joint venture that includes brand development company Authentic Brands Group and mall operator Simon Property Group. Beyond the U.S.-based Forever 21 — which was bought out of bankruptcy just three years ago — Sparc also makes and distributes apparel for brands like Aéropostale, Eddie Bauer and Reebook.

Shein, meanwhile, has had a meteoric rise in the U.S. by offering low-cost apparel and items. Its primary audience is younger women, which it caters to on social media through partnerships with online influencers and celebrities.

Neil Saunders, managing director of GlobalData Retail, says that the new partnership “makes sense for both parties” — noting that Forever 21, which still struggles some in the fast-fashion world, could see fast growth on Shein’s sizeable online platform and that Shein “will also hope that the addition of a well-known American name will help to lessen focus on its manufacturing practices, which have come under scrutiny.”

Shein and Forever 21 have both faced strong criticism around the environmental impact of their fast fashion production and allegations of unethical labor practices. Earlier this year, Shein was notably accused of copyright infringement. There’s also been ongoing concerns among some lawmakers and advocacy groups about its supply chains.

In May, a bipartisan group of two dozen lawmakers asked the Securities and Exchange Commission to put the brakes on an initial public offering by Shein until it verified that it does not use forced labor from the country’s predominantly Muslim Uyghur population. A June Congressional report also unloaded a blistering critique of Shein and another Chinese fashion retailer, Temu — which sued Shein last month, accusing its rival of violating U.S. antitrust law by preventing garment makers from working with it.

Lawmakers have also been trying to crack down on a century-old trade rule — known as de minimis — that benefits both Shein and Temu. Under the provision, imported packages valued under $800 receive tax exemptions and less oversight from U.S. customs.

In June, Shein said that the company’s “policy is to comply with the customs and import laws of the countries in which we operate.” It also said it has “zero tolerance” for forced labor and has implemented a robust system to ensure compliance with U.S. law.

Shein, which is now headquarted in Singapore, has also tried to distance itself from China in recent years. According to The Journal, Shein doesn’t sell goods in China and denies sourcing cotton from the country.

While both Shein and Forever 21 are expected to benefit from the newly-announced partnership, Shein still “has an advantage as it is operating from a position of strength and is already taking share away from Forever 21, and others,” Saunders said. “This is something of an admission by Forever 21 that it is not able to engineer growth in its own business in the way that it would like. There is an element of ‘if you can’t beat them, join them.’”