Jump in Treasury yields rattled stocks while a China slowdown hangs over markets

The S&P 500 index is on course for its biggest monthly loss of 2023, jolted by rising Treasury yields as investors face the prospect of the Federal Reserve keeping interest rates higher for longer.

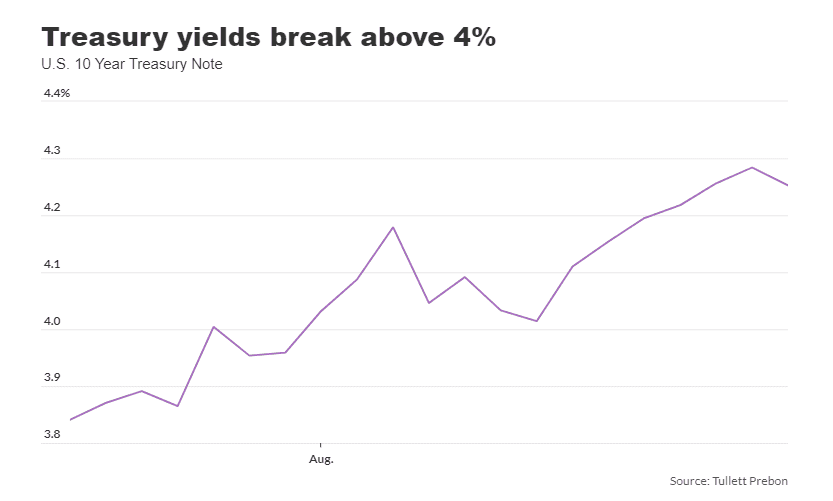

In August the yield on the 10-year Treasury note broke out of the 3.5% – 4% channel in which it had been trading, denting valuations in the stock market as it climbed, said Scott Chronert, a U.S. equity strategist at Citigroup, in a phone interview. “It disrupts the paradigm that has been in place for much of this year,” he said.

The U.S. stock market is slumping this month as investors brace for comments this coming week from Fed Chair Jerome Powell at the Jackson Hole Economic Symposium in Wyoming expected on Friday. Investors are contending with a jump in yields in August while also monitoring possible spillover effects from woes in China, the world’s second largest economy.

See: Global investors expect China to deliver a massive fiscal stimulus. Here’s why it may never arrive

Although the Fed has slowed its pace of interest rate hikes this year against the backdrop of easing inflation in the U.S., the yield on the 10-year treasury note BX:TMUBMUSD10Y jumped this month to its highest level since 2007, startling investors.

“It is ironic that rates have been moving higher” when inflation is coming down “considerably” based on moving averages of the consumer-price index over the past three and six months, said Rick Rieder, BlackRock’s chief investment officer of global fixed income and head of the asset manager’s global allocation investment team, in a phone interview.

The U.S. stock market ended mostly lower Friday, with the S&P 500 SPX suffering a third straight week of losses, according to Dow Jones Market Data. The widely followed index is down 4.8% so far in August, on pace for its biggest monthly loss since December, FactSet data show.

The Nasdaq Composite COMP and Dow Jones Industrial Average DJIA also finished Friday with weekly losses. The technology-heavy Nasdaq joined the S&P 500 in sliding three consecutive weeks.

There’s some investor concern in the stock market that the strength of the U.S. economy could cause the Fed to increase the tightening of its monetary policy, according to Rieder. He said that fear, combined with an increased supply of U.S. Treasurys, appears to be weighing on equities.

“There’s this incredible amount of bill issuance and draining of liquidity that I think is starting to kick in,” said Rieder, referring to Treasury bills, or U.S. government debt that matures within months and has been yielding more than 5% lately.

Scott Wren, senior global market strategist at Wells Fargo Investment Institute, said by phone that earlier this year the firm took some money out of the equities market, cutting back on tech stocks to invest in Treasury bills. He said that positions the firm to invest in stock-market pullbacks, with Wells Fargo expecting the S&P 500 to end 2023 at 4,100.

The S&P 500 ended Friday at 4,369.71, down 8.9% from its record close in January 2022, according to Dow Jones Market Data.

In Wren’s view, “the Fed’s not finished hiking” rates to combat sticky core inflation and Chair Jerome Powell may take the opportunity at the Jackson Hole meeting to signal to the market that the central bank is not close to cutting rates.

Read: Long-term Treasury bond ETFs fall as Goldman Sachs forecasts rate cuts in 2024

Powell may continue to sound “hawkish” in reiterating that the Fed could again raise its benchmark rate in order to bring inflation down to its 2% target, said Wren.

Chair Powell is scheduled to speak at the Jackson Hole meeting on Aug. 25.

“The U.S. economy is actually doing very well right now,” said David Kelly, chief global strategist at J.P. Morgan Asset Management, in a phone interview. “I still think that inflation can absolutely come down without a recession.”

Many investors have long worried that the Fed risks triggering a recession by continuing to raise rates after rapidly hiking them last year to tame high inflation.

“Unless the economy cracks in some way, certainly we don’t get a rate cut this year,” in Kelly’s view.

But Kelly anticipates the Fed might begin to slowly reduce rates in the spring of 2024 should inflation continue easing toward 2%. He said the central bank would probably accelerate the rate cuts if the labor market began “flashing an orange light that we’re about to head into a recession” with back-to-back monthly losses in jobs in nonfarm payroll employment reports.

Meanwhile, 10-year Treasury yields have risen for five straight weeks, their longest stretch of increases since March, to end Friday at 4.251%, according to Dow Jones Market Data. The rate retreated a bit Friday after on Aug. 17 finishing at the highest level since November 2007 based on 3 p.m. Eastern Time levels.

BlackRock’s Rieder chalked up the climb in part to an increased supply of U.S. government debt, the ripple effect of the Bank of Japan tweaking its yield-curve control to allow its own 10-year yields to rise, and Treasury bills BX:TMUBMUSD06M offering competitive rates of around 5.5% with no credit or duration risk.

While the U.S. economy is doing well, China’s is not, said Kelly. The country’s property sector has been suffering while investors worry its slowing economy could wind up in recession.

A slowing Chinese economy could take pressure off demand for commodities, potentially having a deflationary effect that helps lower costs for companies, according to Citi’s Chronert. But he also cautioned that an economic downturn in China could hurt earnings of U.S. manufacturers and retailers that are selling into the country.

Meanwhile, “the earnings picture still seems to be pretty good for the second half of this year” for U.S. companies, said Chronert.

That leaves investors closely watching Powell trying to balance the risk of cooling the U.S. economy too much in his bid to keep inflation under control with a restrictive policy rate. The Fed last month raised its benchmark rate to a target range of 5.25% to 5.5%, a 22-year high.

“If he starts waving a flag that it’s got to go significantly higher from here to get where he needs to be on inflation, then that’s an issue,” said Chronert.