Stock Markets

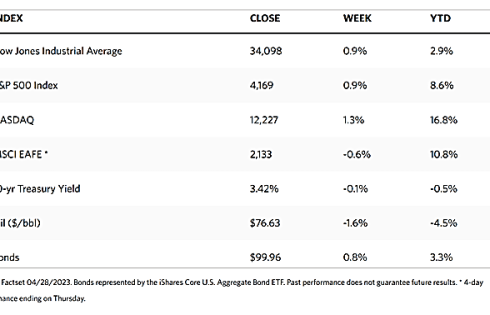

Major stock market indexes were mixed this week. The Dow Jones Industrial Average (DJIA) was up marginally by 0.86% week-on-week, mirroring the Total Stock Market index increase of 0.58%. The S&P 500 Index was on pace with the DJIA as it gained by 0.87% for the week, although the Nasdaq Stock Market Composite performed better with a 1.28% climb. The NYSE Composite moved sideways with a slight dip of 0.21%. CBOE Volatility, an indicator of investors’ perceived risk, declined by 5.90%. Trading for the week was selective as only four stocks – Microsoft, Apple, Amazon.com. and Facebook parent Meta Platforms – accounted for almost half of the strong gain of the S&P 500, its strongest since January 6. Unfortunately, cyclical sectors mostly performed poorly as investors discounted several new signs of an economic slowdown, particularly in the manufacturing sector.

Looking at the stock market’s performance year-to-date, there is still much to be optimistic about. This week added to the year’s gains so far, including a 2% rally on Thursday, the best day since January 6. The S&P 500 is up by 8%, while the Nasdaq has seen the strongest momentum with a 16% gain as technology and growth stocks rallied on the back of lower rates. Global markets have also surged as international developed-market equities moved up 11% year-to-date. Bonds likewise participated in the rebound, with yields pulling back from the last year’s peak and returning 3%.

U.S. Economy

Early in the week, several indicators of regional manufacturing activity came in well below expectations and suggested that factories were cutting back on production in April. A negative outlook was noted for shipping volumes from United Parcel Service, which lost 10% of its stock price on the news. Durable goods data released on Wednesday surprised on the upside as it rose by 3.2% in March orders. The optimism is tempered, however, by the fact that orders excluding aircraft and defense, considered a better indicator of business spending plans, dipped by 0.4%. Retail inventories rose by 0.4% for the month, which is more than expected and the most since August, suggesting the need for further cutbacks in production and spending.

The Commerce Department’s advance estimate of annualized growth in gross domestic product (GDP) in the first quarter was released on Thursday, coming in at 1.1% which is well below the consensus estimate of 2%. The GDP report signals a softening economy, nevertheless, it also confirms that the movement is gradual rather than abrupt, suggesting that a mild and shallow recession, rather than a precipitous drop, is ahead. This outlook appears to be bolstered by a labor market that is in a historically healthy position, allowing consumers to deal with a recession in better shape. The latest data suggests that employment conditions are weakening, but moderately, which contributes to softening the effect of a coming market slowdown.

Fears of a slowdown and possible recession were further escalated by renewed turmoil in the banking industry. U.S. markets ended on session lows on Tuesday following the earnings release by California’s First Republic Bank. The report revealed that the bank had suffered more than $100 billion in deposit outflows in the first quarter. The news plunged the bank’s stock price by almost half and influenced the performance of the overall regional banking sector. On Friday morning, news came that the Federal Deposit Insurance Corporation (FDIC) was planning on taking the bank into receivership that evening, sending the bank’s stock even lower.

Metals and Mining

Gold prices appear to be stuck in neutral at $2,000 an ounce, which is not necessarily a disadvantage at this point. Precious metals may not be going anywhere for the time being as stubborn inflation continues to compel the Federal Reserve to raise rates and maintain aggressive policies. However, looking back at where gold has been, it appears that the yellow metal is performing exceptionally well. Gold is maintaining a steady grip on $2,000 an ounce as investors prepare to close the books in April. This signifies that it has once more managed an all-time high monthly close at $1,997 an ounce. The prices are well north of a post-pandemic three-year average of approximately $1,807.65 an ounce. At the same time, the gold price is far above the five-year pre-pandemic average of about $1,267.57 an ounce.

As of this past trading week, gold gained by 0.35% from its previous week’s close at $1,983.06 to its latest close at $1,990.00 per troy ounce. Silver slipped by 0.12% from the prior week’s ending at $25.08 to this week’s ending at $25.05 per troy ounce. Platinum lost 4.34% of its closing price from the previous week’s $1,127.20 to this week’s $1,078.31 per troy ounce. Palladium also declined from its previous closing price of $1,605.10 to this week’s closing price of $1,506.87 per troy ounce, a loss of 6.12%. The three-month LME prices for base metals mostly ended the week on the downside. Copper came from $8,794.50 a week ago and lost by 2.26% to end this week at $8,595.50 per metric tonne. Zinc, which closed one week ago at $2,719.00, ended this week at $2,647.50 per metric tonne for a loss of 2.63%. Aluminum, which one week ago ended at $2,396.50, lost by 1.69% to end this week at $2,356.00 per metric tonne. Tin ended this week at $26,088.00 per metric tonne, a decline of 1.90% from last week’s close at $26,594.00.

Energy and Oil

After Wednesday’s double whammy of bad macroeconomic data, oil prices have stabilized at $78 per barrel for ICE Brent and $74 per barrel for WTI. Fears that economic growth is slowing down in the United States are bolstered by the decline in U.S. capital goods spending. Refinery margins likewise continued their descent this week, making it much harder for downstream players to stay profitable. On the back of these developments and despite the OPEC+ production cuts, oil is poised to see its sixth straight monthly loss.

In other developments this week, OPEC Secretary General Haitham al-Ghais issued a warning to the International Energy Agency (IEA) to exercise caution regarding discouraging investment into oil and gas. Advocating for such measures and finger-pointing at oil producers may lead to increased volatility in the future, al-Ghais argued.

Natural Gas

European natural gas storage inventories as of April 1, 2023, were 56% full. According to data from Gas Storage Europe’s Aggregated Gas Storage Inventory, this is the highest level on record for the end of the heating season. An exceptionally warm winter reduced heating demand, resulting in Europe’s high levels of natural gas in storage. Lower natural gas consumption resulting from a Europe-wide effort to conserve natural gas, as well as record levels of liquefied natural gas (LNG) imports, also contributed to the higher levels and offset lower imports by pipeline from Russia. The U.S. remained the largest LNG supplier to Europe for the second year in a row, accounting for 44% of total LNG imports during 2022.

For this report week beginning Wednesday, April 19, and ending Wednesday, April 26, 2023, the Henry Hub spot price fell by $0.01 from $2.20 per million British thermal units (MMBtu) at the start of the week to $2.19/MMBtu by the week’s end. The May 2023 NYMEX contract expired on April 26 at $2.117/MMBtu, down by $0.11 from one week earlier. The June 2023 NYMEX contract price decreased to $2.305/MMBtu, down by $0.09 throughout the week. The price of the 12-month stripping averaging June 2023 to May 2024 futures contracts declined by $0.04 to $3.042/MMBtu.

International natural gas futures prices declined for this report week. The weekly average front-month futures prices for LNG cargoes in East Asia fell by $0.66 to a weekly average of $11.90/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF), the most liquid natural gas market in Europe, fell by $0.51 to a weekly average of $12.84/MMBtu. In the corresponding week last year (the week from April 20 to 27, 2022), the prices were $25.26/MMBtu and $31.29/MMBtu in East Asia and at the TTF, respectively.

World Markets

European stock markets trekked lower on heightened concerns that the rounds of interest rate increases may finally tip the economy into a recession. The pan-European STOXX Europe 600 Index closed the week lower by 0.50% in local currency terms. The major stock indexes were mixed to lower. Italy’s FTSE MIB declined by 2.41% while France’s CAC 40 Index dipped by 1.13%. Germany’s DAX, on the other hand, advanced by 0.26%. The UK’s FTSE 100 Index gave up 0.55%. Core eurozone bonds were highly volatile for the week. Resurrected concerns about the U.S. banking industry and an unexpected fall in Spanish producer price inflation initially pushed the 10-year German bund yield lower. Around midweek, however, it corrected upward on the back of the U.S. core personal consumption expenditures inflation that surprised on the upside. Thereafter, news of stagnating first-quarter German economic growth and a more dovish-than-expected Bank of Japan (BoJ) policy meeting on Friday resulted in a pullback in yields. Peripheral eurozone and UK government bonds broadly followed the trend set by core markets.

Japan’s equities markets ascended over the week. The Nikkei 225 Index rose by 1.02% while the broader TOPIX Index gained by 1.10%. A dovish BoJ surprised the markets by signaling a continued commitment to its ultra-loose stance by leaving monetary policy unchanged, including its yield curve control framework. Also contributing to the positive investor sentiment was the government’s easing of Japan’s border controls ahead of an expected increase in arrivals, particularly from China, due to the Golden Week holidays scheduled at the end of April and the beginning of May. Largely due to an unexpectedly dovish BoJ, the yield on the 10-year Japanese government bond (JGB) dipped to 0.41% from 0.46% at the end of the previous week. The yen pulled back to about JPY 135 against the U.S. dollar, from around JPY 134 to the greenback during the prior week, which further signaled policy continuity.

China’s stock markets ended mixed ahead of a five-day holiday. Beijing reaffirmed its commitment to a supportive policy stance, easing worries about an uneven economic recovery. The Shanghai Stock Exchange Index rose by 0.67%, while the blue-chip CSI 300 retreated by 0.09% in local currency terms. China’s stock markets will remain closed for the coming Monday through Wednesday in celebration of the Labor Day holiday. Trading will resume on Thursday, May 4. The country’s top decision-making body, the Chinese Politburo, promised to continue its “forceful” fiscal and monetary policy position to support the economy which is expected to face obstacles in economic transformation and insufficient domestic demand. In this year’s first quarter, China’s economy expanded at its fastest pace in a year. Nevertheless, policymakers remain cautious in light of headwinds ranging from high youth unemployment and slowing global growth.

The Week Ahead

Among the important economic data scheduled for release this week are several labor market indicators (e.g., employment reports and unemployment rate) as well as the Federal Reserve interest rate statement.

Key Topics to Watch

- S&P U.S. manufacturing PMI

- ISM manufacturing

- Construction spending

- S. job openings

- Factory orders

- ADP employment

- S&P U.S. services PMI

- ISM services

- Federal Reserve interest rate statement

- Fed Chair Powell press conference

- S. productivity

- S. trade deficit

- Initial jobless claims

- Continuing jobless claims

- S. employment report

- S. unemployment rate

- S. hourly wages

- Hourly wages year over year

- Consumer credit

Markets Index Wrap Up