TransMedics Group (NASDAQ:TMDX – Get Rating) will release its earnings data after the market closes on Monday, May 1st. Analysts expect TransMedics Group to post earnings of ($0.27) per share for the quarter. TransMedics Group has set its FY 2023 guidance at EPS.Persons that wish to listen to the company’s earnings conference call can do so using this link.

TransMedics Group (NASDAQ:TMDX – Get Rating) last released its quarterly earnings data on Wednesday, February 22nd. The company reported ($0.21) earnings per share for the quarter, beating analysts’ consensus estimates of ($0.28) by $0.07. The firm had revenue of $31.38 million during the quarter, compared to analyst estimates of $23.60 million. TransMedics Group had a negative return on equity of 29.82% and a negative net margin of 38.77%. The business’s quarterly revenue was up 224.5% compared to the same quarter last year. During the same quarter in the prior year, the firm posted ($0.46) earnings per share. On average, analysts expect TransMedics Group to post $-1 EPS for the current fiscal year and $0 EPS for the next fiscal year.

TransMedics Group Stock Performance

NASDAQ:TMDX opened at $88.73 on Monday. The firm has a market cap of $2.89 billion, a PE ratio of -70.98 and a beta of 1.44. TransMedics Group has a fifty-two week low of $20.36 and a fifty-two week high of $90.15. The company has a debt-to-equity ratio of 0.31, a quick ratio of 9.79 and a current ratio of 10.66. The business has a 50 day moving average price of $74.08 and a 200-day moving average price of $62.54.

Insiders Place Their Bets

In other news, CEO Waleed H. Hassanein sold 2,173 shares of TransMedics Group stock in a transaction dated Tuesday, February 14th. The stock was sold at an average price of $70.08, for a total transaction of $152,283.84. Following the transaction, the chief executive officer now directly owns 389,112 shares of the company’s stock, valued at approximately $27,268,968.96. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. In other news, CEO Waleed H. Hassanein sold 2,173 shares of TransMedics Group stock in a transaction dated Tuesday, February 14th. The stock was sold at an average price of $70.08, for a total transaction of $152,283.84. Following the transaction, the chief executive officer now directly owns 389,112 shares of the company’s stock, valued at approximately $27,268,968.96. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, insider Tamer I. Khayal sold 4,070 shares of TransMedics Group stock in a transaction dated Tuesday, February 14th. The shares were sold at an average price of $70.15, for a total value of $285,510.50. Following the transaction, the insider now directly owns 1,300 shares in the company, valued at $91,195. The disclosure for this sale can be found here. Over the last three months, insiders have sold 121,934 shares of company stock valued at $9,156,146. Insiders own 8.70% of the company’s stock.

Institutional Inflows and Outflows

Large investors have recently added to or reduced their stakes in the business. Royal Bank of Canada lifted its holdings in TransMedics Group by 643.0% in the 3rd quarter. Royal Bank of Canada now owns 1,122 shares of the company’s stock worth $46,000 after purchasing an additional 971 shares in the last quarter. Tower Research Capital LLC TRC lifted its holdings in TransMedics Group by 125.4% in the 3rd quarter. Tower Research Capital LLC TRC now owns 2,603 shares of the company’s stock worth $109,000 after purchasing an additional 1,448 shares in the last quarter. Captrust Financial Advisors lifted its holdings in TransMedics Group by 738.8% in the 1st quarter. Captrust Financial Advisors now owns 5,788 shares of the company’s stock worth $156,000 after purchasing an additional 5,098 shares in the last quarter. BNP Paribas Arbitrage SA lifted its holdings in TransMedics Group by 161.6% in the 2nd quarter. BNP Paribas Arbitrage SA now owns 5,998 shares of the company’s stock worth $189,000 after purchasing an additional 3,705 shares in the last quarter. Finally, Algert Global LLC purchased a new position in TransMedics Group in the 3rd quarter worth approximately $260,000. 88.58% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of analysts recently commented on the company. JPMorgan Chase & Co. raised their price target on TransMedics Group from $67.00 to $81.00 and gave the stock an “overweight” rating in a research note on Thursday, February 23rd. Cowen raised their price target on TransMedics Group from $70.00 to $75.00 and gave the stock an “outperform” rating in a research note on Thursday, February 23rd. Oppenheimer raised their price target on TransMedics Group from $55.00 to $85.00 and gave the stock an “outperform” rating in a research note on Thursday, February 23rd. Canaccord Genuity Group raised their price target on TransMedics Group from $68.00 to $78.00 and gave the stock a “buy” rating in a research note on Thursday, February 23rd. Finally, Morgan Stanley raised their price target on TransMedics Group from $63.00 to $74.00 and gave the stock an “equal weight” rating in a research note on Thursday, February 23rd. One equities research analyst has rated the stock with a hold rating and six have given a buy rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of “Moderate Buy” and an average price target of $71.57.

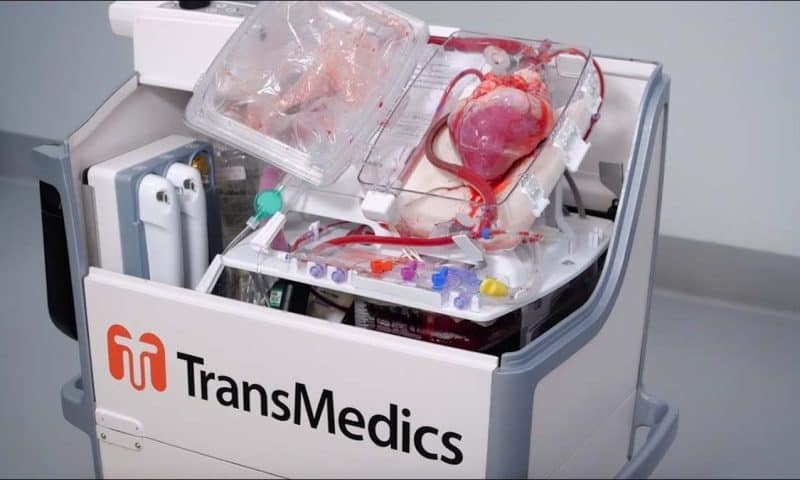

TransMedics Group Company Profile

TransMedics Group, Inc operates as a commercial stage medical technology company. The firm engages in the development and commercialization of organ care system platform. It focuses on the preservation of human organs for transplant in a near-physiologic condition to address the limitations of cold storage organ preservation.