Sanford C. Bernstein initiated coverage on shares of Beam Therapeutics (NASDAQ:BEAM – Get Rating) in a research report issued on Tuesday, The Fly reports. The firm set a “market perform” rating on the stock.

Other research analysts have also recently issued research reports about the stock. Cantor Fitzgerald began coverage on shares of Beam Therapeutics in a research note on Tuesday, January 31st. They set an “overweight” rating and a $62.00 price target on the stock. Citigroup began coverage on shares of Beam Therapeutics in a research report on Tuesday, December 13th. They set a “buy” rating and a $62.00 price objective on the stock. Wells Fargo & Company decreased their price objective on shares of Beam Therapeutics from $125.00 to $105.00 and set an “overweight” rating on the stock in a research report on Wednesday, March 1st. SVB Leerink decreased their price objective on shares of Beam Therapeutics from $81.00 to $77.00 and set an “outperform” rating on the stock in a research report on Monday, January 23rd. Finally, BMO Capital Markets upgraded shares of Beam Therapeutics from a “market perform” rating to an “outperform” rating and raised their price objective for the company from $61.00 to $66.00 in a research report on Tuesday, December 20th. Three analysts have rated the stock with a hold rating and six have given a buy rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of “Moderate Buy” and a consensus target price of $76.33.

Beam Therapeutics Trading Down 3.0 %

Shares of BEAM stock opened at $32.23 on Tuesday. Beam Therapeutics has a 12-month low of $27.77 and a 12-month high of $73.27. The firm’s 50 day moving average is $41.16 and its 200 day moving average is $44.45. The stock has a market capitalization of $2.33 billion, a P/E ratio of -7.80 and a beta of 1.70.

Beam Therapeutics (NASDAQ:BEAM – Get Rating) last issued its quarterly earnings results on Tuesday, February 28th. The company reported ($0.54) earnings per share for the quarter, topping the consensus estimate of ($1.34) by $0.80. The business had revenue of $20.04 million for the quarter, compared to analysts’ expectations of $12.73 million. Beam Therapeutics had a negative net margin of 474.54% and a negative return on equity of 37.58%. The company’s revenue was down 60.8% compared to the same quarter last year. During the same quarter last year, the company posted ($0.95) EPS. As a group, equities analysts predict that Beam Therapeutics will post -5.54 earnings per share for the current year.

Insider Buying and Selling

In other Beam Therapeutics news, CFO Terry-Ann Burrell sold 14,810 shares of the company’s stock in a transaction that occurred on Tuesday, January 24th. The shares were sold at an average price of $45.01, for a total transaction of $666,598.10. Following the transaction, the chief financial officer now owns 31,277 shares in the company, valued at approximately $1,407,777.77. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Insiders sold a total of 63,107 shares of company stock worth $2,846,747 in the last 90 days. 4.00% of the stock is owned by corporate insiders.

Institutional Trading of Beam Therapeutics

Several large investors have recently made changes to their positions in the business. Nisa Investment Advisors LLC lifted its holdings in Beam Therapeutics by 19.7% during the fourth quarter. Nisa Investment Advisors LLC now owns 1,741 shares of the company’s stock valued at $68,000 after purchasing an additional 287 shares in the last quarter. D.A. Davidson & CO. increased its position in Beam Therapeutics by 2.4% during the third quarter. D.A. Davidson & CO. now owns 12,380 shares of the company’s stock worth $590,000 after purchasing an additional 295 shares during the last quarter. Alliancebernstein L.P. increased its position in shares of Beam Therapeutics by 0.4% during the third quarter. Alliancebernstein L.P. now owns 70,100 shares of the company’s stock valued at $3,340,000 after acquiring an additional 300 shares during the last quarter. Vident Investment Advisory LLC increased its position in shares of Beam Therapeutics by 4.2% during the fourth quarter. Vident Investment Advisory LLC now owns 8,520 shares of the company’s stock valued at $333,000 after acquiring an additional 343 shares during the last quarter. Finally, The Manufacturers Life Insurance Company increased its position in shares of Beam Therapeutics by 1.4% during the fourth quarter. The Manufacturers Life Insurance Company now owns 25,580 shares of the company’s stock valued at $1,000,000 after acquiring an additional 343 shares during the last quarter. 76.70% of the stock is owned by hedge funds and other institutional investors.

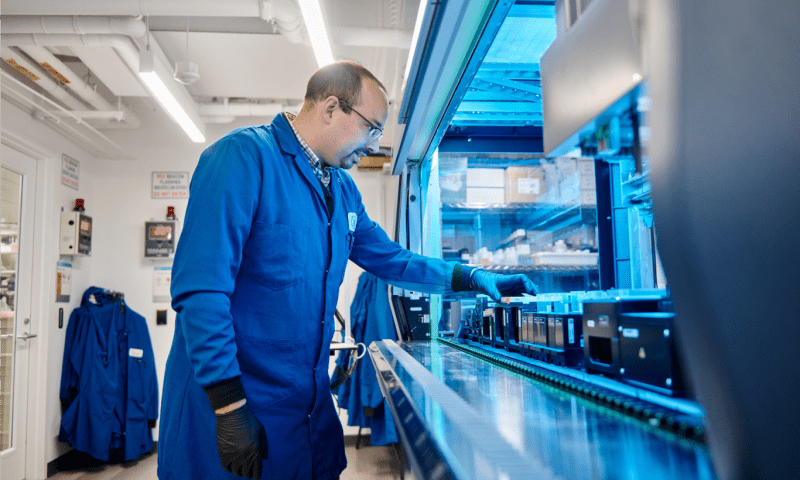

About Beam Therapeutics

Beam Therapeutics Inc, a biotechnology company, develops precision genetic medicines for patients suffering from serious diseases in the United States. The company is developing BEAM-101 for the treatment of sickle cell disease and beta thalassemia; BEAM-102 for the treatment of sickle cell disease; and BEAM-201, an allogeneic chimeric antigen receptor T cell for the treatment of relapsed/refractory T-cell acute lymphoblastic leukemia; and BEAM-301, a liver-targeted development candidate for the treatment of patients with Glycogen Storage Disease Type Ia.