RingCentral (NYSE:RNG – Get Rating) was upgraded by StockNews.com from a “sell” rating to a “hold” rating in a report issued on Monday.

Several other equities analysts also recently commented on RNG. Raymond James decreased their price objective on shares of RingCentral from $135.00 to $90.00 and set a “strong-buy” rating on the stock in a report on Wednesday, August 3rd. Moffett Nathanson began coverage on shares of RingCentral in a research note on Thursday, September 22nd. They issued a “buy” rating and a $90.00 price target on the stock. Piper Sandler decreased their price target on shares of RingCentral from $118.00 to $75.00 and set an “overweight” rating on the stock in a research note on Wednesday, July 13th. Wells Fargo & Company decreased their price target on shares of RingCentral from $115.00 to $100.00 and set an “overweight” rating on the stock in a research note on Wednesday, August 3rd. Finally, Deutsche Bank Aktiengesellschaft decreased their price target on shares of RingCentral from $110.00 to $70.00 and set a “buy” rating on the stock in a research note on Wednesday, August 3rd. Six equities research analysts have rated the stock with a hold rating, nineteen have issued a buy rating and one has assigned a strong buy rating to the company’s stock. Based on data from MarketBeat.com, the company has an average rating of “Moderate Buy” and an average price target of $126.38.

RingCentral Stock Performance

Shares of NYSE:RNG traded down $4.06 on Monday, hitting $35.26. The company had a trading volume of 2,414,975 shares, compared to its average volume of 1,757,588. RingCentral has a 1-year low of $35.26 and a 1-year high of $315.00. The stock has a market cap of $3.36 billion, a price-to-earnings ratio of -5.73 and a beta of 0.97. The stock has a 50 day moving average price of $44.61 and a 200 day moving average price of $62.97. The company has a current ratio of 1.19, a quick ratio of 1.19 and a debt-to-equity ratio of 33.52.

RingCentral (NYSE:RNG – Get Rating) last released its quarterly earnings data on Tuesday, August 2nd. The software maker reported ($0.57) EPS for the quarter, missing the consensus estimate of ($0.47) by ($0.10). RingCentral had a negative net margin of 31.67% and a negative return on equity of 233.94%. The company had revenue of $486.90 million during the quarter, compared to analyst estimates of $478.98 million. Analysts expect that RingCentral will post -1.42 EPS for the current year.

Insider Transactions at RingCentral

In related news, COO Mohammed Katibeh sold 2,978 shares of the firm’s stock in a transaction that occurred on Tuesday, August 16th. The shares were sold at an average price of $50.26, for a total value of $149,674.28. Following the completion of the transaction, the chief operating officer now owns 136,905 shares in the company, valued at approximately $6,880,845.30. The sale was disclosed in a document filed with the SEC, which can be accessed through this link. In related news, COO Mohammed Katibeh sold 2,978 shares of the firm’s stock in a transaction that occurred on Tuesday, August 16th. The shares were sold at an average price of $50.26, for a total value of $149,674.28. Following the completion of the transaction, the chief operating officer now owns 136,905 shares in the company, valued at approximately $6,880,845.30. The sale was disclosed in a document filed with the SEC, which can be accessed through this link. Also, CAO John H. Marlow sold 6,047 shares of the firm’s stock in a transaction that occurred on Monday, August 29th. The shares were sold at an average price of $42.05, for a total transaction of $254,276.35. Following the completion of the transaction, the chief accounting officer now owns 202,198 shares of the company’s stock, valued at approximately $8,502,425.90. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 16,884 shares of company stock valued at $763,314. 7.35% of the stock is currently owned by insiders.

Institutional Trading of RingCentral

Institutional investors and hedge funds have recently added to or reduced their stakes in the company. Cornerstone Wealth Advisors Inc. acquired a new stake in RingCentral during the 1st quarter valued at approximately $26,000. Richelieu Gestion PLC acquired a new stake in RingCentral during the 1st quarter valued at approximately $37,000. Newbridge Financial Services Group Inc. increased its position in RingCentral by 177.9% during the 1st quarter. Newbridge Financial Services Group Inc. now owns 314 shares of the software maker’s stock valued at $37,000 after purchasing an additional 201 shares during the period. Ronald Blue Trust Inc. acquired a new stake in RingCentral during the 2nd quarter valued at approximately $41,000. Finally, Clearstead Advisors LLC increased its position in RingCentral by 57.1% during the 1st quarter. Clearstead Advisors LLC now owns 666 shares of the software maker’s stock valued at $78,000 after purchasing an additional 242 shares during the period. Institutional investors and hedge funds own 86.29% of the company’s stock.

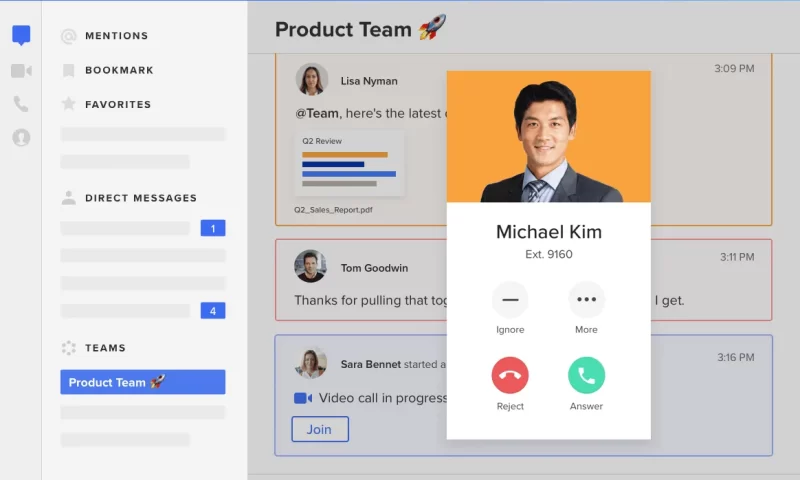

About RingCentral

RingCentral, Inc engages in the provision of global enterprise cloud communications and collaboration solutions. The firm’s solutions provide a single user identity across multiple locations and devices, including smartphones, tablets, PCs and desk phones, and allows for communication across multiple modes, including high-definition voice, video, SMS, messaging and collaboration, conferencing, online meetings and fax.