Last week’s first gain in four for stocks has likely emboldened some bulls out there, but investor wariness remains, according to a new survey from Deutsche Bank.

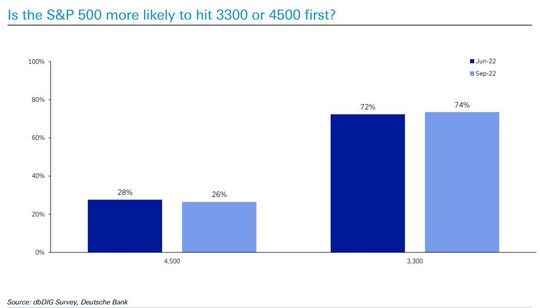

Observe the chart below that shows how positions may be stretchy on the bear side if the stock market can keep up its momentum. When asked what the S&P 500’s next move would be, 74% of respondents said 3,300 — a roughly 18% drop from Friday’s close of 4,067. That was slightly up from 73% predicting that level in June.

A 10% move higher to 4,500 was predicted by 26% of respondents, down from 28% in June.

Meanwhile, fewer than 10% of those surveyed believe the stock market has bottomed, with 58% saying the market will hit its lows for this cycle in 2023 or beyond.

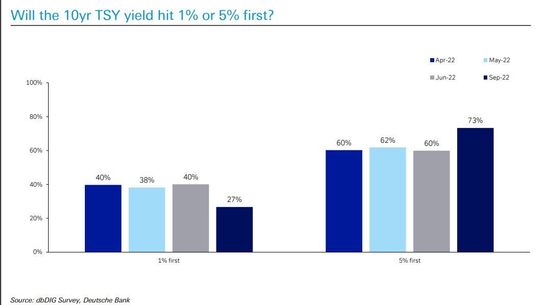

Since the June survey, expectations for 5% 10-year U.S. Treasury yields has grown to 73% from 60%:

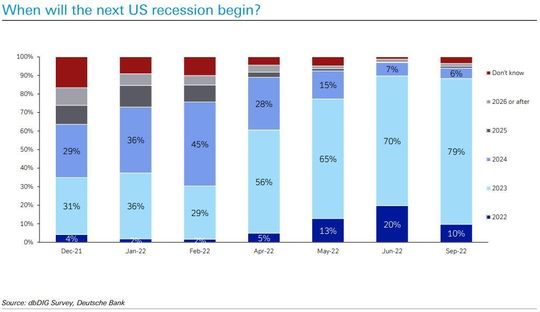

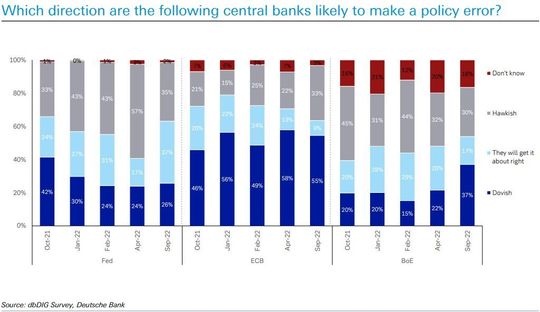

Finally, these two charts, the first showing most respondents — 80% — think a U.S. recession is coming in 2023, and the second that the Federal Reserve is doing a better job than the European Central Bank or Bank of England: