SecureWorks Corp. (NASDAQ:SCWX – Get Rating) has earned a consensus recommendation of “Hold” from the eight research firms that are currently covering the stock, MarketBeat reports. Two research analysts have rated the stock with a sell rating and four have given a hold rating to the company. The average 12 month price target among brokerages that have issued ratings on the stock in the last year is $14.20.

A number of equities analysts have commented on the stock. Morgan Stanley dropped their price objective on shares of SecureWorks from $14.00 to $13.00 and set an “equal weight” rating for the company in a research note on Friday, June 3rd. Barclays lowered their target price on shares of SecureWorks from $13.00 to $11.00 in a report on Friday.

Insider Transactions at SecureWorks

In other news, major shareholder Neil Gagnon bought 10,711 shares of the stock in a transaction dated Tuesday, July 5th. The stock was purchased at an average price of $11.04 per share, for a total transaction of $118,249.44. Following the acquisition, the insider now owns 395,331 shares of the company’s stock, valued at $4,364,454.24. The transaction was disclosed in a legal filing with the SEC, which is accessible through the SEC website. In the last quarter, insiders bought 105,788 shares of company stock worth $1,108,865. 85.30% of the stock is currently owned by insiders.

Institutional Investors Weigh In On SecureWorks

A number of institutional investors and hedge funds have recently added to or reduced their stakes in SCWX. Acadian Asset Management LLC bought a new stake in SecureWorks during the 4th quarter valued at about $28,000. FNY Investment Advisers LLC lifted its holdings in SecureWorks by 20.8% during the 2nd quarter. FNY Investment Advisers LLC now owns 11,616 shares of the technology company’s stock valued at $126,000 after buying an additional 2,000 shares in the last quarter. Dynamic Technology Lab Private Ltd bought a new stake in SecureWorks during the 1st quarter valued at about $145,000. Delphia USA Inc. bought a new stake in SecureWorks during the 1st quarter valued at about $148,000. Finally, US Bancorp DE lifted its holdings in SecureWorks by 60.0% during the 2nd quarter. US Bancorp DE now owns 14,054 shares of the technology company’s stock valued at $153,000 after buying an additional 5,268 shares in the last quarter. Institutional investors own 10.73% of the company’s stock.

SecureWorks Stock Up 1.5 %

Shares of NASDAQ:SCWX opened at $10.19 on Friday. SecureWorks has a 52 week low of $9.26 and a 52 week high of $26.89. The stock has a market capitalization of $864.72 million, a P/E ratio of -15.44 and a beta of 0.89. The firm has a fifty day simple moving average of $10.46 and a two-hundred day simple moving average of $11.65.

SecureWorks (NASDAQ:SCWX – Get Rating) last issued its quarterly earnings data on Thursday, September 1st. The technology company reported ($0.13) EPS for the quarter, topping analysts’ consensus estimates of ($0.16) by $0.03. SecureWorks had a negative net margin of 10.64% and a negative return on equity of 4.66%. The business had revenue of $116.20 million during the quarter, compared to analysts’ expectations of $116.10 million. During the same period last year, the company posted ($0.06) EPS. The business’s revenue was down 13.4% on a year-over-year basis. On average, analysts expect that SecureWorks will post -1.02 earnings per share for the current year.

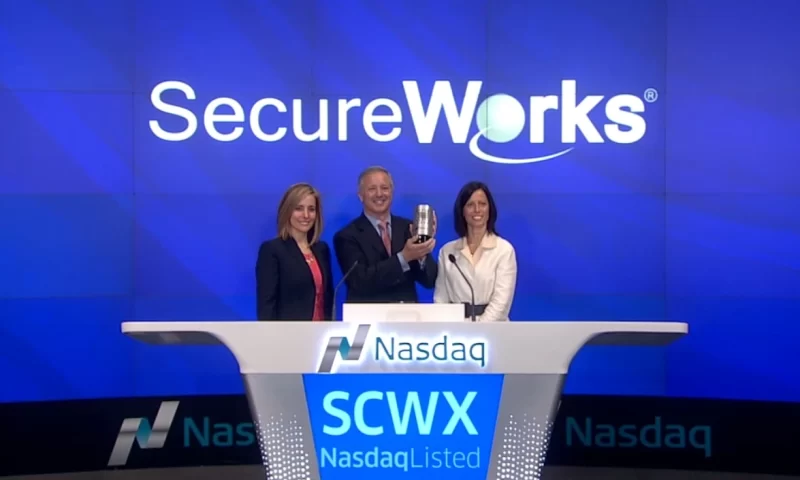

SecureWorks Company Profile

SecureWorks Corp., through its subsidiaries, provides technology-driven information security solutions for protecting its customers in the United States and internationally. The company’s solutions include software-as-a-service solutions, managed security services, and professional services, including incident response and security risk consulting services.