Hundreds of stocks are trading more than 40% below their prior highs

You may be surprised to learn that nearly 500 stocks within the S&P 1500 SPTM, -0.65% have crashed this year.

That’s how many have fallen more than 40% from their trailing two-year highs. In defining a crash in this way, I’m following the lead of academic research into bubbles and crashes.

You shouldn’t be surprised by how many stocks have crashed. Given how far many of these stocks soared over the prior two years prior to crashing, their plunges should have been expected. Indeed, among the highest fliers a crash was almost certain.

This illustrates what is perhaps the most important investment lesson for all of us to learn, but especially for retirees: Extrapolating past trends into the future is a risky business. In fact, your risk goes up to the extent the past you’re extrapolating has been rosier.

Consider a study into the predictability of crashes that appeared in the January 2019 issue of the Journal of Financial Economics. The authors—Robin Greenwood and Andrei Shleifer of Harvard, and Yang You of the University of Hong Kong—found a strong inverse correlation between the frequency of such crashes and performance over the two years prior to that crash.

In other words, the higher they go, the harder they fall.

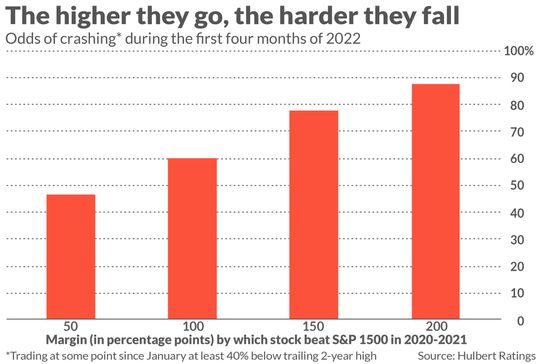

This inverse correlation is illustrated in the accompanying chart. Consider the first column in the chart, which reflects the experience of those stocks within the S&P 1500 that beat the market by at least 50 percentage points over the two-year period from January 2020 through December 2021. As you can see, so far this year 46% of these highfliers at some point in the first four months of the year traded at least 40% or more below their prior highs.

Notice for each of the successive columns in the chart that these odds of crashing grow as the prior two-year gain also grows. By the time we’re focusing on stocks that beat the market by 200 or more percentage points, the odds of crashing rose to almost 90%.

These results are right in line with those that the researchers report in their 2019 academic study, providing further confirmation that stocks’ experiences this year are not a fluke. As the professors conclude: “Sharp price increases do predict a heightened likelihood of a crash… There are times when one can call a bubble with some confidence.”

Extrapolation bias

These results serve as a powerful reminder why we need to be on guard against the naive belief that past trends will continue indefinitely into the future. As the great British economist John Maynard Keynes warned us a century ago: Trees don’t grow to the sky.

Though we immediately see the fallacy in believing trees will grow to the sky, most of us still extrapolate the past into the future—if unconsciously. This tendency is so common that behavioral economists have given a name to it: extrapolation bias.

It’s not Monday-morning quarterbacking to point out the dangers of extrapolation bias in the current market environment. In March, on the second anniversary of the bull market that began in March 2020, I devoted a column to the subject, writing that: “Not only will the market’s return in coming months likely be a lot lower than it was over the past two years, the odds are good that its return will be well-below average. Barely positive, in fact.” The S&P 500 SPX, -0.57% is currently trading 8.7% below where it stood when that column was published.

To counter extrapolation bias, we need to cultivate a contrarian attitude. As Warren Buffett classically put it, our job is to be greedy when others are fearful and fearful when others are greedy.