Stock Markets

Amid extreme volatility, benchmark indexes absorbed their fifth straight week of losses, borne down by the twin concerns of rising inflation and interest rates. Growth stocks in particular took the brunt of the price declines. The Dow Jones Industrial Average (DJIA) was temporarily dragged into correction territory, roughly 10% below its recent peak where it joined the S&P 500 and S&P MidCap 400 indexes. Faring worse were the Nasdaq Composite and the small-cap Russell 2000 Index which closed the trading week down by more than 25% and well into the bear markets. Although the Cboe Volatility Index (VIX) continued to stay well below the intraday levels it briefly reached in late January, the markets were unusually volatile late this week. Investors exited their leverage positions and caused record flows of exchange-traded funds. Despite the apparent rush of activity, Wall Street had anticipated the Federal Reserve’s announcement of a 50-basis-point (0.50 percentage point) increase in the Federal fund’s target rate to a range of 0.75% to 1.00%. This is the largest Fed rate hike in 22 years.

U.S. Economy

Coming into the past week, it appeared as if inflation may continue to rise unabated. After the week’s events, however, it is likely that inflation, though still heated, may already be reaching its peak and can be expected to head lower in the future. The Fed remains at the early stage of its tightening campaign that is aimed at curbing the rising inflation. This week’s 0.50% interest rate hike may be only the first of several such outsized escalations, but the policy authorities are not likely to impose larger hikes (e.g., 0.75% or higher), nor it is likely to pursue an even more aggressive pace of monetary tightening.

Despite these developments, the economic foundation remains sound in light of the historically tight labor market and robust consumer finances. Headwinds remain in the form of the ongoing supply disruptions primarily caused by the lockdowns in China and elevated consumer prices due to the high cost of oil. Nevertheless, conditions in the employment arena support a positive outlook for consumers. The rising-cost environment remains a challenge for corporate earnings, but profits continue to remain resilient. Furthermore, while the markets appear to be pricing in a possible recession, analysts are still hopeful that an impending recession is hardly certain The labor market, which historically is the most powerful driver of economic activity, continues as a source of optimism.

Metals and Mining

Another week of lackluster performance transpired for gold as its price hit but did not penetrate the $1,900 per ounce resistance level. Selling pressure mounted as the U.S. dollar approached its highest level in two decades as a result of the Federal Reserve’s aggressive move to raise interest rates. Although gold lost its momentum for the moment, analysts remain optimistic that the precious metal continues to remain healthy and appears merely to go through a consolidation phase following its strong performance in the year’s first quarter. Continued rate increases are unlikely to push gold further down as there is a limit to how far the Fed can raise its rates.

Gold began the week at $1,896.93 and ended at $1,883.81 per troy ounce, lower slightly by 0.69%. Silver slid by 1.84% week-on-week, from the previous close at $22.78 to its recent close at $22.36 per troy ounce. Platinum ended one week ago at $939.32 and closed this week at $962.24 per troy ounce for a marginal gain of 2.44%. Palladium closed the prior week at $2,326.92 but ended this week at $2,051.92 per troy ounce, falling by 11.82%. Three-month prices of base metals likewise sustained losses. Copper, which closed the week before at $9,769.50, ended this week at $9,414.50 per metric tonne, declining by 3.63%. Zinc came from $4,107.00 and ended at $3,772.00 per metric tonne for a drop of 8.16%. Aluminum began the week at $3,052.50 and closed at $2,842.00 per metric tonne, falling by 6.90%. Tin, which previously closed at $40,259.00, ended the week lower by 2.28%, at $39,340.00 per metric tonne

Energy and Oil

The past week, the European Union remained unable to reach an agreement regarding a comprehensive Russia crude oil embargo, as the member states continue to be plagued with internal differences on the timeline of the phasing out. If the draft is adopted, this may result in another supply shortage as the OPEC+ has already expressed its preference for consistency rather than abrupt changes. The willingness of the oil consortium to meet global demand may fall even further if the United States proceeds with its NOPEC bill.

In the meantime, during its meeting that lasted for a mere 30 minutes, the OPEC+ countries concurred to increase their June 2022 production target by 432,000 barrels per day. They had foregone any discussion about sanctions on Russia, indicating that the global oil supply-demand situation is more or less balanced. In the U.S., a Senate committee passed the NOPEC bill with bipartisan support. This potentially revokes the sovereign immunity protecting OPEC countries and Middle Eastern National Oil Companies (NOCs) from lawsuits.

Natural Gas

At most locations this report week, April 27 to May 4, natural gas spot prices rose, with the Henry Hub spot price ascending from $6.94 per million British thermal units (MMBtu) at the start of the week, to $8.30/MMBtu by the week’s end. The price is at its highest level since February 2021 when a winter storm nudged natural gas to its highest spot price on record. International spot prices, on the other hand, descended during this report week.

In the country, prices along the Gulf Coast climbed consistently with the higher temperatures and increased demand for air conditioning. In the Midwest, prices ended higher, but during the week they fluctuated with the weather even as production from North Dakota continued to increase. Across the West, prices rose in line with the national average as temperatures remained normal. In the Northeast, prices were mixed this week. The U.S. natural gas supply remained largely unchanged from the previous week to this week, and demand by sector is mixed. U.S. LNG exports increased by two vessels from last week to this week.

World Markets

European equities markets plummeted amid concerns that central banks may need to adopt more stringent policies to respond to inflationary pressures, in the course of which economic growth may be compromised. The spread of the coronavirus in China and the lockdowns the Chinese government has imposed to curb the spread of the virus, coupled with the Ukrainian conflict, have further exacerbated the economic uncertainties. The pan-European STOXX Europe 600 Index lost 4.55% in local currency terms. Germany’s DAX Index dropped 3.00%, Italy’s FTSE MIB Index gave up 3.20%, and France’s CAC 40 Index lost 4.22%. The UK’s FTSE 100 Index lost 2.08%, less than the other three country indexes. The core eurozone bond yields followed the lead of U.S. Treasury yields, rising after the Fed’s 50-basis point increase was announced. The peripheral eurozone government bond yields largely tracked the core market yields. After the Bank of England (BoE) raised rates, UK gilt yields fell; however, the BoE also lowered its economic growth forecast and issued a warning that a recession may be imminent.

In Japan, trading was truncated in light of the holiday-shortened week (markets were closed from May 3 to 5), but nevertheless, there was a modest rise in Japanese equities. The Nikkei 225 Index inched higher by 0.58%, while the broader TOPIX Index gained 0.86%, even though the U.S. Federal Reserve’s decision to hike interest rates by 50 basis points (the first such hike since 2000) triggered strong volatility in markets domestically and globally. The yield on the 10-year Japanese government bond rose to 0.24%, up from the previous week’s close at 0.21%, in tandem with the move in U.S. Treasuries. The yen weakened slightly to around JPY 130.51 against the U.S. dollar, from approximately JPY 129.76 the week earlier. The latest level is still hovering at the lows of the past two decades. The weakness in the Japanese currency, however, triggered optimism among exporters as it boosted the value of their overseas earnings.

Chinese markets slumped in response to the signs that Beijing shall continue to pursue its zero-tolerance assault on the coronavirus. This raised worries among investors about the toll the economy is taking with the continuous lockdowns. The broad, capitalization-weighted Shanghai Composite Index slid 1.5% while the blue-chip CSI 300 Index sank 2.7%, the latter tracking the largest listed companies in Shanghai. In a statement issued by the Chinese Communist Party’s policy-making arm, the Politburo, any effort that relaxes virus prevention and control measures is perceived to lead to large-scale infections, serious illnesses, and deaths. The recent pronouncements made no mention of reconciling virus control measures with economic growth or reducing the damage to the economy, unlike previous statements. Although the city appears to relax restrictions and the rate of infections has declined, most of Shanghai’s 25 million residents are still under various degrees of lockdown. Beijing, on the other hand, announced mass testing and increased restrictions given a growing outbreak. As a result, domestic consumer spending over China’s five-day Labor Day holiday plunged 43% from that of the past year.

The Week Ahead

Inflation, hourly earnings growth, and jobless claims are among the important economic data expected to be released in the week to come.

Key Topics to Watch

- Wholesale inventories (revision)

- Consumer 1-year inflation expectations

- Consumer 3-year inflation expectations

- NFIB small-business index

- Real household debt (SAAR)

- Consumer price index

- Core CPI

- CPI (year-over-year)

- Core CPI (year-over-year)

- Federal budget

- Initial jobless claims

- Continuing jobless claims

- Producer price index (final demand)

- Import price index

- UMich consumer sentiment index (preliminary)

- UMich 5-year inflation expectations

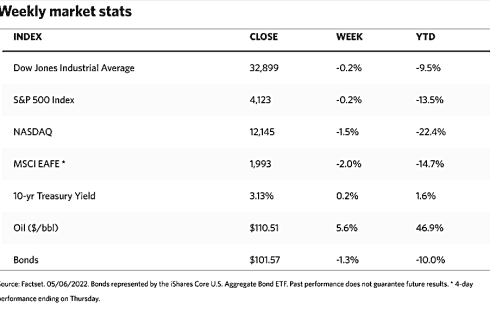

Markets Index Wrap Up