Lattice Semiconductor (NASDAQ:LSCC) had its price objective upped by analysts at Benchmark from $81.00 to $96.00 in a research note issued on Tuesday, The Fly reports. The firm currently has a “buy” rating on the semiconductor company’s stock. Benchmark’s price target would suggest a potential upside of 15.47% from the company’s previous close.

A number of other equities research analysts have also issued reports on the company. Susquehanna raised their price target on Lattice Semiconductor from $57.00 to $67.00 and gave the stock a “neutral” rating in a research note on Wednesday, November 3rd. KeyCorp raised their price target on Lattice Semiconductor from $72.00 to $80.00 and gave the stock an “overweight” rating in a research note on Wednesday, November 3rd. Susquehanna Bancshares raised their price target on Lattice Semiconductor from $57.00 to $67.00 and gave the stock a “neutral” rating in a research note on Wednesday, November 3rd. Craig Hallum raised their price target on Lattice Semiconductor from $50.00 to $60.00 and gave the stock a “hold” rating in a research note on Wednesday, November 3rd. Finally, William Blair reissued an “outperform” rating on shares of Lattice Semiconductor in a research note on Wednesday, November 3rd. Four research analysts have rated the stock with a hold rating and seven have issued a buy rating to the company’s stock. According to data from MarketBeat, Lattice Semiconductor presently has a consensus rating of “Buy” and a consensus target price of $77.13.

NASDAQ:LSCC opened at $83.14 on Tuesday. The firm has a market capitalization of $11.39 billion, a price-to-earnings ratio of 143.35, a PEG ratio of 11.46 and a beta of 0.97. Lattice Semiconductor has a 1 year low of $37.38 and a 1 year high of $84.99. The business has a 50 day simple moving average of $68.97 and a 200-day simple moving average of $59.27. The company has a debt-to-equity ratio of 0.37, a current ratio of 3.40 and a quick ratio of 2.76

Lattice Semiconductor (NASDAQ:LSCC) last posted its quarterly earnings data on Monday, November 1st. The semiconductor company reported $0.28 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.17 by $0.11. Lattice Semiconductor had a return on equity of 22.26% and a net margin of 17.34%. The business had revenue of $131.91 million during the quarter, compared to analyst estimates of $128.37 million. During the same period last year, the company earned $0.11 EPS. As a group, analysts expect that Lattice Semiconductor will post 0.72 earnings per share for the current fiscal year.

Lattice Semiconductor declared that its board has approved a stock repurchase program on Monday, November 8th that permits the company to buyback $100.00 million in outstanding shares. This buyback authorization permits the semiconductor company to purchase up to 0.9% of its stock through open market purchases. Stock buyback programs are generally a sign that the company’s leadership believes its stock is undervalued.

In related news, CEO James Robert Anderson sold 13,181 shares of the business’s stock in a transaction on Wednesday, August 18th. The stock was sold at an average price of $56.73, for a total transaction of $747,758.13. Following the transaction, the chief executive officer now directly owns 524,988 shares in the company, valued at approximately $29,782,569.24. The sale was disclosed in a document filed with the SEC, which can be accessed through this link. Also, VP Stephen Douglass sold 34,516 shares of the business’s stock in a transaction on Saturday, September 4th. The stock was sold at an average price of $63.07, for a total value of $2,176,924.12. Following the transaction, the vice president now owns 87,621 shares in the company, valued at $5,526,256.47. The disclosure for this sale can be found here. Insiders have sold a total of 334,861 shares of company stock worth $22,111,278 over the last 90 days. 1.64% of the stock is currently owned by company insiders.

A number of hedge funds have recently made changes to their positions in LSCC. Ameriprise Financial Inc. grew its stake in Lattice Semiconductor by 6.0% during the 1st quarter. Ameriprise Financial Inc. now owns 9,176 shares of the semiconductor company’s stock worth $413,000 after buying an additional 522 shares during the last quarter. Captrust Financial Advisors grew its stake in Lattice Semiconductor by 2,004.0% during the 1st quarter. Captrust Financial Advisors now owns 8,479 shares of the semiconductor company’s stock worth $382,000 after buying an additional 8,076 shares during the last quarter. AQR Capital Management LLC lifted its position in Lattice Semiconductor by 27.4% during the 1st quarter. AQR Capital Management LLC now owns 69,745 shares of the semiconductor company’s stock worth $3,140,000 after acquiring an additional 14,981 shares during the period. Schonfeld Strategic Advisors LLC acquired a new stake in Lattice Semiconductor during the 1st quarter worth about $642,000. Finally, Maverick Capital Ltd. acquired a new stake in Lattice Semiconductor during the 1st quarter worth about $68,000. Hedge funds and other institutional investors own 97.99% of the company’s stock.

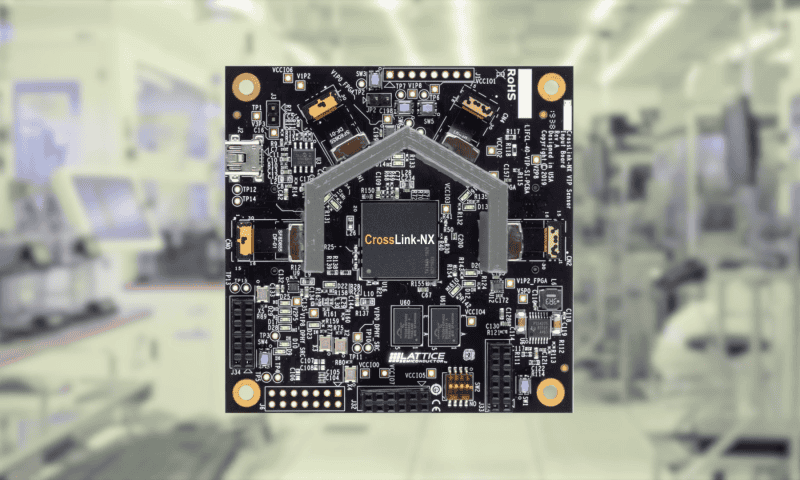

Lattice Semiconductor Company Profile

Lattice Semiconductor Corp. designs, develops and markets programmable logic products and related software. The company includes semiconductor devices, evaluation boards, development hardware, and related intellectual property licensing, services, and sales. It provides smart connectivity solutions powered by its low power FPGA, video ASSP, millimeter wave, and IP products to the consumer, communications, industrial, computing, and automotive markets.