Stock Markets

The major stock indexes were mixed in the past week’s trading. Investors appear to be caught between the optimism of the continued reopening of the economy and ongoing concerns about the possible increase in inflation and interest rates. Small-cap stocks slowed for the second week in a row, while the S&P 500 managed a slight gain despite communication services stocks faring worse. Several traditional media companies met with sharp declines after their past strong performance. The rising covid infection rates in several states and news of repeated lockdowns in Europe also dampened investor optimism early in the week. The market rebounded on Thursday, however, on news of expanded vaccination targets and announcement by the states that vaccination will be opened to all residents over 16.

U.S. Economy

There was a sizable decline last week in weekly jobless claims by as much as 100,000 to 684,000. This is the first recorded jobless claims report below 700,000 since the beginning of the pandemic. The figure remains higher than the jobless claims of 665,000 during the worse of the 2009 financial crisis. However, this points to the upside still to be traversed as the economy opens up and businesses continue to provide jobs for many of those still dislocated by the pandemic.

- Another driver that has still to be factored in is the latest round of stimulus checks which will hopefully boost consumer spending and release the pent-up demand for goods and services expected to flood the market. As consumer spending improves, attention is likely to shift to the infrastructure bill currently being considered. Whether this bill will find its way through Congress as easily as the pandemic relief bill is something still to be seen. The price tag is going to be hefty but long-term in nature, therefore it is likely that the infrastructure build-up will provide a sustained fiscal boost to the economy in the years to come.

- The underlying optimism among investors will continue to be buoyed by faster economic growth and increasing corporate profits. However, the post-pandemic stock market will be defined by more modest corporate gains and increased volatility. Worries about the direction of inflation and interest rates will create challenges to investor confidence, although there is no strong indication at present that fiscal policy constraints will seriously threaten the prospects of continued economic expansion and bull market.

Metals and Mining

Gold was down in the past week’s trading and is now at its lowest levels in six months. It last peaked in August 2020 when it broke out of the $2,000 per ounce level, and its decline since then mirrors the decrease in holdings for exchange-traded funds that gave up 84.7 tonnes in February. The metal descended to $1,722 this week before rebounding slightly to Friday’s $1,728.98. Demand may be lower this year than in 2020, as investors are not seen to chase the metal higher, and instead tempering their actions with more savvy buying. Silver tread the same path as gold in the face of rising values for the US currency and Treasury yields. It succumbed to downward pressure to test its year-to-date low of $24,53 per ounce. It recovered quickly to close Thursday’s trading at $25 per ounce. It slipped back on Friday’s opening to $24.90 and traded at $24.93 later in the day.

Platinum and palladium prices continue to be benefitted from supply issues in Russia. Platinum gained 1.9% from its open on Monday at $1.158 per ounce to its Friday value at $1,167. Palladium gained by a modest 0.8% for the week to end Friday at $2.562. It is experiencing some resistance as it inches closer to its all-time high of $2,614, attained in February 2020.

Base metals suffered declines across the board during the trading weak, which was largely attributed to the continued spread of covid variants and its likely negative impact on economic recovery. Copper fell by 3.4% by Thursday from its week’s opening at $9,097 per tonne. Nickel ended the week at $15,984 from its monthly high at $16.526. Zinc opened at $2,860 on Monday and ended Friday down by $101 at $2,759. Lead also ended the week lower at $1,907 per tonne. Noticeable during the dips, however, are signs of value buying that suggest an underlying bullish sentiment. Despite the current market softness, the sector continues to remain higher in its year-to-date performance, indicating the presence of robust support.

Energy and Oil

Oil prices were extremely volatile this week. Downward pressure was exerted by lockdowns and the slowdown in vaccination, but buying was buoyed due to news of the Suez Canal bottlenecks. Analysts remained positive despite the recent decline in prices, convinced that they were oversold on the fundamentals and that demand was set to ramp up during the summer. At about the same time, retail gasoline prices in the U.S. are expected to hit $3 per gallon, according to analysts. This week the price of gasoline inched up to $2.88 per gallon. Also noted by a Bloomberg report is the increasing frequency of talk about ESG (environmental, social, and governmental) issues, having noted that it was mentioned hundreds of times in the industry throughout the first quarter of 2021.

Shale costs are gradually inching up as the average cost to drill a new well in the U.S., as noted by a recent Dallas Fed survey, rising by 5% to $52 per barrel from last year’s figures. The increase in cost was mainly due to fewer service providers accounting for cost inflation. The same survey nevertheless sparked some optimism that the shale industry will see higher growth for the first quarter of this year. The business activity index of the survey, which gave a reading of only 18.5 for the fourth quarter of 2020, soared to 53.6 for the first three months of 2021.

Natural Gas

For this report week (March 17 to March 24), natural gas spot prices fell across most locations due to reduced demands as heating requirements continued to decline. Furthermore, dry natural gas production reached its highest level since the year began. The Henry Hub spot price fell to $2.45 per million British thermal units (MMBtu) from last week’s $2.51/MMBtu. The price of the April 2021 contract decreased at the New York Mercantile Exchange (NYMEX); down by $0.01 from $2.528/MMBtu to $2.518/MMBtu for the week. The price of the 12-month strip averaging April 2021 through March 2022 futures contracts rose by $0.02, to $2.750/MMBtu.

World Markets

European share prices went up in anticipation of a post-pandemic economic recovery, making up for earlier losses in the preceding weeks. The losses were weighed by concerns over the resumption of covid restrictions in response to the accelerating spread of the virus throughout Europe and the possibility that the European Commission (EC) may halt further vaccine exports. The pan-European STOXX Europe 600 Index gained 0.85% while major stock indexes were mostly mixed. Germany’s Xetra DAX Index, the UK’s FTSE 100 Index, and Italy’s FTSE MIB posted gains while France’s CAC 40 dropped lower for the week.

Overall, the core and peripheral eurozone government bonds fell over concerns of the slow vaccine rollout in Europe. A new wave of coronavirus infections also worked to drive demand for high-quality government bonds. An increase of EUR 7.1 billion in the weekly bond purchases of the European Central Bank exerted downward pressure on yields. Fears that the EC may block vaccine exports to the UK caused a decline in gilt yields. Furthermore, weaker-than-expected inflation data pulled yields lower as it became unlikely that the Bank of England may resort to tightening its monetary policy.

In Japan, equities dropped precipitously on Monday as the Nikkei fell below the 29,200 level amid ongoing concerns of the tenuousness of a global economic recovery. The optimism caused by the lifting of the state of emergency in the Tokyo region was offset by the renewed pessimism brought about by the renewed coronavirus lockdowns in Europe. The Nikkei 225 Stock Average slid 2.1% for the week, even as the TOPIX declined 1.4%. The yen weakened to just below JPY 110 against the U.S. dollar, and the yield on the 10-year Japanese government bond also dropped to 0.08%.

In China, it was the reverse as stocks exhibited weekly gains. Shares rallied on Friday on news that the central bank was not going to adopt a monetary tightening policy. The Shanghai Stock Exchange Composite (SSEC) Index climbed by 0.4% to close the week at 3418.3, and large-cap CSI 300 Index also strengthened by 0.6% to end trading at 5038.0, signaling the bourses’ first weekly at the end of five weeks of successive losses. China’s sovereign 10-year bond closed down four basis points from the previous week at 3.22%, in response to expectations that the country’s monetary policy will remain supportive in the short term.

The Week Ahead

Major economic data scheduled for release in the coming week are the Unemployment Rate, the Consumer Confidence Index, and the PMI Manufacturing Index.

Key Topics to Watch

- Case-Shiller national home price index (year-over-year change)

- Consumer confidence index

- ADP employment report

- Chicago PMI

- Pending home sales index

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Markit manufacturing PMI (final)

- ISM manufacturing index

- Construction spending

- Motor vehicle sales (SAAR)

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

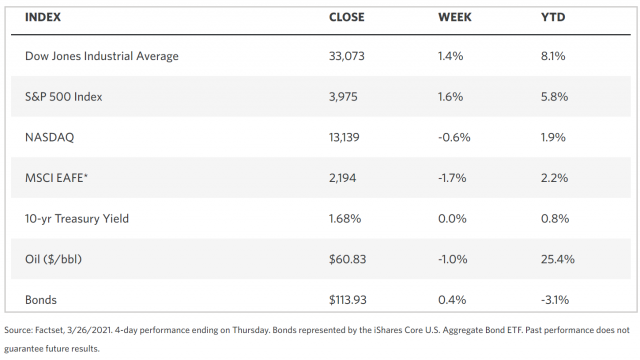

Markets Index Wrap Up