ATI’s (NYSE:ATI) stock is up by a considerable 22% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Specifically, we decided to study ATI’s ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

So, based on the above formula, the ROE for ATI is:

25% = US$460m ÷ US$1.8b (Based on the trailing twelve months to September 2025).

The ‘return’ is the income the business earned over the last year. So, this means that for every $1 of its shareholder’s investments, the company generates a profit of $0.25.

See our latest analysis for ATI

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company’s future earnings. We now need to evaluate how much profit the company reinvests or “retains” for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don’t have the same features.

ATI’s Earnings Growth And 25% ROE

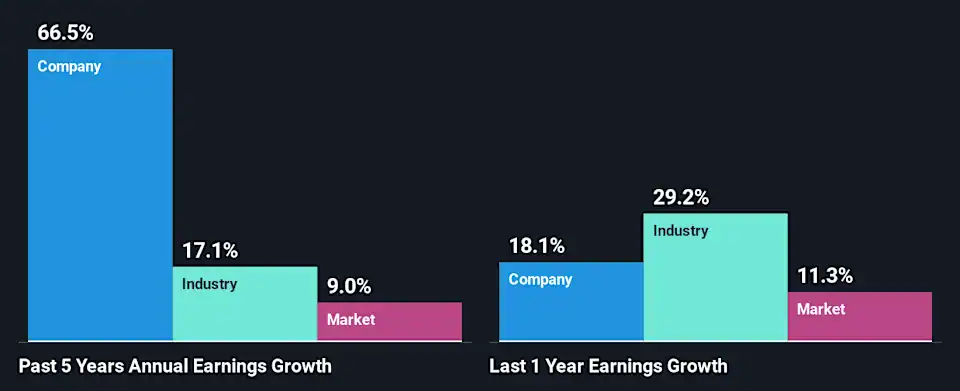

Firstly, we acknowledge that ATI has a significantly high ROE. Secondly, even when compared to the industry average of 12% the company’s ROE is quite impressive. So, the substantial 67% net income growth seen by ATI over the past five years isn’t overly surprising.

Next, on comparing with the industry net income growth, we found that ATI’s growth is quite high when compared to the industry average growth of 17% in the same period, which is great to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company’s expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Has the market priced in the future outlook for ATI?

Is ATI Efficiently Re-investing Its Profits?

ATI doesn’t pay any regular dividends currently which essentially means that it has been reinvesting all of its profits into the business. This definitely contributes to the high earnings growth number that we discussed above.

Summary

Overall, we are quite pleased with ATI’s performance. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. That being so, a study of the latest analyst forecasts show that the company is expected to see a slowdown in its future earnings growth. Are these analysts expectations based on the broad expectations for the industry, or on the company’s fundamentals?