Issued on Behalf of Ares Strategic Mining Inc.

Issued on Behalf of Ares Strategic Mining Inc.

America’s only permitted producer. 100% import dependent. The government just secured the supply chain before the market repriced the stock.

The market hasn’t priced this in yet.

Ares Strategic Mining (CSE: ARS | OTC: ARSMF) just secured a

$168.9 million DoD Contract Award from the

Defense Logistics Agency. Five-year Indefinite Delivery/Indefinite Quantity agreement. Ceiling up to $250 million.

The product? Acid-grade fluorspar.

A

Strategic National Stockpile mineral

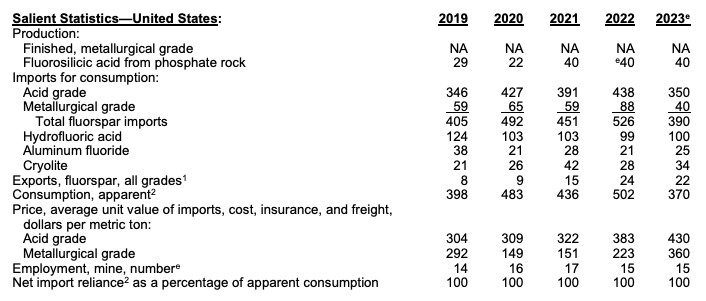

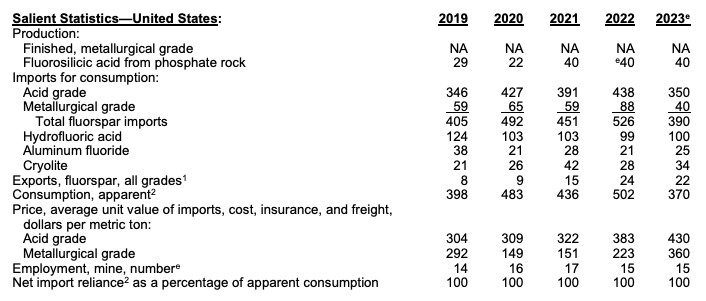

[1] the U.S. imports 100% of.

[2]

Until now.

Ares is the

Sole-Source Supplier. The only domestic producer. The Pentagon needed a secure domestic supply chain and they picked this company. Not a joint venture. Not a diversified contract.

One domestic supplier. Just one.

Here’s the glitch.

The company’s market cap is roughly equal to this single contract. That means the market is valuing the business as if this

Guaranteed Revenue from the

Department of Defense is worth

nothing beyond today.

The DoD just de-risked this trade. with a $169M deal that adds to

Ares’ overall story,

with zero dilution.

The contract is binding. The customer pays. The mineral is critical to defense manufacturing, semiconductors, and battery production.

The setup is asymmetric.

THE STRATEGIC NECESSITY

The Pentagon didn’t have a backup option.

China controls over 60% of global fluorspar production

[3]. They’re tightening exports.

China Export Restrictions are accelerating because they need every ton for their own military and EV buildout.

[4]

The U.S. has been

Import Dependent for decades.

Zero domestic production. Zero alternative suppliers. Zero margin for error.

That’s a national security problem the DoD can’t ignore.

Fluorspar isn’t optional. It’s on the U.S.

Critical Mineral List[5] for a reason.

Without it, you can’t build:

- F-35 fighter jets (missile guidance systems)

- EV batteries (lithium-ion electrolytes)

- Semiconductors (etching and cleaning)

- Steel and aluminum (flux agent in manufacturing)

- Refrigerants and pharmaceuticals (fluorochemical production)

Every advanced economy runs on this mineral.

When China restricts supply, the U.S. military can’t simply “find another vendor.” The

Defense Logistics Agency needed

Supply Chain Resilience. They needed a domestic source under U.S. jurisdiction.

They found one.

THE MOAT

Ares didn’t get this contract because they submitted the best bid.

They got it because they’re the only company in America that can deliver.

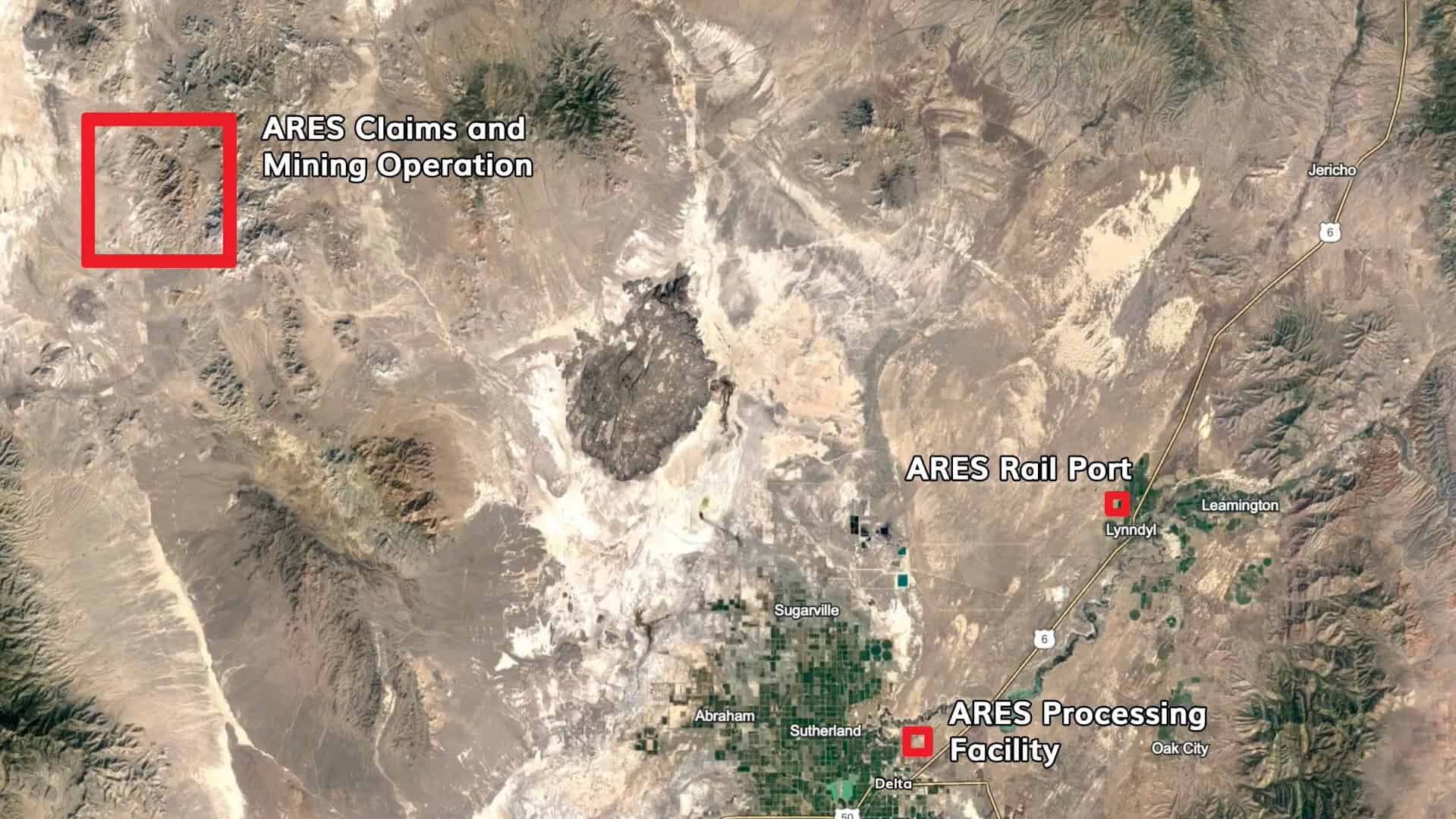

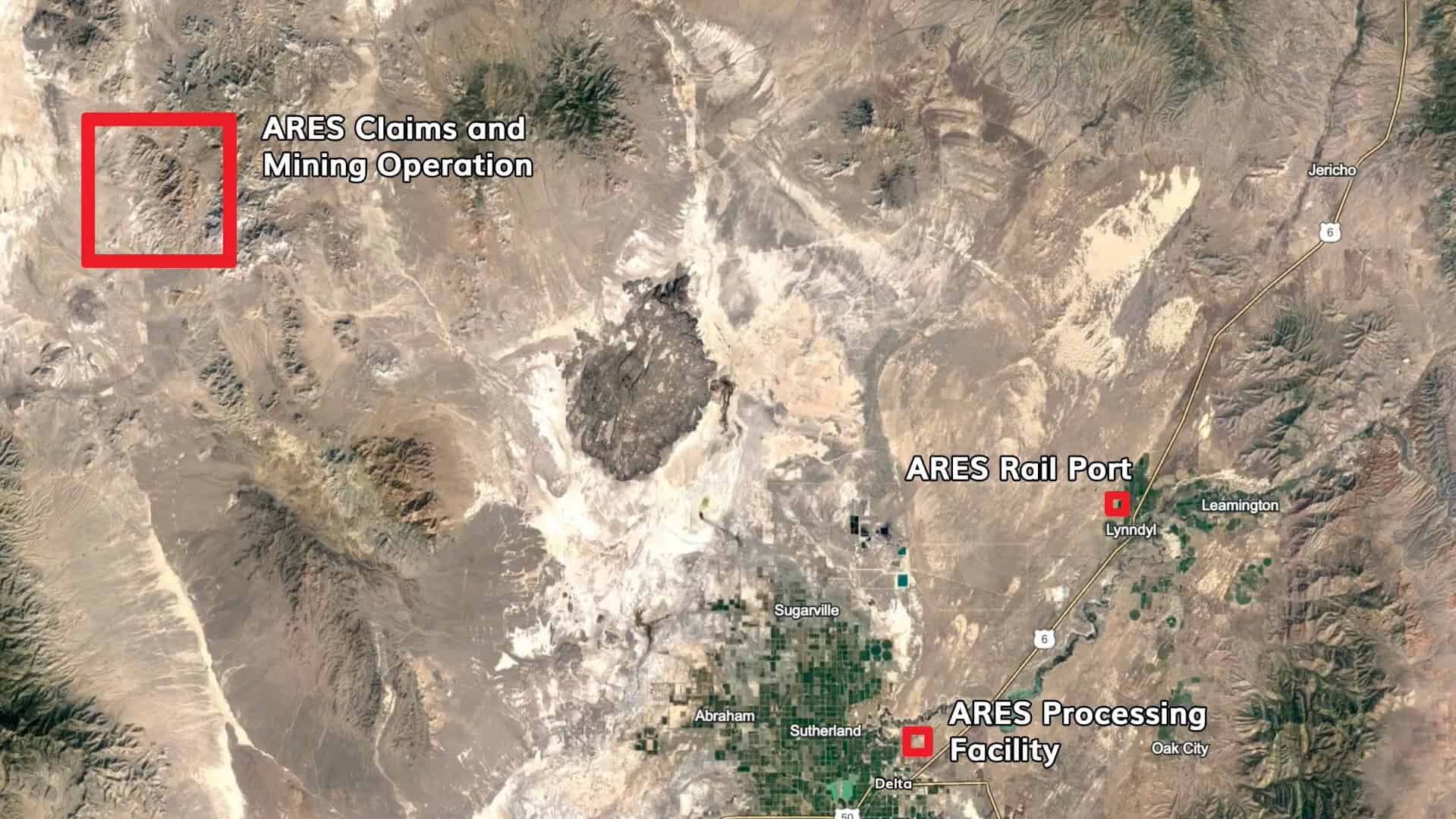

The Lost Sheep Mine in Utah is

Fully Permitted. Mining plan approved by the Bureau of Land Management. Environmental clearances in place. Infrastructure under construction.

No other company has that.

Permits take years. Sometimes decades. You need geological surveys, environmental impact studies, state and federal approvals, water rights, community support, and political alignment.

Ares already cleared those hurdles.

A competitor can’t just open a mine next door. The permitting process alone would take five to seven years minimum. By then,

Ares will have locked in multi-year supply agreements and expanded capacity.

This is a

National Security Asset with regulatory protection baked in.

The Pentagon didn’t pick

Ares out of convenience. They picked them because the alternative was staying dependent on foreign adversaries.

The deal is exclusive by necessity.

THE TECH BONUS

Here’s where it gets interesting.

The Lost Sheep Mine doesn’t just produce fluorspar. It also contains

Gallium and

Germanium.

Two of the rarest tech metals on Earth.

Gallium[6] is critical for:

- AI chip substrates

- 5G infrastructure

- Military radar systems

- LED and laser technology

Germanium[7] is essential for:

- Fiber optics

- Infrared night vision

- Satellite electronics

- Advanced Semiconductor Supply Chain applications

China controls 94% of global

Gallium Production[8]. They’ve already restricted exports twice in the last 18 months.

The DoD knows this.

The

DoD Contract Details cover fluorspar. That’s the $168.9 million.

But the Gallium and Germanium? That’s sitting in the same ore body. Same processing facility. Same extraction timeline.

The government is funding the infrastructure.

Investors get the tech metals as a bonus.

This isn’t speculation. The geological reports confirm commercial-grade concentrations of both elements. When production ramps,

Ares will be producing materials the

Semiconductor Supply Chain is desperate to source domestically.

The Pentagon paid for the meal. The dessert is free.

INSTITUTIONAL VALIDATION

Smart money is already positioned.

Sorbie Bornholm, a UK institutional fund, recently increased their stake

[9],[10]. They don’t buy lottery tickets. They buy asymmetric setups with government backing.

The

State of Utah invested $11 million into

Ares[11]. State governments don’t gamble. They invest when jobs, revenue, and strategic value align.

And now… the

Department of Defense just committed $168.9 million in

Non-Dilutive Capital. No share dilution. No equity giveaway. Pure revenue locked in.

Three institutions. Three different mandates. All betting the same direction.

The re-pricing has begun.

THE CLOSE

The U.S. government just validated a company trading at the value of a single contract.

A five-year DoD agreement. A sole-source monopoly on a critical defense mineral. A bonus tech metal portfolio tied to AI and semiconductors.

Institutional Support from the State of Utah and UK funds.

The setup is rare.

The timing is now.

The news is out. The institutions are in. The question is whether retail catches up before the gap closes.

Where to Learn More

Company Website: https://www.aresmining.com

Investor Contact: jwalker@aresmining.com

Stock Symbols: CSE: ARS | OTC: ARSMF | FRA: N8I1

Current Price: $0.49 USD (Jan 16, 2026)

Market Cap: $108M USD (Jan 16, 2026)

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Equity-Insider.com is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee which has since expired for Ares Strategic Mining Inc. advertising and digital media from the company directly. There may be 3rd parties who may have shares of Ares Strategic Mining Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ owns shares of Ares Strategic Mining Inc. which were purchased in the open market, and through private placements in the past, and reserve the right to buy and sell, and will sell shares of Ares Strategic Mining Inc. at any time without any further notice commencing immediately and ongoing. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material, including this article, which is disseminated by MIQ has been approved by Ares Strategic Mining Inc.; this is a paid advertisement, we currently own shares of Ares Strategic Mining Inc. and will sell shares of the company in the open market, or through private placements, and/or other investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

[1] https://www.dla.mil/Strategic-Materials/

[2] https://pubs.usgs.gov/periodicals/mcs2024/mcs2024-fluorspar.pdf

[3] https://source.benchmarkminerals.com/article/fluorspar-the-quiet-achiever-of-the-lithium-ion-battery-boom

[4] https://www.csis.org/analysis/china-imposes-its-most-stringent-critical-minerals-export-restrictions-yet-amidst

[5] https://www.energy.gov/cmm/what-are-critical-materials-and-critical-minerals

[6] https://www.rfglobalnet.com/doc/how-the-defense-industry-is-using-gan-technology-0001

[7] https://www.usgs.gov/centers/national-minerals-information-center/germanium-statistics-and-information

[8] https://pubs.usgs.gov/periodicals/mcs2024/mcs2024-gallium.pdf

[9] https://www.aresmining.com/post/ares-strategic-mining-announces-increase-in-institutional-investment

[10] https://www.aresmining.com/post/ares-strategic-mining-secures-increased-non-dilutive-cash-injection-to-support-development

[11] https://www.aresmining.com/post/ares-strategic-mining-secures-major-state-funding-of-11-000-000-usd-to-accelerate-production-ramp-u

Issued on Behalf of Ares Strategic Mining Inc.

Issued on Behalf of Ares Strategic Mining Inc.

Here’s the glitch.

The company’s market cap is roughly equal to this single contract. That means the market is valuing the business as if this Guaranteed Revenue from the Department of Defense is worth nothing beyond today.

The DoD just de-risked this trade. with a $169M deal that adds to Ares’ overall story, with zero dilution.

The contract is binding. The customer pays. The mineral is critical to defense manufacturing, semiconductors, and battery production.

The setup is asymmetric.

Here’s the glitch.

The company’s market cap is roughly equal to this single contract. That means the market is valuing the business as if this Guaranteed Revenue from the Department of Defense is worth nothing beyond today.

The DoD just de-risked this trade. with a $169M deal that adds to Ares’ overall story, with zero dilution.

The contract is binding. The customer pays. The mineral is critical to defense manufacturing, semiconductors, and battery production.

The setup is asymmetric.

When China restricts supply, the U.S. military can’t simply “find another vendor.” The Defense Logistics Agency needed Supply Chain Resilience. They needed a domestic source under U.S. jurisdiction.

They found one.

When China restricts supply, the U.S. military can’t simply “find another vendor.” The Defense Logistics Agency needed Supply Chain Resilience. They needed a domestic source under U.S. jurisdiction.

They found one.