Barrick Mining (NYSE:B) continues to be a talking point as investors track its performance through recent months. With a return of 26% over the past month and 54% in the past 3 months, the stock’s momentum invites closer examination.

Barrick Mining’s momentum has been hard to ignore, with the share price climbing sharply through recent months. This year’s powerful rally has brought even more attention to the stock. In short, the 1-year total shareholder return of 145% and a strong share price surge year-to-date signal that market interest is building around the company’s growth story and shifting risk perception. This is especially notable as it continues to outpace sector peers and headlines remain focused on its performance.

If Barrick’s run has you watching for what else could deliver outsized returns, now is the perfect time to broaden your sights and discover fast growing stocks with high insider ownership

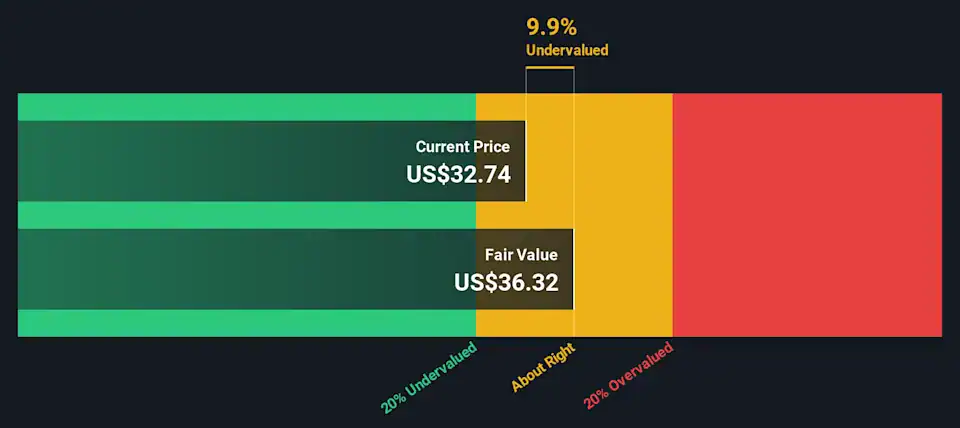

But after such a rapid rally, the key question is whether Barrick Mining’s strong gains still leave room for upside or if today’s price already reflects all of the company’s expected future growth. Is there still value to be found, or has the market moved ahead of fundamentals?

Price-to-Earnings of 19.7x: Is it justified?

Barrick Mining currently trades at a price-to-earnings ratio of 19.7x, placing it below both its sector and peer group averages. This indicates the market is assigning the company a relative discount based on its earnings profile.

The price-to-earnings (P/E) ratio helps investors gauge how much they are paying for each dollar of company earnings. This is particularly relevant for an established and profitable resource company like Barrick Mining. A lower P/E compared to peers may reflect undervaluation or conservative growth expectations from the market.

Looking closer, Barrick’s P/E of 19.7x is lower than the US Metals and Mining industry average of 22.2x and also below the peer average of 23.6x. This positioning becomes even more striking when compared with the estimated fair P/E, which stands at 26.4x. This level is one the market could move toward if the company continues on its current trajectory.

Result: Price-to-Earnings of 19.7x (UNDERVALUED)

However, slowing revenue growth or shifts in commodity prices could weigh on Barrick Mining’s outlook. These factors could potentially challenge the sustainability of recent gains.

Another View: Discounted Cash Flow Tells a Different Story

While Barrick Mining appears undervalued based on its lower price-to-earnings ratio, our DCF model suggests an even wider disconnect. According to the SWS DCF model, the company’s shares trade about 70% below what our estimate of fair value would suggest. This may indicate the market is overlooking Barrick’s future cash generation potential.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Barrick Mining for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Barrick Mining Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own narrative in just a few minutes, so why not Do it your way

A great starting point for your Barrick Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve by seeking out stocks most investors overlook, hidden opportunities in futuristic tech, or reliable income streams. There’s more waiting for you.

-

Start small and take advantage of massive growth potential by scouting out these 3556 penny stocks with strong financials with strong financials before the crowd catches on.

-

Capitalize on the artificial intelligence revolution and tap into breakthroughs and innovation with these 25 AI penny stocks shaping tomorrow’s markets right now.

-

Grow your wealth while enjoying consistent returns by uncovering these 15 dividend stocks with yields > 3% for dependable, high-yielding portfolios.