Somnigroup International (NYSE:SGI) has been attracting attention lately as investors look for signals in the bedding and sleep solutions sector. The company’s recent performance has prompted a closer look at its growth story and valuation trends.

With a year-to-date share price return of nearly 64%, Somnigroup International has clearly caught investors’ attention. Momentum accelerated in recent weeks, coinciding with its name change and ongoing retail expansion. The strong one-year total shareholder return of 64.45% and a notable three-year gain of 199% suggest that interest in the stock is building as the company’s transformation and growth narrative continue to unfold.

If Somnigroup’s recent moves have you thinking bigger picture, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

After such impressive gains, the key question for investors is whether Somnigroup’s current share price still underestimates its future potential, or if the market has already factored in the company’s growth prospects.

Most Popular Narrative: 9.4% Undervalued

Somnigroup International’s widely followed narrative pegs fair value at $101.00, a notable premium to its last close of $91.52. Investors are debating if this optimistic estimate is backed by strong growth catalysts.

The integration of Mattress Firm is already generating meaningful sales and cost synergies, with $100 million in annual net cost synergies projected and sales synergies ahead of schedule. These operational improvements are set to expand EBITDA and enhance net margins moving into 2026 and beyond.

Want to see what propels this fair value? Analysts are betting on bold revenue and earnings leaps as synergies take hold. The assumptions driving this valuation might surprise you; dive into the details that could redraw the map for Somnigroup’s future.

Result: Fair Value of $101.00 (UNDERVALUED)

However, lingering uncertainty in consumer demand and the potential impact of tariffs remain important risks that could disrupt Somnigroup’s current growth narrative.

Another View: What Do Market Multiples Say?

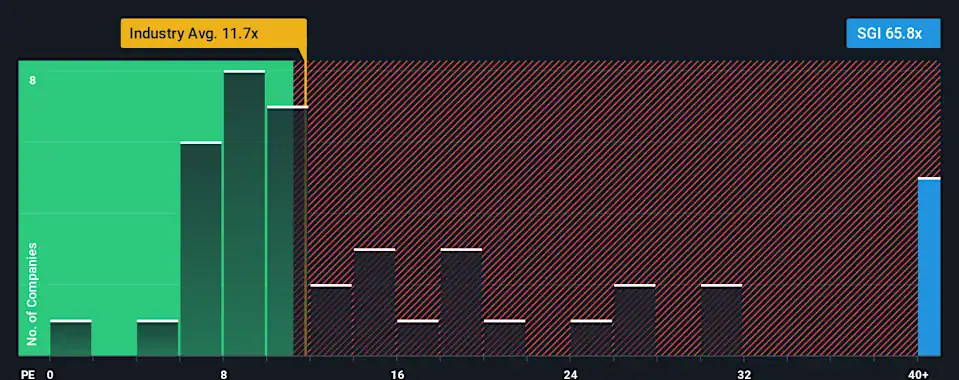

While analysts see Somnigroup as undervalued with a fair value of $101.00, the company’s current price-to-earnings ratio stands at 60.9x. This is far above the US Consumer Durables industry average of 11.8x and also above the fair ratio of 28x. This significant gap raises questions about whether Somnigroup’s growth story has moved ahead of reality, or if the premium will be justified by future results. Will the market align with fundamentals, or could expectations become more measured?

Build Your Own Somnigroup International Narrative

If you want to put the story to the test or see if your perspective leads to a different outlook, you can build your own narrative in just a few minutes: Do it your way

A great starting point for your Somnigroup International research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunity slip by. Unlock your next big move by searching for stocks beyond Somnigroup. Simply Wall Street’s tailored screeners can connect you with standout investment themes you might have missed.

-

Supercharge your portfolio with steady cash flow by targeting these 15 dividend stocks with yields > 3% delivering attractive yields and reliable returns.

-

Jump on the next leap in innovation and disruptive technology through these 25 AI penny stocks powering advancements in artificial intelligence.

-

Catch undervalued gems flying under the radar and sharpen your edge by picking from these 919 undervalued stocks based on cash flows primed for future growth.