ISSUED ON BEHALF OF ALEEN INC.

Aleen Inc. (CSE: ALEN-U) is a small-float CSE company building the non-medical intelligence layer for the $45.65B Digital Wellness sector[1].

You Can’t Afford to Wait.

We all know the fear. It’s 2 AM, you’re searching online for guidance on your phone, and the only thing growing faster than your worry is the wait time for professional advice.

The current system is slow, expensive, and stressful. It treats wellness as a challenge to be managed, not a journey to be understood.

But that is fundamentally changing. Consumers have chosen a new path.

The market for immediate, personalized wellness insights is no longer a niche. It is a massive, self-sustaining shift that demands a technological solution.

The Market is Exploding[2]:

- The Digital Wellness market is currently valued at $12.87 billion.

- It is projected to explode to $45.65 billion by 2034.

The Disruption: Intelligence, Not Just Tracking

This is where Aleen Inc. (CSE: ALEN-U) comes in.

Most wellness apps are just glorified diaries—they track your steps or calories.

Aleen AI is different.

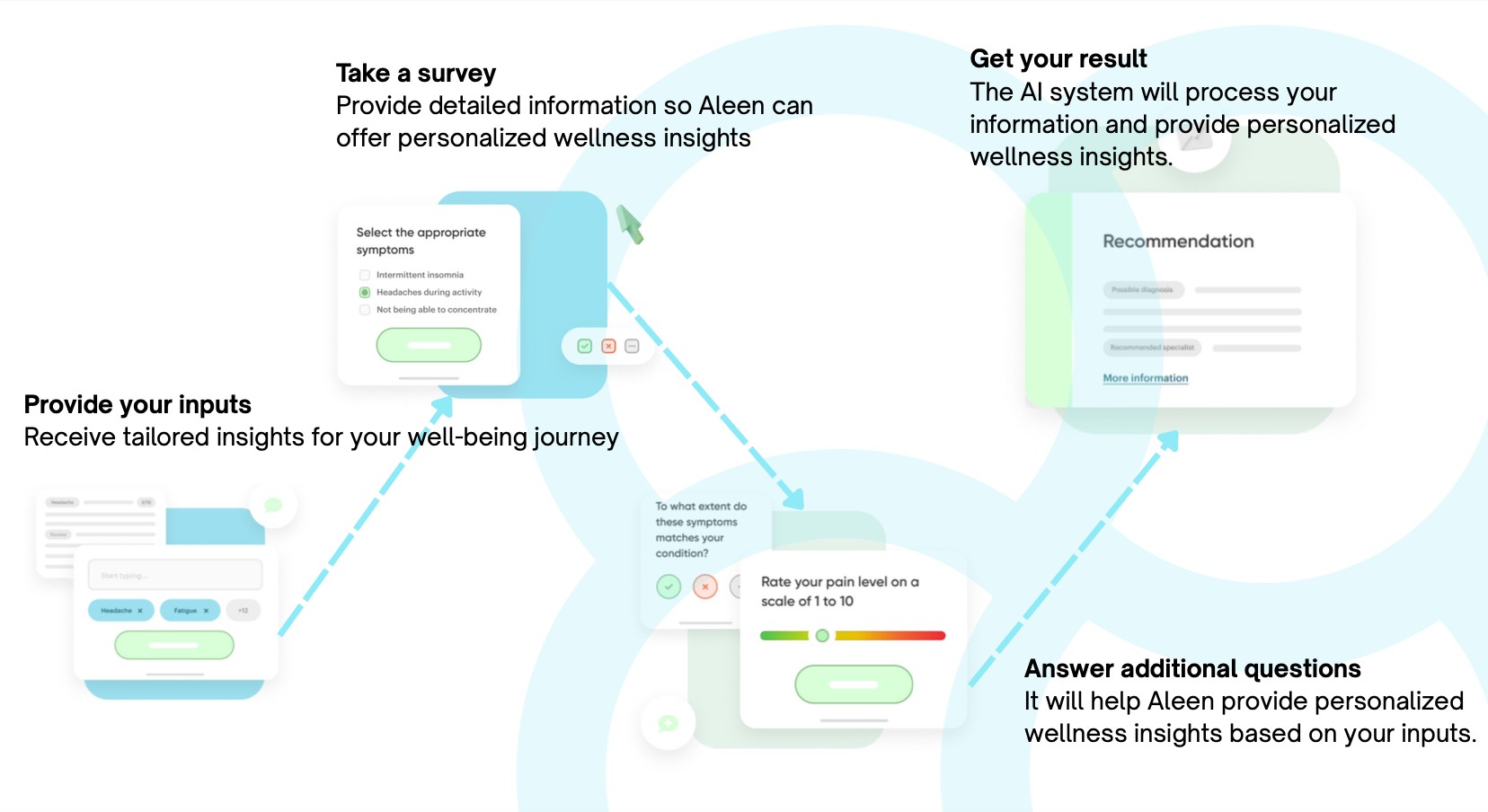

Aleen Inc. (CSE: ALEN-U) has built a proprietary Artificial Intelligence engine that instantly takes interprets multiple user inputs and wellness indicators to provide personalized wellness insights and lifestyle suggestions.

NOTE: not intended to diagnose or treat any condition.

- Aleen is not a medical device or a substitute for a doctor, and they are clear on that.

- It acts as the intelligent bridge that gives people personalized wellness guidance based on user inputs.

- This tool is precisely what the $45 billion wellness market is demanding.

NOTE: Aleen’s solution operate in the wellness domain and are not subject to FDA or Health Canada regulatory approval as medical devices.

The Investment Thesis: How Aleen Captures $660 Billion

The true investment story is not just the free user traffic—which is already strong at over 16,500 monthly visitors and continuously trains the AI.

The core opportunity is the high-margin B2B API.

Aleen Inc.’s (CSE: ALEN-U) Strategic Edge:

- Essential Infrastructure: Positioned to provide the non-clinical AI layer for digital wellness and tele-wellness platforms. These integrations support wellness decision-making, not clinical diagnostics.

- The Scalable Revenue Model: Monetization is based on highly desirable monthly subscriptions or per-call pricing.

- Proven Success Blueprint: This is the model the market is rewarding, with similar B2B digital health IPOs such as when:

These comparisons are for illustrative purposes. Aleen operates in a different regulatory and market environment.

- The Ultimate Ceiling: By serving as the underlying AI layer, Aleen is positioned to capture value from the entire $660 Billion Global Digital Health market by 2027[5]. This is the massive, undeniable infrastructure potential unlocked by the B2B model.

- Hyper-Growth Tailwinds: The company is riding a wave of validated growth—AI in healthcare is projected to surge by 41.7% annually through 2030[6].

The Bottom Line

The message is clear: You have a chance to invest in a small-float, public AI infrastructure play that is actively working to capture value from a $660 billion domain.

Aleen is still an early-stage company:

- Small Float: Only 12.6 million shares outstanding.

- Growth Capital: Currently raising $20-30 million to accelerate B2B API integrations and expansion.

The market is open, the sector is validated, and the window to get in early is closing.

Discover how Aleen Inc. (CSE: ALEN-U) is building the core intelligence engine for the world’s largest wellness revolution.

Click here to check out their official website and see how AI is reshaping wellness from the ground up.

DISCLAIMER:

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Equity Insider is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Aleen Inc. advertising and digital media from the company directly. There may be 3rd parties who may have shares Aleen Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Aleen Inc. which were purchased in the open market. MIQ reserves the right to buy and sell, and will buy and sell shares of Aleen Inc. at any time thereafter without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, and we own shares of the mentioned company that we will sell, and we also reserve the right to buy shares of the company in the open market, or through other investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment. Aleen’s solutions operate in the wellness domain and are not subject to FDA or Health Canada regulatory approval as medical devices.

SOURCES CITED:

[1] https://www.precedenceresearch.com/wellness-apps-market

[2] https://www.precedenceresearch.com/wellness-apps-market

[3] https://www.fiercehealthcare.com/health-tech/hinge-health-shares-jump-17-stock-market-setting-stage-digital-health-ipo-revival

[4] https://www.valuethemarkets.com/analysis/omada-health-stock-omda

[5] https://lucidityinsights.com/infobytes/global-digital-health-market-size-2019-2025

[6] https://www.gmiresearch.com/report/global-artificial-intelligence-in-healthcare-market/