The Trump administration is kicking off investigations into imports of pharmaceuticals and semiconductors as part of a bid to impose tariffs on both sectors on national security grounds, notices posted to the Federal Register on Monday showed.

The filings set to be published on Wednesday set a 21-day deadline from that date for the submission of public comment on the issue and indicate the administration intends to pursue the levies under authority granted by Section 232 of the Trade Expansion Act of 1962. Such section 232 probes need to be completed within 270 days after being announced.

The Trump administration has started 232 investigations into imports of copper and lumber, and probes completed in President Donald Trump’s first term formed the basis for tariffs rolled out since his return to the White House in January on steel and aluminum and on the auto industry.

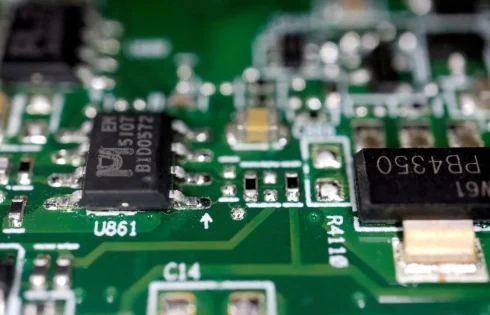

The United States began collecting 10% tariffs on imports on April 5. Pharmaceuticals and semiconductors are exempt from those duties, but Trump has said they will face separate tariffs.

Trump said on Sunday he would be announcing a tariff rate on imported semiconductors over the next week, adding that there would be flexibility with some companies in the sector.

The United States relies heavily on chips imported from Taiwan, something then-President Joe Biden sought to reverse by granting billions in Chips Act awards to lure chipmakers to expand production in the country.

The drug industry has argued that tariffs could increase the chance of shortages and reduce access for patients. Generic drug manufacturers operate on very thin margins, and any cost increase might prompt some to leave the market since it could be hard for them to absorb or pass along the tariff’s impact.

Tariffs “will only amplify the problems that already exist in the U.S. market for affordable medicines,” John Murphy III, CEO of the Association for Accessible Medicines, the trade group for generic and biosimilar medicine, said in a statement.

“Without substantive regulatory and reimbursement changes to the U.S. market, tariffs will exacerbate shortages that hinder patient access today,” he continued.

Brand name drug manufacturers have a greater ability to absorb tariffs, but some experts expect them to pass along the cost.

Although the pharmaceutical industry escaped the tariffs that Trump imposed during his first term, the president now argues that the United States needs more drug manufacturing so it does not have to rely on other countries for its supply of medicines.

Companies in the industry have lobbied Trump to phase in tariffs on imported pharmaceutical products in hopes of reducing the sting from the charges and to allow time to shift manufacturing.

Large drugmakers have global manufacturing footprints, mainly in the United States, Europe and Asia, and moving more production to the United States involves a major commitment of resources and could take years.

Tariffs will not push drugmakers to boost domestic manufacturing because the investment capacity doesn’t exist at this time, Murphy told CNN recently.

Large tariffs will delay Indian companies’ investment the United States, Kathleen Jaeger, US spokesperson for the Indian Pharmaceutical Alliance. Nearly half of generic prescriptions in the United States come from Indian manufacturers.

“Adding tariffs on America’s affordable medicine partners in India would make it even worse — for patients, the healthcare system and for America’s national security,” she said in a statement.