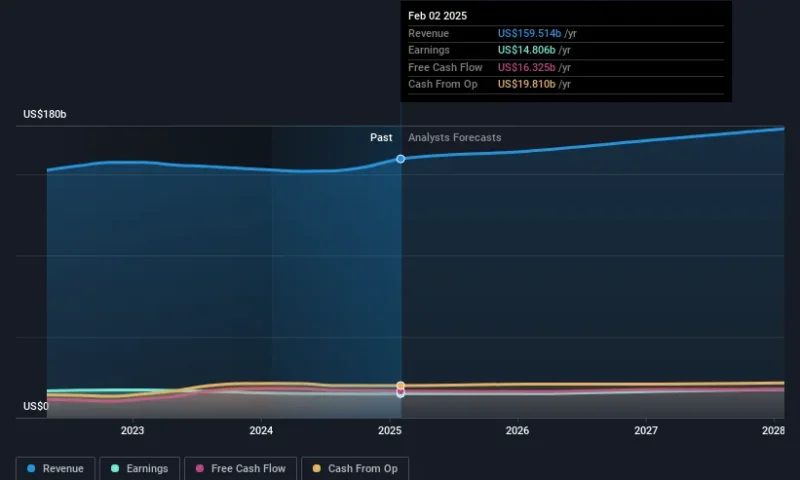

Last week saw the newest full-year earnings release from The Home Depot, Inc. (NYSE:HD), an important milestone in the company’s journey to build a stronger business. Home Depot reported in line with analyst predictions, delivering revenues of US$160b and statutory earnings per share of US$14.91, suggesting the business is executing well and in line with its plan. Earnings are an important time for investors, as they can track a company’s performance, look at what the analysts are forecasting for next year, and see if there’s been a change in sentiment towards the company. With this in mind, we’ve gathered the latest statutory forecasts to see what the analysts are expecting for next year.

Taking into account the latest results, the current consensus from Home Depot’s 35 analysts is for revenues of US$164.3b in 2026. This would reflect a satisfactory 3.0% increase on its revenue over the past 12 months. Statutory per share are forecast to be US$14.86, approximately in line with the last 12 months. In the lead-up to this report, the analysts had been modelling revenues of US$164.3b and earnings per share (EPS) of US$15.57 in 2026. So it looks like there’s been a small decline in overall sentiment after the recent results – there’s been no major change to revenue estimates, but the analysts did make a small dip in their earnings per share forecasts.

The consensus price target held steady at US$431, with the analysts seemingly voting that their lower forecast earnings are not expected to lead to a lower stock price in the foreseeable future. The consensus price target is just an average of individual analyst targets, so – it could be handy to see how wide the range of underlying estimates is. The most optimistic Home Depot analyst has a price target of US$484 per share, while the most pessimistic values it at US$292. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Home Depot shareholders.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that Home Depot’s revenue growth is expected to slow, with the forecast 3.0% annualised growth rate until the end of 2026 being well below the historical 5.7% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 5.1% per year. So it’s pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Home Depot.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. The consensus price target held steady at US$431, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company’s earnings is a lot more important than next year. We have forecasts for Home Depot going out to 2028, and you can see them free on our platform here.