Roku, Inc. (NASDAQ:ROKU – Get Free Report)’s stock price traded down 0.2% on Monday . The company traded as low as $68.52 and last traded at $69.09. 695,984 shares traded hands during trading, a decline of 84% from the average session volume of 4,406,974 shares. The stock had previously closed at $69.20.

Wall Street Analysts Forecast Growth

A number of brokerages have issued reports on ROKU. Needham & Company LLC reissued a “buy” rating and issued a $100.00 target price on shares of Roku in a research report on Thursday, October 31st. Jefferies Financial Group cut their price objective on Roku from $60.00 to $55.00 and set an “underperform” rating on the stock in a report on Friday, November 1st. Citigroup increased their target price on Roku from $60.00 to $77.00 and gave the stock a “neutral” rating in a research note on Wednesday, September 25th. UBS Group initiated coverage on Roku in a research report on Friday. They issued a “neutral” rating and a $73.00 target price for the company. Finally, Baird R W raised shares of Roku from a “hold” rating to a “strong-buy” rating in a research report on Monday, November 18th. Two analysts have rated the stock with a sell rating, nine have assigned a hold rating, thirteen have given a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, the company presently has an average rating of “Moderate Buy” and a consensus target price of $84.14.

Roku Price Performance

The firm’s 50 day simple moving average is $74.45 and its 200-day simple moving average is $65.13. The company has a market cap of $9.91 billion, a price-to-earnings ratio of -57.57 and a beta of 2.07.

Roku (NASDAQ:ROKU – Get Free Report) last posted its quarterly earnings data on Wednesday, October 30th. The company reported ($0.06) EPS for the quarter, beating analysts’ consensus estimates of ($0.35) by $0.29. The company had revenue of $1.06 billion for the quarter, compared to analyst estimates of $1.02 billion. Roku had a negative net margin of 4.42% and a negative return on equity of 7.22%. Roku’s quarterly revenue was up 16.5% on a year-over-year basis. During the same period in the previous year, the business posted ($2.33) earnings per share. On average, analysts forecast that Roku, Inc. will post -1.1 EPS for the current year.

Insider Buying and Selling at Roku

In related news, insider Charles Collier sold 15,454 shares of Roku stock in a transaction on Thursday, September 12th. The stock was sold at an average price of $75.00, for a total transaction of $1,159,050.00. Following the completion of the transaction, the insider now directly owns 200 shares of the company’s stock, valued at approximately $15,000. The trade was a 98.72 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this link. Also, CFO Dan Jedda sold 1,000 shares of the business’s stock in a transaction on Tuesday, September 17th. The stock was sold at an average price of $75.33, for a total value of $75,330.00. Following the sale, the chief financial officer now owns 54,267 shares in the company, valued at approximately $4,087,933.11. The trade was a 1.81 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 90,240 shares of company stock valued at $6,729,582. 13.98% of the stock is owned by corporate insiders.

Institutional Investors Weigh In On Roku

Several institutional investors and hedge funds have recently made changes to their positions in the business. UniSuper Management Pty Ltd lifted its position in Roku by 100.0% during the first quarter. UniSuper Management Pty Ltd now owns 1,800 shares of the company’s stock worth $117,000 after buying an additional 900 shares during the period. CANADA LIFE ASSURANCE Co grew its holdings in Roku by 127.2% in the first quarter. CANADA LIFE ASSURANCE Co now owns 49,912 shares of the company’s stock valued at $3,255,000 after purchasing an additional 27,940 shares during the period. Natixis acquired a new position in Roku during the first quarter worth approximately $53,000. Price T Rowe Associates Inc. MD raised its stake in Roku by 4.6% during the first quarter. Price T Rowe Associates Inc. MD now owns 71,174 shares of the company’s stock worth $4,640,000 after purchasing an additional 3,104 shares during the period. Finally, Jacobs Levy Equity Management Inc. boosted its holdings in shares of Roku by 323.6% in the 1st quarter. Jacobs Levy Equity Management Inc. now owns 199,911 shares of the company’s stock valued at $13,028,000 after purchasing an additional 152,719 shares during the last quarter. 86.30% of the stock is currently owned by hedge funds and other institutional investors.

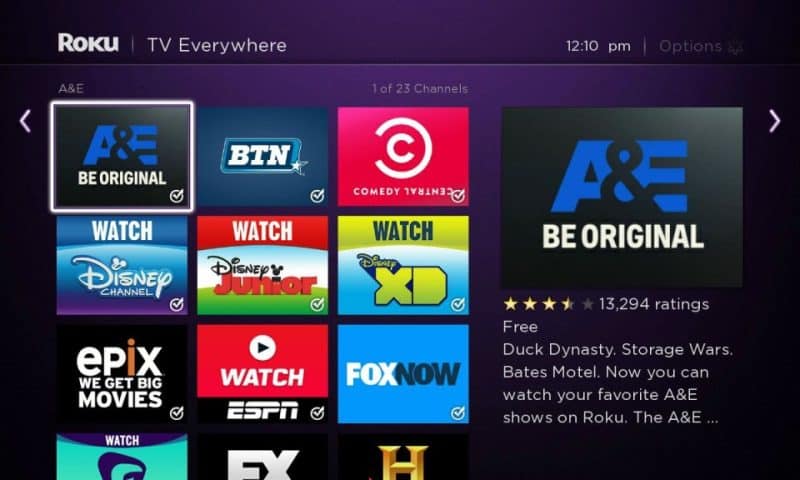

About Roku

Roku, Inc, together with its subsidiaries, operates a TV streaming platform in the United states and internationally. The company operates in two segments, Platform and Devices. Its streaming platform allows users to find and access TV shows, movies, news, sports, and others. The Platform segment offers digital advertising, including direct and programmatic video advertising, media and entertainment promotional spending, and related services; and streaming services distribution, such as subscription and transaction revenue shares, and sale of premium subscriptions and branded app buttons on remote controls.