General Electric (NYSE:GE – Get Free Report) shares dropped 0.4% on Wednesday . The stock traded as low as $176.80 and last traded at $176.86. Approximately 662,634 shares traded hands during trading, a decline of 89% from the average daily volume of 6,189,852 shares. The stock had previously closed at $177.56.

Analyst Upgrades and Downgrades

A number of equities analysts have commented on the company. Citigroup lifted their target price on General Electric from $198.00 to $216.00 and gave the company a “buy” rating in a research note on Thursday, October 10th. UBS Group upped their price objective on General Electric from $223.00 to $230.00 and gave the stock a “buy” rating in a research note on Wednesday, October 23rd. Melius Research raised their target price on General Electric from $194.00 to $202.00 in a research note on Tuesday, October 22nd. Barclays upped their price target on shares of General Electric from $175.00 to $200.00 and gave the stock an “overweight” rating in a research report on Tuesday, July 30th. Finally, Wells Fargo & Company lifted their price objective on shares of General Electric from $205.00 to $210.00 and gave the company an “overweight” rating in a research report on Wednesday, October 23rd. Two equities research analysts have rated the stock with a hold rating and fourteen have given a buy rating to the company. According to data from MarketBeat, the company currently has an average rating of “Moderate Buy” and a consensus target price of $200.93.

General Electric Price Performance

The firm has a market capitalization of $191.92 billion, a P/E ratio of 31.08, a P/E/G ratio of 1.75 and a beta of 1.19. The business’s fifty day moving average is $182.75 and its 200 day moving average is $170.91. The company has a current ratio of 1.13, a quick ratio of 0.85 and a debt-to-equity ratio of 0.95.

General Electric (NYSE:GE – Get Free Report) last posted its quarterly earnings results on Tuesday, October 22nd. The conglomerate reported $1.15 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.13 by $0.02. The company had revenue of $9.84 billion for the quarter, compared to analysts’ expectations of $9.02 billion. General Electric had a return on equity of 18.93% and a net margin of 11.48%. The firm’s revenue was up 5.8% on a year-over-year basis. During the same quarter in the prior year, the company earned $0.82 earnings per share. As a group, analysts forecast that General Electric will post 4.22 EPS for the current year.

General Electric Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Friday, October 25th. Stockholders of record on Thursday, September 26th were given a $0.28 dividend. This represents a $1.12 annualized dividend and a dividend yield of 0.63%. The ex-dividend date of this dividend was Thursday, September 26th. General Electric’s dividend payout ratio (DPR) is currently 19.68%.

Insider Activity at General Electric

In other news, SVP Riccardo Procacci sold 7,000 shares of General Electric stock in a transaction on Wednesday, November 6th. The stock was sold at an average price of $181.13, for a total transaction of $1,267,910.00. Following the transaction, the senior vice president now owns 13,289 shares in the company, valued at approximately $2,407,036.57. The trade was a 34.50 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. 0.66% of the stock is owned by insiders.

Institutional Investors Weigh In On General Electric

Institutional investors have recently modified their holdings of the stock. Newport Trust Company LLC acquired a new stake in shares of General Electric in the 2nd quarter valued at $2,613,332,000. Capital World Investors raised its holdings in General Electric by 2,818.1% during the first quarter. Capital World Investors now owns 12,749,560 shares of the conglomerate’s stock valued at $2,237,930,000 after buying an additional 12,312,648 shares in the last quarter. Capital International Investors lifted its position in shares of General Electric by 9.9% in the first quarter. Capital International Investors now owns 59,100,643 shares of the conglomerate’s stock worth $10,373,936,000 after buying an additional 5,309,543 shares during the last quarter. Canada Pension Plan Investment Board boosted its stake in shares of General Electric by 221.6% during the 1st quarter. Canada Pension Plan Investment Board now owns 7,121,741 shares of the conglomerate’s stock worth $1,250,079,000 after acquiring an additional 4,907,530 shares in the last quarter. Finally, Jennison Associates LLC increased its holdings in shares of General Electric by 91.8% during the 3rd quarter. Jennison Associates LLC now owns 7,771,759 shares of the conglomerate’s stock valued at $1,465,598,000 after acquiring an additional 3,719,894 shares during the last quarter. Institutional investors and hedge funds own 74.77% of the company’s stock.

General Electric Company Profile

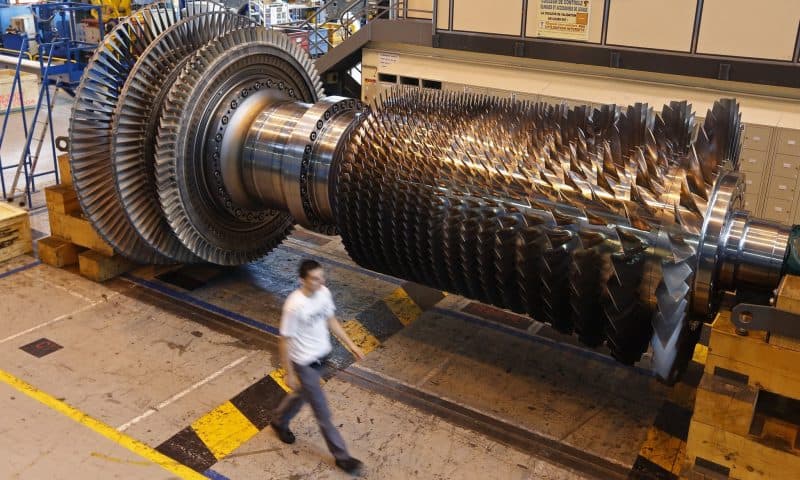

General Electric Company, doing business as GE Aerospace, designs and produces commercial and defense aircraft engines, integrated engine components, electric power, and mechanical aircraft systems. It also offers aftermarket services to support its products. The company operates in the United States, Europe, China, Asia, the Americas, the Middle East, and Africa.