AST SpaceMobile, Inc. (NASDAQ:ASTS – Get Free Report) was the target of some unusual options trading activity on Wednesday. Investors purchased 102,118 call options on the company. This is an increase of 24% compared to the average daily volume of 82,099 call options.

Wall Street Analyst Weigh In

ASTS has been the subject of a number of research reports. B. Riley raised their price objective on AST SpaceMobile from $26.00 to $36.00 and gave the stock a “buy” rating in a research report on Thursday, August 29th. Scotiabank lifted their target price on AST SpaceMobile from $28.00 to $45.90 and gave the company a “sector outperform” rating in a research note on Monday, August 26th. Deutsche Bank Aktiengesellschaft boosted their target price on shares of AST SpaceMobile from $22.00 to $63.00 and gave the stock a “buy” rating in a report on Wednesday, September 4th. Finally, UBS Group lifted their price target on AST SpaceMobile from $13.00 to $30.00 and gave the stock a “buy” rating in a report on Thursday, August 15th.

AST SpaceMobile Trading Up 21.8 %

Shares of ASTS traded up $5.30 during midday trading on Wednesday, reaching $29.56. 20,373,255 shares of the stock were exchanged, compared to its average volume of 10,584,765. The company has a quick ratio of 6.38, a current ratio of 6.38 and a debt-to-equity ratio of 0.83. AST SpaceMobile has a twelve month low of $1.97 and a twelve month high of $39.08. The stock’s 50 day simple moving average is $25.80 and its 200 day simple moving average is $18.01.

AST SpaceMobile (NASDAQ:ASTS – Get Free Report) last issued its earnings results on Wednesday, August 14th. The company reported ($0.14) EPS for the quarter, beating the consensus estimate of ($0.19) by $0.05. The firm had revenue of $0.90 million during the quarter, compared to analyst estimates of $2.00 million. As a group, equities research analysts predict that AST SpaceMobile will post -0.88 earnings per share for the current year.

Insider Buying and Selling at AST SpaceMobile

In other news, President Scott Wisniewski sold 2,700 shares of the stock in a transaction that occurred on Monday, September 30th. The stock was sold at an average price of $23.12, for a total transaction of $62,424.00. Following the completion of the transaction, the president now directly owns 712,660 shares in the company, valued at approximately $16,476,699.20. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. In other AST SpaceMobile news, CTO Huiwen Yao sold 45,000 shares of the company’s stock in a transaction that occurred on Tuesday, October 8th. The shares were sold at an average price of $24.26, for a total transaction of $1,091,700.00. Following the transaction, the chief technology officer now owns 55,000 shares in the company, valued at approximately $1,334,300. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, President Scott Wisniewski sold 2,700 shares of the business’s stock in a transaction that occurred on Monday, September 30th. The shares were sold at an average price of $23.12, for a total transaction of $62,424.00. Following the completion of the sale, the president now directly owns 712,660 shares in the company, valued at $16,476,699.20. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 127,700 shares of company stock valued at $3,220,524 in the last three months. 41.80% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

A number of institutional investors have recently made changes to their positions in ASTS. Vanguard Group Inc. raised its stake in shares of AST SpaceMobile by 49.9% during the 1st quarter. Vanguard Group Inc. now owns 6,663,760 shares of the company’s stock valued at $19,325,000 after purchasing an additional 2,217,531 shares during the period. American International Group Inc. increased its holdings in AST SpaceMobile by 41.5% during the 1st quarter. American International Group Inc. now owns 56,527 shares of the company’s stock worth $164,000 after acquiring an additional 16,568 shares during the period. Natixis grew its position in shares of AST SpaceMobile by 62.2% during the 1st quarter. Natixis now owns 55,863 shares of the company’s stock valued at $162,000 after purchasing an additional 21,430 shares in the last quarter. Price T Rowe Associates Inc. MD raised its position in shares of AST SpaceMobile by 71.1% in the first quarter. Price T Rowe Associates Inc. MD now owns 55,335 shares of the company’s stock worth $161,000 after buying an additional 22,987 shares in the last quarter. Finally, Masters Capital Management LLC bought a new position in AST SpaceMobile in the 1st quarter worth about $2,900,000. Hedge funds and other institutional investors own 60.95% of the company’s stock.

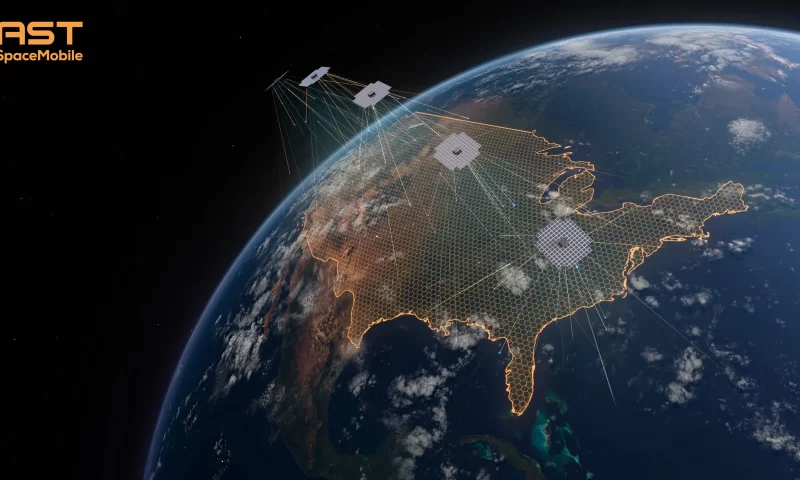

About AST SpaceMobile

AST SpaceMobile, Inc, together with its subsidiaries, develops and provides access to a space-based cellular broadband network for smartphones in the United States. Its SpaceMobile service provides cellular broadband services to end-users who are out of terrestrial cellular coverage. The company was founded in 2017 and is headquartered in Midland, Texas.