Stock Markets

U.S. stock indexes rallied sharply this week in reaction to the decisive U.S. presidential election outcome that cleared the cloud of uncertainty hovering over the markets. The 30-stock Dow Jones Industrial Average (DJIA) jumped by 4.61% while the Total Stock Market climbed by 5.06%. The broad S&P 500 gained by 4.66% while the technology-heavy Nasdaq Stock Market Composite surged by 5.74%. The NYSE Composite added 3.55%. Investor risk perception as gauged by the CBOE Volatility Index (VIX) dropped by 31.72%.

Stocks posted their best-ever post-election rally in the nation’s history, with the Republicans garnering a strong political mandate, having won the White House, the Senate, and most likely the House. There are potential market implications from the shift in the balance of power, despite campaign trail pledges not always translating into policy. The new administration’s promise of tax cuts and deregulation could enhance more rapid economic growth. On the other hand, tariffs and debt worries may cause further rate hikes and pressure bonds.

During this cycle, the Federal Reserve cut interest rates for the second time and continued to maintain a somewhat restrictive policy. Nevertheless, the Fed may be convinced to move more slowly in anticipation of the strong growth and possibly more dovish fiscal policy next year as markets start to price in a shallower rate-cutting cycle. Fundamental conditions remain favorable, which may create opportunities to broaden equity allocations and lock in high bond yields. In any case, it is advisable to refocus on long-term fundamentals rather than focusing solely on recent political shifts.

U.S. Economy

The Federal Reserve announced a 25-basis-point (0.25 percentage point) cut in the federal funds rate following its scheduled policy meeting concluded on Thursday. This is the Fed’s first easing move since it cut rates by 50 basis points in mid-September. However, the week’s biggest surprise was the release of the Institute for Supply Management’s gauge of October services sector activity on Tuesday. The services sector activity came in at 56.0 which is well above expectation (readings above 50.0 indicate expansion) and the best performance since August. Fortunately, even as activity picked up, price pressures somewhat eased, reversing a string of three monthly gains. Surveyed companies reported they were only minimally impacted by recent severe weather as compared to the larger impact on manufacturing firms.

As yields largely ended lower than where they ended the previous week, U.S. Treasuries generated positive returns heading into Friday. Some short-term yields increased slightly while intermediate- and long-term yields ended slightly lower. (Recall that yields and bond prices move in opposite directions.) On Wednesday, the previous day’s election results sent yields upward, although the expected rate cut from the Federal Reserve helped bring them lower by Thursday evening.

Metals and Mining

The spot price of precious metals corrected on the back of improving the risk perception of investors in the financial markets, reducing the demand for risk haven assets for the moment. Gold closed at $2,684.77 per troy ounce this week, down by 1.89% from last week’s closing price of $2,736.53. Silver closed at $31.31 per troy ounce, lower by 3.63% from the previous weekly close of $32.49. Platinum settled at $972.49 per troy ounce, down by 2.37% from last week’s closing price of $996.08. Palladium closed this week at $992.35 per troy ounce, down by 10.16% from last week’s close at $1,104.60. The three-month LME prices of industrial metals were mixed. Copper ended the week at $9,443.50 per metric ton, lower by 1.33% from the previous week’s closing price of $9,570.50. Aluminum ended at $2,620.50 per metric ton, 0.79% higher than its last traded price of $2,600.00 one week ago. Zinc settled at $2,979.50 per metric ton, 2.93% down from last week’s closing price of $3,069.50. Tin closed at $31,648.00 per metric ton, 0.24% lower than the previous week’s close of $31,724.00.

Energy and Oil

Global newsfeeds this week were dominated by the U.S. presidential election, resulting in widespread speculation regarding how the new administration would actualize its election promises in the coming weeks and months. In the meantime, the approaching Hurricane Rafael, which may be the last in this Atlantic season, has temporarily shut down about 400,000 barrels per day (b/d) of production. Ahead of Hurricane Rafael through the U.S. Gulf of Mexico, offshore operators evacuated 17 producing platforms. Even though it is gradually weakening, the seventeenth named storm of this hurricane season threatens some 4 million b/d of production capacity. In recent sessions, ICE Brent traded around the $75 per barrel level, suggesting that oil prices will remain rangebound. For the longer term, President Trump’s return to power has renewed the prospects of revising the stalled 830,000 b/d Keystone XL pipeline which is intended to carry Canadian oil from Alberta. Operator TC Energy is expected to drop its $15 billion claim against the U.S. government.

Natural Gas

For the report week from Wednesday, October 30, to Wednesday, November 6, 2024, the Henry Hub spot price fell by $0.14 from $1.94 per million British thermal units (MMBtu) to $1.80/MMBtu. Regarding Henry Hub futures, the price of the December 2024 NYMEX contract decreased by $0.10, from $2.845/MMBtu at the start of the week to $2.747/MMBtu at the week’s end. The price of the 12-month strip averaging December 2024 through November 2025 futures contracts declined by $0.07 to $2.965/MMBtu. Natural gas spot prices fell at most major pricing locations for this report week. Price changes ranged from a decrease of $2.57 at the Waha Hub to an increase of $0.25 at SoCal Citygate.

International natural gas futures prices decreased this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $0.17 to a weekly average of $13.52/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.66 to a weekly average of $12.79/MMBtu. In the week last year corresponding to this report week (beginning November 1 and ending November 8, 2023), the prices were $17.46/MMBtu in East Asia and $14.63/MMBtu at the TTF.

World Markets

Worries about the impact of U.S. President-elect Donald Trump’s trade policies on European economic growth and central bank policy weighed on market sentiment this week. The pan-European STOXX Europe 600 Index ended 0.84% lower in local currency terms. Major stock indexes ended weaker: Italy’s FTSE MIB lost 2.48%, France’s CAC 40 Index declined by 0.95%, and Germany’s DAX softened by 0.21%. The UK’s FTSE 100 Index dipped by 1.28%. The Bank of England’s (BoE’s) policy committee voted 8 to 1 to reduce the key Bank Rate for a second time this year by a quarter-point to 4.75%, in light of inflation continuing to decelerate. Sweden likewise lowered its key rate although Norway left its policy rate unchanged. On the economic front, the HCOB eurozone composite purchasing managers’ index (PMI) was revised higher to 50 in October from an earlier estimate of 49.7. At this level, the indicator sits at the borderline of expansion (greater than 50) and contraction (less than 50). Manufacturing contracted at a slower pace than first estimated, while the services sector output expanded at a slightly faster rate. Business confidence fell to its lowest level for the year so far.

Japan’s stock markets climbed over the week. The Nikkei 225 Index gained 3,8% and the broader TOPIX Index climbed 3.7%. The outcome of the U.S. presidential election and the Federal Reserve rate cut positively impacted investor risk appetite. These events overshadowed the discouraging domestic corporate earnings season where there were some downgrades to company guidance, and the adverse effect of yen strength on Japan’s export-heavy industries. The yen appreciated to about JPY 152 against the USD, from around JPY 153 at the end of the previous week. Authorities committed to closely monitoring the impact of Donald Trump’s election victory on the country’s economy and finances, given the close economic ties between the two countries. On the economic front, Japan’s real (inflation-adjusted) wages fell by 0.1% in September, following a revised decline of 0.8% in August. In line with expectations, nominal wages grew by 2.8% in September, lagging consumer inflation at 2.9%. Household spending fell 1.1% year-on-year in September which was lower than the consensus estimate of 2.1% decline.

China’s stocks rallied as concerns about potential U.S. tariff hikes were offset by Beijing’s unveiling of fresh stimulus measures. The Shanghai Composite Index advanced by 5.51% while the blue-chip CSI 300 gained by 5.5%. The Hong Kong benchmark Hang Seng Index ended higher by 1.08%. The standing committee of the National People’s Congress, China’s top legislative body, announced on Friday a RMB 10 trillion program to refinance local government debt, a key national economic and financial risk flagged by Beijing. Policymakers also raised the local government debt ceiling from RMB 29.52 trillion to RMB 35.52 trillion. This is the first time that the government raised the ceiling midyear since 2015. On trade, exports rose by 12.7% in October which exceeds the forecast and is up sharply from 2.4% in September. This is the fastest export growth rate since July 2022 and was attributed to better weather and steep discounts. Imports fell by 2.3%, down from the previous month’s growth rate of 0.3%. The overall trade surplus rose to $95.72 billion from $81.71 billion in September. The growth in October’s exports indicated strong demand for Chinese goods, which has been an optimistic spot for the economy. Analysts cautioned, however, that the country’s export outlook has become increasingly uncertain in light of a possible trade war when Trump assumes office in 2025.

The Week Ahead

Included among the important economic reports scheduled for release this week are the CPI and PPI inflation, retails sales, and industrial production data.

Key Topics to Watch

- NFIB optimism index for Oct.

- Consumer price index for Oct.

- CPI year over year

- Core CPI for Oct.

- Core CPI year over year

- Monthly U.S. federal budget for Oct.

- Initial jobless claims for Nov. 9

- Producer price index for Oct.

- PPI year over year

- Core PPI for Oct.

- Core PPI year over year

- Import price index for Oct.

- Import price index minus fuel for Oct.

- Empire State manufacturing survey for Nov.

- U.S. retail sales for Oct.

- Retail sales minus autos for Oct.

- Industrial production for Oct.

- Capacity utilization for Oct.

- Business inventories for Sept.

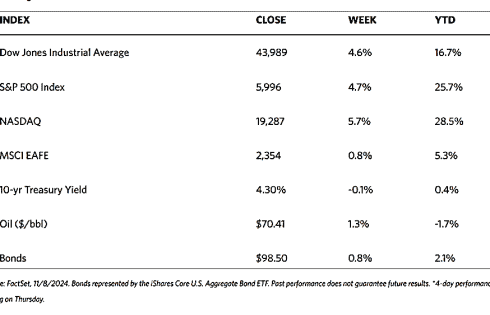

Markets Index Wrap-Up