Shares of Super Micro Computer, Inc. (NASDAQ:SMCI – Get Free Report) fell 2.6% during trading on Tuesday . The company traded as low as $46.52 and last traded at $46.58. 10,083,920 shares traded hands during trading, a decline of 87% from the average session volume of 80,581,008 shares. The stock had previously closed at $47.80.

Analyst Upgrades and Downgrades

SMCI has been the topic of several recent analyst reports. Cfra reissued a “hold” rating and set a $45.40 price target (down from $72.90) on shares of Super Micro Computer in a research report on Wednesday, August 28th. Bank of America lowered Super Micro Computer from a “buy” rating to a “neutral” rating and reduced their target price for the stock from $109.00 to $70.00 in a report on Wednesday, August 7th. Wedbush reaffirmed a “neutral” rating and issued a $80.00 price target on shares of Super Micro Computer in a research report on Friday, August 2nd. Susquehanna increased their price target on shares of Super Micro Computer from $28.50 to $32.50 and gave the company a “negative” rating in a report on Monday, July 15th. Finally, Barclays cut their price objective on shares of Super Micro Computer from $438.00 to $42.00 and set an “equal weight” rating for the company in a research report on Wednesday, October 2nd. Two investment analysts have rated the stock with a sell rating, eleven have issued a hold rating and five have issued a buy rating to the company’s stock. According to data from MarketBeat.com, the stock currently has an average rating of “Hold” and a consensus price target of $74.53.

Super Micro Computer Trading Down 3.8 %

The business has a 50-day moving average price of $48.05 and a two-hundred day moving average price of $69.91. The company has a quick ratio of 1.93, a current ratio of 3.77 and a debt-to-equity ratio of 0.32. The company has a market cap of $2.57 billion, a P/E ratio of 2.58 and a beta of 1.23.

Super Micro Computer (NASDAQ:SMCI – Get Free Report) last posted its quarterly earnings results on Tuesday, August 6th. The company reported $0.62 earnings per share for the quarter, missing analysts’ consensus estimates of $0.76 by ($0.14). The company had revenue of $5.31 billion during the quarter, compared to analyst estimates of $5.32 billion. Super Micro Computer had a net margin of 8.09% and a return on equity of 30.57%. The business’s revenue for the quarter was up 142.9% compared to the same quarter last year. During the same period last year, the company earned $0.34 EPS. On average, analysts predict that Super Micro Computer, Inc. will post 2.85 EPS for the current year.

Institutional Investors Weigh In On Super Micro Computer

Large investors have recently modified their holdings of the business. Farmers & Merchants Investments Inc. lifted its holdings in shares of Super Micro Computer by 400.0% in the second quarter. Farmers & Merchants Investments Inc. now owns 30 shares of the company’s stock valued at $25,000 after purchasing an additional 24 shares in the last quarter. Moser Wealth Advisors LLC bought a new position in shares of Super Micro Computer during the 2nd quarter worth approximately $25,000. Hazlett Burt & Watson Inc. lifted its position in shares of Super Micro Computer by 141.2% in the second quarter. Hazlett Burt & Watson Inc. now owns 41 shares of the company’s stock worth $34,000 after purchasing an additional 24 shares in the last quarter. VitalStone Financial LLC boosted its holdings in Super Micro Computer by 250.0% during the first quarter. VitalStone Financial LLC now owns 35 shares of the company’s stock worth $35,000 after purchasing an additional 25 shares during the last quarter. Finally, AlphaCentric Advisors LLC acquired a new position in shares of Super Micro Computer during the 2nd quarter worth about $42,000. 84.06% of the stock is currently owned by institutional investors.

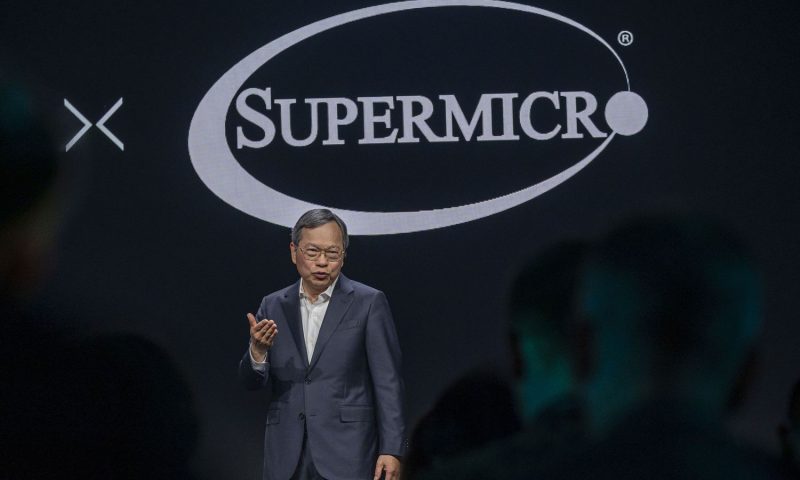

Super Micro Computer Company Profile

Super Micro Computer, Inc, together with its subsidiaries, develops and manufactures high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally. Its solutions range from complete server, storage systems, modular blade servers, blades, workstations, full racks, networking devices, server sub-systems, server management software, and security software.