One eye-popping number from the University of Michigan is making long-dated government debt look out of line with an upside risk to prices, one chief investment officer says

Buried inside last Friday’s data from the University of Michigan was a shocking inflation outlook from a small segment of consumers — one that is causing some nervousness about whether Treasury-market traders are underestimating the upside risks to prices.

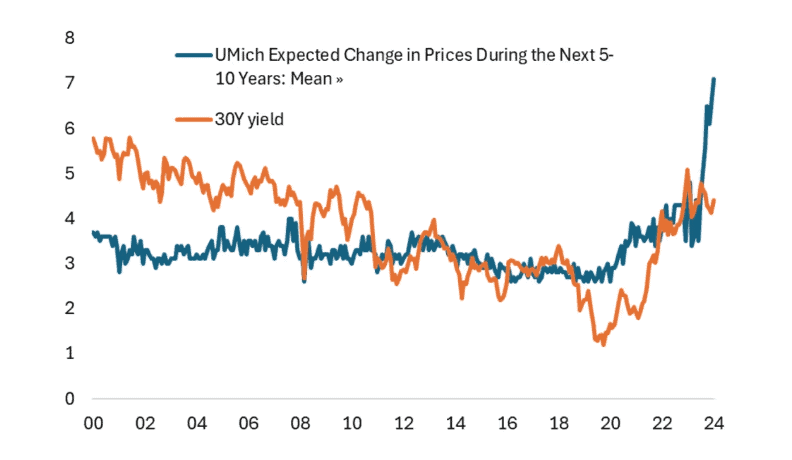

The mean expected increase in prices in the next five to 10 years was 7.1%, based on a preliminary reading for October. That’s more than twice the median increase of 3% expected over the same time frame. Mean refers to the average of a set of numbers, while median refers to the middle value in that set.

Joanne Hsu, the University of Michigan’s director of consumer surveys, offered plenty of words of caution about trying to interpret this 7.1% mean figure, however.

In an email to MarketWatch on Monday, she said that October’s mean reading “is being driven by a small share of consumers with very high inflation expectations,” and that the university’s preferred measure of expected inflation over five to 10 years “is the median, not the mean.” Median long-run inflation expectations fell to 3% in October on a preliminary basis, down from 3.1% in September. And “because averages are highly sensitive to outliers, the final release [of the survey data] on Oct. 25 will provide a more meaningful read of the mean,” she said.

Even so, some market participants are fretting about where inflation could go from here, given last Friday’s data and other things they are seeing. Last week, break-even rates, a measure of what the market expects average inflation to be over the next five or 10 years, jumped to the highest levels since June or July, according to the most recent data from the Federal Reserve Bank of St. Louis. Break-evens also approached the 2.5% mark that some say would signal growing fears of more sustained upside risk to prices.

Separately, the 5-year inflation swap, a contract used to hedge or mitigate the risk of inflation, has jumped in the past five weeks by more than any other time since March 2023, right before the collapse of Silicon Valley Bank, according to Deutsche Bank strategist Jim Reid.

It all adds up to brewing concerns about future price gains, less than a month after Federal Reserve officials cut interest rates by a half of a percentage point and indicated they had greater confidence inflation is moving sustainably toward their 2% objective.

According to Ben Emons, chief investment officer and founder of FedWatch Advisors in Washington, the rise in mean inflation expectations is likely tied to some extent to worries about the outcome of the Nov. 5 presidential election and its potential impact on prices. In addition, traders of long-dated government debt look to be significantly underestimating the risk of surging inflation, he wrote in an email on Monday.

“In last Friday’s U-Michigan survey, the mean price outlook for the next 5 to 10 years reached 7.1% compared to the widely followed survey median at 3%,” Emons told MarketWatch. “Expectations of inflation have surged before the election, likely reflecting voters’ concerns that prices are likely to continue to rise regardless of who will occupy the White House. Should mean and median expectations persist in rising, inflation is likely to reemerge amidst persistently low Treasury yields.”

The mean expectation for inflation in the next five to 10 years based on data from the University of Michigan’s survey of consumers released last Friday has surged to 7.1%.

The bond market was closed on Monday for the Columbus Day holiday. But on Friday, 10- and 30-year yields finished at 4.072% and 4.382%, respectively, after having jumped at least 40 basis points each over the past four weeks. However, both remain mostly below the levels that largely prevailed prior to the 2007-09 financial crisis and recession.

Helping to drive some of the recent moves were a blockbuster nonfarm-payrolls report for September and better-than-expected data including a reading on the services side of the economy from the Institute for Supply Management. September’s consumer-price index also came in stickier than expected.

Investors have also been considering the inflationary effects of a possibly broadening Middle East conflict and of economic stimulus in China, while others have pointed out that there are inflationary aspects to the policies of both presidential candidates, Vice President Kamala Harris and former President Donald Trump.

“Consumer sentiment has been severely damaged by rising prices of necessities, and expectations are getting worse,” according to an online post from the Kobeissi Letter, which provides commentary on markets. “Inflation is still a major concern for Americans.”