KeyBanc backs away from longtime call to buy Qualcomm’s stock, as AI benefit is not expected for a while and as competition ramps up

Shares of Qualcomm Inc. took a hit Tuesday after KeyBanc Capital dropped its longtime buy call, saying the semiconductor maker hasn’t been benefiting as expected from the artificial-intelligence boom and could start losing market share in the coming months.

Analyst John Vinh cut his rating on the stock QCOM-0.36% to sector weight, after being at overweight for at least the past three years. Vinh removed his price target on the stock, which prior to the downgrade was at $225.

The stock fell 0.6% in morning trading toward a four-week low. That bucked the rally in the broader technology sector, with the Technology Select Sector SPDR exchange-traded fund XLK 1.87% rising 1.2%.

“Our previous thesis was that [Qualcomm] would be increasingly viewed as an edge AI play given its positioning in handsets and PCs,” Vinh wrote in a note to clients.

“However, given these end markets have yet to materialize in any meaningful manner, we don’t foresee [Qualcomm] benefiting from a replacement cycle fundamentally or being given a market premium as an edge AI beneficiary until that happens,” Vinh added.

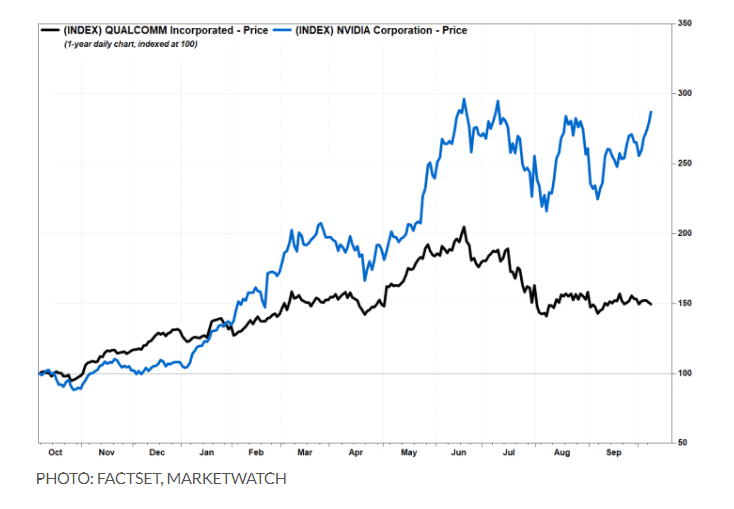

Qualcomm’s stock has been struggling over the past several months. After running up 57% year to date to a record close of $227.09 on June 18, it has since tumbled 27%.

AI leader Nvidia Corp.’s stock NVDA4.05% also reached its record close on June 18, at $135.58, but it is currently just 2.8% below that price.

There is also growing concern about competition from one of Qualcomm’s biggest customers.

Vinh said Qualcomm is believed to have 100% share of the modems for Apple Inc.’s AAPL1.84% new iPhone 16. But he believes that will change as Apple starts ramping up use of its own modems.

He expects that the Apple “headwind” to earnings will increase over the next few years and that it will likely continue to weigh on the stock until it’s completely accounted for by investors. The full impact of the loss of modem share to Apple is estimated to be $1.55 to $1.65 in earnings per share.