Plug Power Inc. (NASDAQ:PLUG – Get Free Report) dropped 4.9% during mid-day trading on Tuesday . The stock traded as low as $2.12 and last traded at $2.14. Approximately 9,686,578 shares traded hands during trading, a decline of 75% from the average daily volume of 39,237,871 shares. The stock had previously closed at $2.25.

Wall Street Analyst Weigh In

PLUG has been the topic of several analyst reports. Susquehanna lowered their target price on Plug Power from $3.00 to $2.00 and set a “neutral” rating on the stock in a research report on Monday, August 12th. Jefferies Financial Group lowered their price target on Plug Power from $2.20 to $2.00 and set a “hold” rating on the stock in a report on Thursday, October 3rd. Wells Fargo & Company reduced their price objective on shares of Plug Power from $4.00 to $3.00 and set an “equal weight” rating for the company in a report on Friday, August 9th. Canaccord Genuity Group decreased their target price on shares of Plug Power from $3.00 to $2.50 and set a “hold” rating for the company in a research report on Monday, August 12th. Finally, Craig Hallum dropped their price target on shares of Plug Power from $5.00 to $4.00 and set a “buy” rating on the stock in a research report on Friday, August 9th. Four research analysts have rated the stock with a sell rating, fifteen have given a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the company’s stock. According to MarketBeat, the company presently has a consensus rating of “Hold” and a consensus price target of $5.01.

Plug Power Trading Down 8.4 %

The company has a current ratio of 2.07, a quick ratio of 0.91 and a debt-to-equity ratio of 0.16. The firm has a market cap of $1.53 billion, a PE ratio of -0.88 and a beta of 1.79. The company’s 50-day moving average is $2.06 and its 200 day moving average is $2.57.

Plug Power (NASDAQ:PLUG – Get Free Report) last released its earnings results on Thursday, August 8th. The electronics maker reported ($0.36) earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of ($0.30) by ($0.06). Plug Power had a negative net margin of 216.80% and a negative return on equity of 47.51%. The business had revenue of $143.40 million during the quarter, compared to analysts’ expectations of $184.54 million. During the same quarter in the previous year, the company earned ($0.35) EPS. Plug Power’s revenue for the quarter was down 44.9% on a year-over-year basis. As a group, sell-side analysts predict that Plug Power Inc. will post -1.15 EPS for the current year.

Institutional Inflows and Outflows

Several large investors have recently added to or reduced their stakes in PLUG. State Board of Administration of Florida Retirement System lifted its holdings in shares of Plug Power by 5.9% during the 1st quarter. State Board of Administration of Florida Retirement System now owns 600,188 shares of the electronics maker’s stock valued at $2,065,000 after buying an additional 33,311 shares during the last quarter. Rafferty Asset Management LLC grew its position in Plug Power by 69.5% in the fourth quarter. Rafferty Asset Management LLC now owns 359,537 shares of the electronics maker’s stock worth $1,618,000 after acquiring an additional 147,435 shares in the last quarter. Gabelli Funds LLC increased its stake in shares of Plug Power by 42.9% during the 1st quarter. Gabelli Funds LLC now owns 250,000 shares of the electronics maker’s stock worth $860,000 after purchasing an additional 75,000 shares during the last quarter. Healthcare of Ontario Pension Plan Trust Fund raised its holdings in shares of Plug Power by 25.9% during the 2nd quarter. Healthcare of Ontario Pension Plan Trust Fund now owns 1,945,162 shares of the electronics maker’s stock valued at $4,532,000 after purchasing an additional 400,120 shares in the last quarter. Finally, Diversified Trust Co acquired a new stake in shares of Plug Power in the 2nd quarter valued at $35,000. Institutional investors and hedge funds own 43.48% of the company’s stock.

Plug Power Company Profile

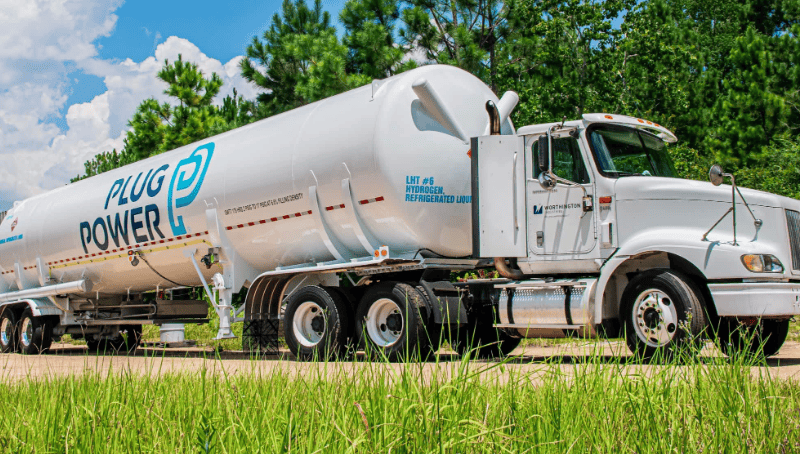

Plug Power Inc develops hydrogen and fuel cell product solutions in North America, Europe, Asia, and internationally. The company offers GenDrive, a hydrogen-fueled proton exchange membrane (PEM) fuel cell system that provides power to material handling electric vehicles; GenSure, a stationary fuel cell solution that offers modular PEM fuel cell power to support the backup and grid-support power requirements of the telecommunications, transportation, and utility sectors; ProGen, a fuel cell stack and engine technology used in mobility and stationary fuel cell systems, and as engines in electric delivery vans; GenFuel, a liquid hydrogen fueling delivery, generation, storage, and dispensing system; GenCare, an ongoing Internet of Things-based maintenance and on-site service program for GenDrive fuel cell systems, GenSure fuel cell systems, GenFuel hydrogen storage and dispensing products, and ProGen fuel cell engines; and GenKey, an integrated turn-key solution for transitioning to fuel cell power.