Creative Planning increased its position in Autodesk, Inc. (NASDAQ:ADSK – Free Report) by 5.3% during the second quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 37,659 shares of the software company’s stock after purchasing an additional 1,900 shares during the period. Creative Planning’s holdings in Autodesk were worth $9,319,000 at the end of the most recent quarter.

Several other hedge funds have also bought and sold shares of the business. Price T Rowe Associates Inc. MD boosted its stake in Autodesk by 263.6% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 6,294,746 shares of the software company’s stock valued at $1,639,279,000 after purchasing an additional 4,563,668 shares during the last quarter. Ninety One UK Ltd lifted its stake in Autodesk by 28.0% during the 2nd quarter. Ninety One UK Ltd now owns 5,071,950 shares of the software company’s stock valued at $1,255,054,000 after acquiring an additional 1,108,973 shares in the last quarter. Van ECK Associates Corp boosted its holdings in Autodesk by 100.9% during the 2nd quarter. Van ECK Associates Corp now owns 1,642,973 shares of the software company’s stock worth $406,554,000 after acquiring an additional 825,165 shares during the last quarter. Point72 Asset Management L.P. grew its stake in shares of Autodesk by 366.5% in the 2nd quarter. Point72 Asset Management L.P. now owns 843,040 shares of the software company’s stock worth $208,610,000 after acquiring an additional 662,339 shares in the last quarter. Finally, FIL Ltd lifted its position in shares of Autodesk by 19.6% during the fourth quarter. FIL Ltd now owns 2,921,044 shares of the software company’s stock valued at $711,216,000 after purchasing an additional 479,559 shares in the last quarter. Institutional investors and hedge funds own 90.24% of the company’s stock.

Autodesk Stock Down 2.9 %

Shares of NASDAQ:ADSK opened at $267.47 on Wednesday. The company has a debt-to-equity ratio of 0.80, a quick ratio of 0.64 and a current ratio of 0.64. Autodesk, Inc. has a 52-week low of $192.01 and a 52-week high of $279.53. The firm has a market capitalization of $57.64 billion, a P/E ratio of 57.89, a P/E/G ratio of 3.41 and a beta of 1.48. The stock has a 50 day moving average price of $253.46 and a 200-day moving average price of $240.15.

Autodesk (NASDAQ:ADSK – Get Free Report) last released its earnings results on Thursday, August 29th. The software company reported $2.15 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.00 by $0.15. The firm had revenue of $1.51 billion during the quarter, compared to analyst estimates of $1.48 billion. Autodesk had a net margin of 18.21% and a return on equity of 59.41%. The business’s revenue was up 11.9% on a year-over-year basis. During the same period last year, the business earned $1.12 earnings per share. As a group, equities research analysts anticipate that Autodesk, Inc. will post 5.73 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

Several equities research analysts have commented on the stock. Royal Bank of Canada increased their price objective on shares of Autodesk from $290.00 to $313.00 and gave the company an “outperform” rating in a research note on Friday, August 30th. Hsbc Global Res raised Autodesk to a “strong-buy” rating in a research report on Tuesday, September 3rd. Piper Sandler boosted their price objective on Autodesk from $239.00 to $257.00 and gave the company a “neutral” rating in a research note on Friday, August 30th. Citigroup increased their price objective on Autodesk from $316.00 to $325.00 and gave the stock a “buy” rating in a report on Tuesday, September 3rd. Finally, Mizuho upped their target price on shares of Autodesk from $230.00 to $260.00 and gave the stock a “neutral” rating in a report on Friday, August 30th. Eight equities research analysts have rated the stock with a hold rating, eleven have given a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, the company has a consensus rating of “Moderate Buy” and a consensus target price of $290.47.

Insiders Place Their Bets

In related news, Director Mary T. Mcdowell sold 550 shares of the firm’s stock in a transaction that occurred on Thursday, August 15th. The shares were sold at an average price of $248.18, for a total transaction of $136,499.00. Following the completion of the sale, the director now owns 31,899 shares of the company’s stock, valued at $7,916,693.82. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. In other Autodesk news, Director Mary T. Mcdowell sold 550 shares of the stock in a transaction on Thursday, August 15th. The stock was sold at an average price of $248.18, for a total transaction of $136,499.00. Following the sale, the director now directly owns 31,899 shares in the company, valued at approximately $7,916,693.82. The sale was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, COO Steven M. Blum sold 19,693 shares of the business’s stock in a transaction on Thursday, July 11th. The stock was sold at an average price of $250.00, for a total value of $4,923,250.00. Following the completion of the transaction, the chief operating officer now owns 34,443 shares of the company’s stock, valued at approximately $8,610,750. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 38,973 shares of company stock valued at $10,106,590. Insiders own 0.14% of the company’s stock.

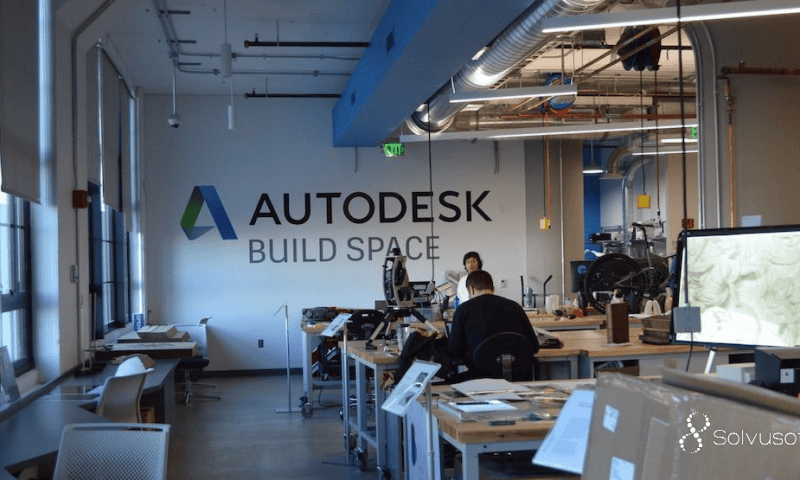

Autodesk Company Profile

Autodesk, Inc provides 3D design, engineering, and entertainment technology solutions worldwide. The company offers AutoCAD Civil 3D, a surveying, design, analysis, and documentation solution for civil engineering, including land development, transportation, and environmental projects; BuildingConnected, a SaaS preconstruction solution; AutoCAD, a software for professional design, drafting, detailing, and visualization; AutoCAD LT, a drafting and detailing software; computer-aided manufacturing (CAM) software for computer numeric control machining, inspection, and modelling for manufacturing; Fusion 360, a 3D CAD, CAM, and computer-aided engineering tool; and Industry Collections tools for professionals in architecture, engineering and construction, product design and manufacturing, and media and entertainment collection industries.