Stock Markets

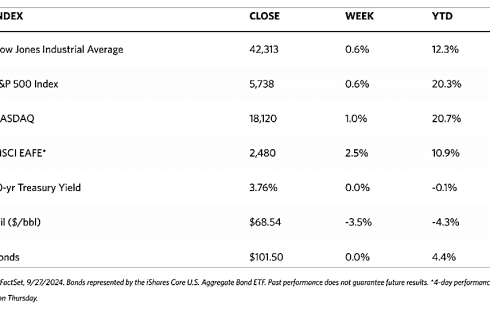

Stocks hit new record highs this week on the back of optimism about the Federal Reserve’s recent rate cut, ongoing enthusiasm about AI, and new stimulus measures adopted by China that may spur hopes for a rebound in that country’s demand. All major stock market indexes were up week-on-week. The 30-stock Dow Jones Industrial Average (DJIA) inched up by 0.59%, mimicking the Total Stock Market Index’s 0.59% rise. The broad-based S&P 500 Index gained 0.62% while the technology-heavy Nasdaq Stock Market Composite Index climbed by 0.95%. The NYSE Composite Index added 0.66% this week. The investor risk perception indicator, the CBOE Volatility Index (VIX) rose by 5.02%.

Technology stocks outperformed on the back of reports of a possible takeover of Intel and news that the CEO of NVIDIA had halted sales of his own shares in the company. Additionally, chip maker Micron Technology surged following its positive outlook for artificial intelligence demand, thereby providing a general tailwind for the sector. Sentiment was also driven in part by economic news. On Tuesday, there was a slight sell-off as news that the Conference Board’s index of U. S. consumer confidence fell sharply in August and put it back close to the bottom of its range over the past two years.

U.S. Economy

This week, it was reported that the index of consumers’ perception of labor market conditions slid to 81.7, only slightly above the threshold of 80 that historically had predicted a recession. There was also some mixed news regarding the housing sector. There have been some recent signals that the sector may be stabilizing as mortgage rates start to descend. On Wednesday, the Commerce Department reported that new home sales declined, although not as much as expected, by 4.7% in August, and building permits data were revised lower. New buyers remained on the sidelines, but the falling mortgage rates appeared to spark a surge in refinancing. Shortly after the Fed started to raise short-term rates, the Mortgage Bankers Association Mortgage Refinance Index jumped to its highest level since April 2022.

On Friday, some benign inflation data helped trigger an early rally in the markets. The Commerce Department reported that the core personal consumer expenditures (PCE) price index (less food and energy), which is the Fed’s preferred inflation gauge, rose by only 0.1% in August, slightly below expectations. The index climbed only 2.2% year-on-year, close to the Fed’s 2.0% long-term inflation target and the lowest since February 2021. Personal incomes and spending in August were both lower than expected, which further signals a moderation in inflationary pressures.

Metals and Mining

Although September has traditionally been a trying time for metals, This week’s trading appears to have broken the trend. The spot prices for precious metals generally went up this week. Gold closed at $2,658.24 per troy ounce, 1.39% higher than the previous weekly close of $2,621.88. Silver settled at $31.57 per troy ounce for the week, higher by 1.25% from the last weekly close at $31.18. Platinum closed this week at $1,003.82 per troy ounce for a gain of 2.49% over last week’s close at $979.43. Palladium ended at $1,016.12 per troy ounce for a decline of 4.95% from last week’s $1,069.01. The three-month LME prices of industrial metals were also mostly up. Copper closed the week at $9,982.50 per metric ton, 5.34% above the last weekly close of $9,476.50. Aluminum rested this week at $2,646.50 for an increase of 6.50% from last week’s close of $2,485.00. Zinc ended at the week’s closing price of $3,089.50 per metric ton, 7.50% higher than last week’s close of $2,874.00. Tin ended the week at $2,913.00, 2.45% higher than the metal’s previous weekly closing price of $32,127.00.

Gold underwent its best monthly gain since March, and while it has drawn much attention from investors, other metals appear to present great prospects. Silver ended this week with some strong selling momentum despite exhibiting some volatility over the past weeks. It rallied to a new 12-year high at $33 per ounce. December silver futures last traded at $31.74 per ounce, down by almost 2% on the day, but up 8.8% for the month. Silver saw renewed buying interest after China launched its most impressive stimulus package since the COVID-19 pandemic. Beijing is pumping more liquidity into the financial markets and has also cut interest rates to prevent its economy from lapsing into a deflationary spiral and pull it back toward its growth target. Almost 50% of the demand for silver comes from industrial applications, mostly from the solar power sector. So far this year, gold prices have ascended by 28.8% while silver prices have rallied by nearly 32%.

Energy and Oil

Firm fundamental support for oil prices has been provided so far by China’s economic stimulus measures and U.S. hurricanes, but the big story this week came from Saudi Arabia. Media outlets alleged that Riyadh is considering a strategy shift to retake its market share in the oil market. According to the Financial Times, Saudi Arabia is adopting measures to raise its crude oil production in a bid to win back market share. It will allegedly abandon its unofficial $100 per barrel oil price target despite the likelihood of lower prices and has raised hopes that OPEC+ would proceed with its December hikes. Market observers witnessed a $3 per barrel drop from one week ago in fear of an oversupply, with WTI dropping below $70 per barrel again.

Natural Gas

For the report week covering Wednesday, September 18, to Wednesday, September 25, 2024, the Henry Hub spot prices rose by $0.29 from $2.33 per million British thermal units (MMBtu) to $2.62/MMBtu. Regarding Henry Hub futures, the price of the October 2024 NYMEX contract increased by $0.353, from $2.284/MMBtu at the start of the week to $2.637/MMBtu at the week’s end. The price of the 12-month strip averaging October 2024 through September 2025 futures contracts advanced by $0.191 to $3.134/MMBtu. At most locations this report week, natural gas spot prices rose. Price changes ranged from a drop of $0.59 at the Waha Hub to an increase of $0.54 at the FGT Citygate in Florida.

International natural gas futures price changes were mixed this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $0.37 to a weekly average of $13.03/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands increased by $0.10 to a weekly average of $11.54/MMBtu. In the week last year corresponding to this report week (the week from September 20 to September 27, 2023) the prices were $14.63/MMBtu in East Asia and $12.61 /MMBtu at the TTF.

World Markets

Evidence of slowing business activity spurred hopes for potential interest rate cuts and drove European equities to rally for the week. The pan-European STOXX Europe 600 Index rebounded this week and settled 2.69% higher. Sentiment also lifted as a result of China’s newly launched round of stimulation measures that can energize the global economy. Major stock indexes also rebounded. Italy’s FTSE MIB rose by 2.86%, France’s CAC 40 Index gained 3.89%, and Germany’s DAX surged by 4.03%. The UK’s FTSE Index added 1.10%. According to purchasing managers’ indexes (PMIs) compiled by S&P Global, business activity in the eurozone shrank unexpectedly in September as a result of a significant flow of new orders. An initial reading of the seasonally adjusted HCOB Eurozone Composite PMI Output Index fell from 51.0 in August to 48.9 in September, signifying a shift from expansion to contraction. As the boost from the Paris Olympics faded, services activity came close to stalling. German business activity declined the most in seven months, signaling that a second quarterly drop in output is likely in the outlook of the economy. UK private sector activity, on the other hand, remained in expansionary territory for the 11th consecutive month.

Japan’s stock markets soared over the week. The Nikkei 225 Index surged by 5.6% while the broader TOPIX Index rose by 3.7%. Providing a favorable backdrop was the latest commentary from the Bank of Japan (BoJ) that was perceived as dovish and which weighed on the yen. China’s fresh round of stimulus announcements that detailed various support mechanisms drove optimism that the country will better respond to sluggish economic growth and the weak housing market. The stimulus announcements boosted the many Japanese companies that directly or indirectly China beneficiaries, given the large volume of Japanese exports that go to China and Japan’s sensitivity to the Chinese purchasing managers’ index. Regarding Japan’s economic front, the Tokyo-area core consumer price index (CPI) rose by 2.0% year-on-year in September, down from 2.4% in August. Given that the indicator is considered a leading indicator of nationwide trends, there is a slowdown in consumer inflation, although this was expected and largely attributable to the effect of renewed energy subsidies. Separately, flash PMI data collated by an Jibun Bank showed that Japan’s private sector continued to expand in September albeit the rate of growth has slowed slightly from August. The driver of the expansion was business activity in the services segment, while manufacturing output contracted marginally.

China’s stocks skyrocketed after Beijing set into motion a host of measures to shore up the economy. The Shanghai Composite Index jumped 12.8% while the blue-chip CSI 300 soared by 15.7%. Hong Kong’s benchmark Hang Seng Index gained 13%. The rally charted the biggest weekly for the CSI 300 since 2008. At that time, Beijing put into effect a massive stimulus package to address the global financial crisis. To meet the present economic challenges, China’s top leaders committed to take action to stabilize the property market and halt the decline of real estate prices. The 24-man Politburo stated that China would deploy the necessary fiscal spending to meet its 2024 growth target of 5%. Although there were no specifics contained in the Politburo statement, China plans to issue special sovereign bonds worth about RMB 2 trillion (USD 284.4 billion) this year as part of the financial stimulus plan, plus other measures. All in all, the stimulus package is a positive development for China’s economy and will bolster short-term economic activity and enhance market sentiment. In the long term, however, it is not certain that the present steps taken will be sustainable in the long run.

The Week Ahead

Among the important economic data scheduled for release this week are the September non-farm payrolls report, the ISM manufacturing PMI, and the ISM services PMI all for September.

Key Topics to Watch

- Federal Reserve Governor Michelle Bowman speaks (Sept. 30)

- Chicago Business Barometer (PMI) for Sept.

- Federal Reserve Chair Jerome Powell speaks (Sept. 30)

- S&P final U.S. manufacturing PMI for Sept.

- ISM manufacturing for Sept.

- Construction spending for Aug.

- Job openings for Aug.

- Federal Reserve Governor Lisa Cook speaks (Oct. 1)

- Richmond Fed President Tom Barkin, Atlanta Fed President Raphael Bostic and Boston Fed President Susan Collins on a joint panel about technology-enabled disruption (Oct. 1)

- Auto sales for Sept.

- ADP employment for Sept.

- Cleveland Fed President Beth Hammack gives welcoming remarks (Oct. 2)

- Louis Fed President Alberto Musalem gives opening remarks (Oct. 2)

- Federal Reserve Governor Michelle Bowman speaks (Oct. 2)

- Richmond Fed President Tom Barkin speaks (Oct.2)

- Initial jobless claims for Sept. 28

- S&P final U.S. services PMI for Sept.

- ISM services for Sept.

- Factory orders for Aug.

- Minneapolis Fed President Neel Kashkari moderates discussion with Atlanta Fed President Raphael Bostic (Oct. 3)

- U.S. nonfarm payroll for Sept.

- U.S. unemployment rate for Sept.

- U.S. hourly wages for Sept.

- Hourly wages year over year

- New York Fed President John Williams gives opening remarks (Oct. 4)

Markets Index Wrap-Up