Joby Aviation, Inc. (NYSE:JOBY – Get Free Report)’s stock price was up 0.4% during trading on Tuesday . The company traded as high as $5.24 and last traded at $5.14. Approximately 993,723 shares traded hands during trading, a decline of 82% from the average daily volume of 5,490,029 shares. The stock had previously closed at $5.12.

Wall Street Analysts Forecast Growth

JOBY has been the subject of several recent analyst reports. Cantor Fitzgerald restated an “overweight” rating and issued a $10.00 target price on shares of Joby Aviation in a research note on Monday. Canaccord Genuity Group dropped their target price on Joby Aviation from $11.00 to $10.50 and set a “buy” rating on the stock in a research note on Thursday, August 8th. JPMorgan Chase & Co. boosted their price target on Joby Aviation from $5.00 to $6.00 and gave the stock a “neutral” rating in a research note on Wednesday, July 24th. Finally, HC Wainwright initiated coverage on shares of Joby Aviation in a research report on Tuesday, September 3rd. They issued a “buy” rating and a $9.00 price objective for the company.

Joby Aviation Price Performance

The firm has a 50 day moving average price of $5.45 and a 200-day moving average price of $5.22. The stock has a market capitalization of $3.63 billion, a PE ratio of -6.76 and a beta of 1.97.

Joby Aviation (NYSE:JOBY – Get Free Report) last released its quarterly earnings data on Wednesday, August 7th. The company reported ($0.18) earnings per share for the quarter, hitting analysts’ consensus estimates of ($0.18). The business had revenue of $0.28 million during the quarter, compared to analyst estimates of $0.28 million. During the same quarter in the previous year, the company earned ($0.17) EPS. Equities analysts expect that Joby Aviation, Inc. will post -0.69 earnings per share for the current fiscal year.

Insider Transactions at Joby Aviation

In other news, insider Didier Papadopoulos sold 23,188 shares of Joby Aviation stock in a transaction that occurred on Monday, July 1st. The shares were sold at an average price of $4.86, for a total transaction of $112,693.68. Following the completion of the transaction, the insider now directly owns 54,666 shares of the company’s stock, valued at approximately $265,676.76. The transaction was disclosed in a legal filing with the SEC, which is available through the SEC website. In other news, insider Kate Dehoff sold 12,500 shares of the company’s stock in a transaction that occurred on Thursday, July 11th. The stock was sold at an average price of $5.50, for a total transaction of $68,750.00. Following the completion of the transaction, the insider now directly owns 189,163 shares of the company’s stock, valued at approximately $1,040,396.50. The sale was disclosed in a filing with the SEC, which is available at this link. Also, insider Didier Papadopoulos sold 23,188 shares of the business’s stock in a transaction on Monday, July 1st. The stock was sold at an average price of $4.86, for a total transaction of $112,693.68. Following the completion of the sale, the insider now directly owns 54,666 shares of the company’s stock, valued at approximately $265,676.76. The disclosure for this sale can be found here. Insiders have sold 327,840 shares of company stock worth $1,624,660 over the last quarter. 32.40% of the stock is currently owned by insiders.

Institutional Trading of Joby Aviation

A number of institutional investors and hedge funds have recently modified their holdings of JOBY. Vanguard Group Inc. increased its holdings in Joby Aviation by 9.1% during the 1st quarter. Vanguard Group Inc. now owns 34,659,624 shares of the company’s stock worth $185,776,000 after purchasing an additional 2,889,012 shares during the period. Ieq Capital LLC increased its holdings in Joby Aviation by 68.6% in the second quarter. Ieq Capital LLC now owns 4,441,574 shares of the company’s stock valued at $22,652,000 after buying an additional 1,807,054 shares during the last quarter. Healthcare of Ontario Pension Plan Trust Fund purchased a new stake in Joby Aviation during the 1st quarter worth about $15,357,000. Lingotto Investment Management LLP boosted its position in shares of Joby Aviation by 129.8% during the 4th quarter. Lingotto Investment Management LLP now owns 2,088,980 shares of the company’s stock worth $13,892,000 after acquiring an additional 1,180,000 shares in the last quarter. Finally, Bank of New York Mellon Corp raised its position in shares of Joby Aviation by 41.8% during the 2nd quarter. Bank of New York Mellon Corp now owns 1,474,677 shares of the company’s stock worth $7,521,000 after acquiring an additional 435,069 shares in the last quarter. Hedge funds and other institutional investors own 45.54% of the company’s stock.

Joby Aviation Company Profile

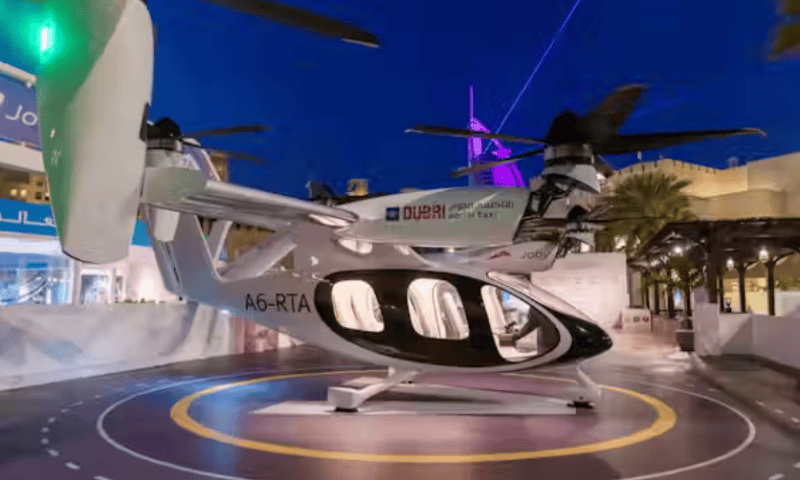

Joby Aviation, Inc, a vertically integrated air mobility company, engages in building an electric vertical takeoff and landing aircraft optimized to deliver air transportation as a service. The company intends to build an aerial ridesharing service, as well as developing an application-based platform that will enable consumers to book rides.