Stock Markets

The major stock indexes are mostly up for the week. The 30-stock Dow Jones Industrial Average (DJIA) rose by 1.62% while the Total Stock Market Index gained 1.49%. The broad-based S&P 500 Index advanced by 1.36% while the technology-heavy Nasdaq Stock Market Composite added 1.49%. The NYSE Composite climbed by 1.32%. The investor risk-perception indicator, the CBOE Volatility Index (VIX) slid by 2.48%.

The large-cap indexes climbed to record highs as investors rushed to take positions on what they perceived to be a prolonged Fed rate-cutting cycle. The rally was relatively broad. Smaller-cap indexes outperformed even while remaining below their previous highs. In particular, the small-cap Russell 2000 Index closed the week about 9% below its all-time high set in November 2021. The week prior, although the rate cut was generally expected, there was a split in opinion between whether the rate cut would amount to the more cautious 25 basis points (0/25%) or 0.50%. Initial reaction to the Fed’s decision to “go bigger” was comparatively muted, with the S&P 500 Index falling slightly before the day’s end.

U.S. Economy

For the first time in four years, the U.S. Federal Reserve, or Fed, lowered its policy rate last week. The rate cut, a larger-than-usual 0.5% or 50-basis-point reduction, signals that the monetary policy cycle has entered a critical turning point and that the Fed has adopted a proactive approach that increases the likelihood of a soft landing. The projected series of rate cuts tends to lower borrowing costs for consumers and businesses over time. The result points to reaccelerated growth in 2025.

The Commerce Department announced on Tuesday that retail sales had risen 0.1% which is more than anticipated and followed an upwardly revised growth rate of 1.1% in July. On Thursday, more evidence that consumers remained strong came in the form of a lower-than-expected weekly jobless claims report. Likewise, continuing claims dropped to their lowest level in three months.

Investors also showed interest in improving data regarding the troubled housing sector. Building permits rose by 4.9% in August, their biggest monthly gain in a year, according to the Commerce Department in a report released on Wednesday. This restores the building permits statistic to its highest level since March. On the contrary, the sales of existing homes had unexpectedly fallen by 2.5% in August, as reported by the National Association of Home Builders. Fed Chair Powell stressed that the central bank had limited influence on housing prices and easing the current tight housing supply.

Metals and Mining

Gold ended this week at a new high, but its path had been volatile and far from smooth. December gold futures last traded at $2.647.40 per ounce, higher by 1% from one week ago. Gold prices sharply rallied after the Federal Reserve cut interest rates by 50 basis points, as expected. The move signaled that rates could drop to 3% by mid-2026. In an attempt to quickly quell the market rally, Federal Reserve Chair Jerome Powell warned investors that the Fed is not in a hurry to further lower rates drastically or too son. Instead, the committee foresees that interest rates will be reduced in an orderly manner, keeping the neutral rate well above 0%. This is unlike the levels encountered during the Great Financial Crisis and the pandemic.

The spot markets for precious metals were mixed this week. Gold gained 1.71% from its close last week at $2,577.70 to its closing price this week at $2,621.88 per troy ounce. Silver added 1.50% from last week’s closing price of $30.72 to end this week at $31.18 per troy ounce. Platinum lost 1.93% from last week’s close at $998.70 to settle this week at $979.43 per troy ounce. Palladium also gave back 0.16% from its closing price last week at $1,070.73 to end this week at $1,069.01. The three-month LME prices of industrial materials were also mixed. Copper, which closed at $9,308.00 one week ago, ended at $9,476.50 per metric ton for a gain of 1.81%. Aluminum, which closed last week at $2,471.00, ended this week at $2,485.00 per metric ton to realize a gain of 0.57%. Zinc settled this week at $2,874.00 per metric ton, 1.05% lower than last week’s close of $2,904.50. Tin closed this week at $32,127.00 per metric ton, 1.01% higher than its close last week at $31,805.00.

Energy and Oil

For the second straight week, oil prices registered week-on-week gains as the WTI rebounded above $70 per barrel. It is now trading closer to the $72 per barrel resistance level. It is likely, however, that the fact that the Fed has finally initiated a new cycle of monetary easing should prompt a stronger market response. Additionally, crude oil inventories in the United States have plummeted to their lowest level in a week to post another week-on-week decline to 417.5 million barrels. Stocks were particularly drained in the Midwest where they fell to their lowest since December 2014. Next week could see further upside due to a weaker dollar and an improved macro risk outlook.

Natural Gas

For the report week from Wednesday, September 11 to Wednesday, September 18, 2024, the Henry Hub spot price rose by $0.19 from $2.14 per million British thermal units (MMBtu) to $2.333/MMBtu. Regarding the Henry Hub futures, the price of the October 2024 NYMEX contract increased by $0.01, from $2.270/MMBtu to $2.284/MMBtu for the same week. The price of the 12-month strip averaging October 2024 through September 2025 futures contracts decreased by $0.02 to $2.944/MMBtu.

International natural gas futures prices decreased for this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $0.38 to a weekly average of $13.40/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands decreased by $0.32 to a weekly average of $11.44/MMBtu. In the week last year corresponding to this report week (the week from September 13 to September 20, 2023), the prices were $13.83/MMBtu in East Asia and $11.29/MMBtu at the TTF.

World Markets

European stocks slid as the rally triggered by the Fed’s rate cut in the US was discounted by the market. The pan-European STOXX Europe 600 Index descended by 0.33%. Investors appear to have grown cautious about the monetary policy outlook moving forward, now that the long-anticipated rate cut has taken place. Major stock indexes advanced in the region. Germany’s DAX squeezed out a 0.11% increase, France’s CAC 40 Index had a more substantial gain of 0.47%, and Italy’s FTSE MIB added 0.58%. The UK’s FTSE 100 Index went in the opposite direction and lost 0.52%. The Bank of England (BoE) met expectations by holding its key policy rate at 5% after the Monetary Policy Committee voted 8-1 to adopt no change. According to Gov. Andrew Bailey, “It is vital that inflation stays low, so we need to be careful not to cut too fast or by too much,” although he expressed optimism that rates would further fall with further evidence that the inflationary pressures were cooling. Regarding the European economy, hourly wages and salaries in the Eurozone grew at an annual rate of 4.5% in the three months through June, down from a revised 5.2% in the first quarter.

Japan’s equities markets climbed this week, as the Nikkei 225 Index advanced by 3.1% and the broader TOPIX Index gained 2.8%. As the yen weakened on the U.S. Federal Reserve’s latest monetary policy decision to cut interest rates for the first time since its series of steep rate hikes, Japanese stocks benefited. The Fed delivered an outsized 50-basis-point reduction in interest rates. The Bank of Japan’s (BoJ’s) decision to leave rates unchanged on Friday further weighed on the yen, which depreciated to about JPY 143.8 against the U.S. dollar. At the end of the previous week, the currency exchange rate was around 140.8 yen versus the greenback. The yield on the 10-year Japanese government bond rose to 0.86% from 0.84% the prior week. On the economic front, Japan’s core consumer price index (CPI) for August rose by 2.8% year-on-year from 2.7% in July and generally in line with expectations. Also matching consensus was the overall CPI which rose by 3.0% up from 2.8% in July.

On this holiday-shortened week, Chinese stocks rose as the Fed’s decision to cut interest rates offset disappointing economic data released during the week. The Shanghai Composite Index added 1.21% while the blue-chip CSI 300 gained by 1.32%. The Hong Kong benchmark Hang Seng Index advanced by 5.12%. The markets this week in mainland China were closed on Monday and Tuesday for the Mid-Autumn Festival, while Hong Kong markets were closed on Wednesday but reopened on Thursday. Disappointing August data only brought into focus the slowing momentum of China’s economy. Amid weaker commodity prices and auto sales, industrial production rose by 4.5% from last year, lower than forecasted and down from July’s 5.1% increase. Expansion in retail sales was 2.1% year-on-year, compared to July’s 2.7% rise and short of expectation. The January to August fixed asset investment rose by a lower-than-expected 3.4% down from 3.6% for the same period last year. Property investment fell by 10.2% year-on-year. New home prices in 70 cities fell by 0.7% in August, unchanged from the pace of declines in the prior three months and marking the 14th consecutive monthly decline. In their overall picture, the indicators suggest that Beijing is encountering a growing risk in meeting its economic growth target of around 5% this year. Many economists therefore expect that China’s government will try to stimulate the economy by implementing further easing measures.

The Week Ahead

PCE inflation data, an analysis of consumer confidence, and a revised GDP reading are among the important economic news expected to be released in the coming week.

Key Topics to Watch

- Atlanta Fed President Raphael Bostic speaks (Sept. 23)

- S&P flash U.S. services PMI for Sept.

- S&P flash U.S. manufacturing PMI for Sept.

- Chicago Fed President Austan Goolsbee speaks (Sept. 23)

- Minneapolis Fed President Neel Kashkari speaks (Sept. 23)

- Federal Reserve Governor Michelle Bowman speaks (Sept. 24)

- S&P Case-Shiller home price index (20 cities) for July

- Consumer confidence for Sept.

- New home sales for Aug.

- Federal Reserve Governor Adriana Kugler speaks (Sept. 25)

- Initial jobless claims for Sept. 21

- Durable-goods orders for Aug.

- Durable-goods minus transportation for Aug.

- GDP (second revision) for Q2

- Federal Reserve Governor Adriana Kugler and Boston Fed President Susan Collins speak together (Sept. 26)

- Federal Reserve Governor Michelle Bowman speaks (Sept. 26)

- Federal Reserve Chair Jerome Powell gives opening remarks (Sept. 26)

- New York Fed President John Williams speaks (Sept. 26)

- Pending home sales for Aug.

- Federal Reserve Vice Chair for Supervision Michael Barr speaks (Sept. 26)

- Federal Reserve Governor Lisa Cook speaks (Sept. 26)

- Minneapolis Fed President Neel Kashkari speaks with Fed Vice Chair for Supervision Michael Barr (Sept. 26)

- Personal income for Aug.

- Personal spending for Aug.

- PCE index for Aug.

- PCE (year-over-year)

- Core PCE index for Aug.

- Core PCE (year-over-year)

- Advanced U.S. trade balance in goods for Aug.

- Advanced wholesale inventories for Aug.

- Advanced retail inventories for Aug.

- Consumer sentiment (final) for Sept.

- Federal Reserve Governor Michelle Bowman speaks (Sept. 27)

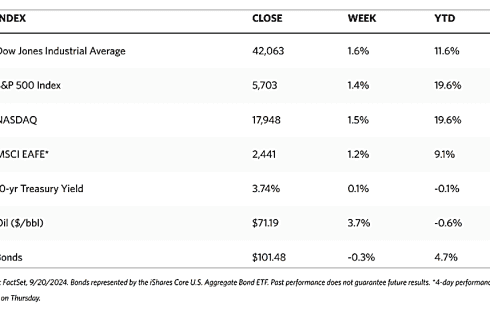

Markets Index Wrap-Up