ZURICH – A tax on the super-rich pitched by the youth wing of one of Switzerland’s main political parties is “extremely dangerous” for the country, a top Swiss banker said on Wednesday, pointing to widespread concern it had sparked among clients.

The initiative by the Young Socialists (JUSOs), the youth arm of Switzerland’s leftist Social Democrats (SP), proposes levying a 50% tax on inheritances and gifts above 50 million Swiss francs ($59.30 million).

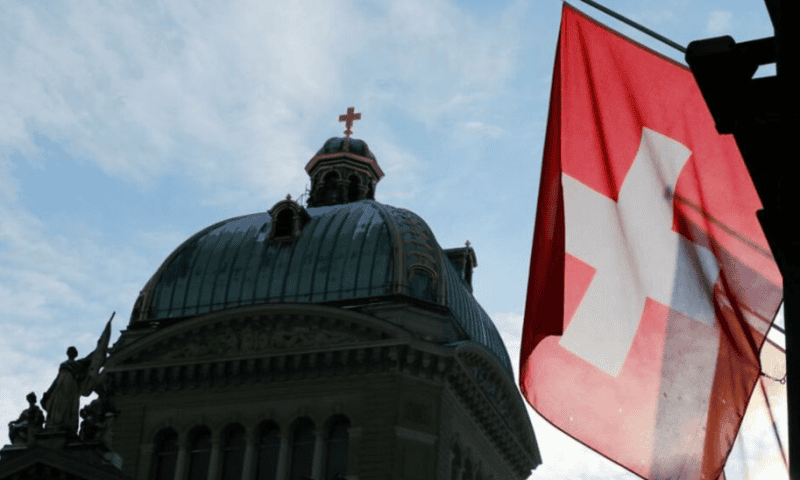

The proposal will be put to Swiss voters in a referendum, likely to take place by late 2026, after JUSOs collected enough signatures to meet the criteria for a public vote. JUSOs want the super-rich to do more to fund the battle against climate change. The Swiss government is against the tax proposal.

“This initiative, we feel for the country, is extremely dangerous on its potential consequences,” said Frederic Rochat, managing partner of private bank Lombard Odier, which manages around 320 billion Swiss francs of client assets.

“The simple fact that it exists, is being talked about, and will be voted on, is opening about two years of huge uncertainty,” he told reporters in Zurich, calling the proposal “incredibly un-Swiss”.

The referendum should take place by late 2026, JUSO president Mirjam Hostetmann told Reuters.

Rochat said the initiative had made many individuals wonder whether they should be taking “contingency measures”, which he said meant “moving out of Switzerland”.

“Since June of this year and through literally every single client meeting that we’re having with our Swiss clients and sometimes foreign clients, the JUSO initiative is the main topic that they are interested to talk about,” he added.

Switzerland’s economic prosperity, Rochat argued, rests not chiefly with its big listed companies but with its smaller and medium-sized businesses (KMUs) exporting across the globe.

“This initiative is literally a nuclear bomb within the fabric of the … best quality KMUs that we have in Switzerland, and the risk is that the owners leave.”