Hurco Companies, Inc. (NASDAQ:HURC – Get Free Report) was the target of a significant increase in short interest in the month of July. As of July 31st, there was short interest totalling 7,300 shares, an increase of 15.9% from the July 15th total of 6,300 shares. Based on an average trading volume of 24,500 shares, the short-interest ratio is presently 0.3 days. Currently, 0.1% of the shares of the stock are sold short.

Hurco Companies Stock Performance

Shares of HURC traded up $0.01 during mid-day trading on Friday, hitting $17.02. 6,451 shares of the company were exchanged, compared to its average volume of 25,166. The stock has a market cap of $111.02 million, a price-to-earnings ratio of -37.00 and a beta of 0.38. Hurco Companies has a 1-year low of $14.82 and a 1-year high of $28.20. The company has a 50 day moving average of $16.47 and a 200-day moving average of $19.27.

Hurco Companies (NASDAQ:HURC – Get Free Report) last announced its earnings results on Friday, June 7th. The scientific and technical instruments company reported ($0.61) EPS for the quarter. Hurco Companies had a negative net margin of 1.38% and a negative return on equity of 1.30%. The firm had revenue of $45.17 million for the quarter.

Insiders Place Their Bets

In other Hurco Companies news, CFO Sonja K. Mcclelland purchased 1,950 shares of the business’s stock in a transaction that occurred on Tuesday, July 9th. The stock was purchased at an average price of $15.32 per share, for a total transaction of $29,874.00. Following the purchase, the chief financial officer now directly owns 81,266 shares in the company, valued at $1,244,995.12. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Over the last quarter, insiders bought 2,915 shares of company stock worth $44,565. Company insiders own 7.20% of the company’s stock.

Institutional Inflows and Outflows

An institutional investor recently bought a new position in Hurco Companies stock. George Kaiser Family Foundation purchased a new position in shares of Hurco Companies, Inc. (NASDAQ:HURC – Free Report) in the second quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor purchased 19,241 shares of the scientific and technical instruments company’s stock, valued at approximately $294,000. Hurco Companies accounts for 0.1% of George Kaiser Family Foundation’s investment portfolio, making the stock its 17th biggest holding. George Kaiser Family Foundation owned about 0.30% of Hurco Companies as of its most recent filing with the Securities and Exchange Commission. Hedge funds and other institutional investors own 74.36% of the company’s stock.

Analyst Upgrades and Downgrades

Separately, StockNews.com lowered shares of Hurco Companies from a “hold” rating to a “sell” rating in a report on Thursday, June 6th.

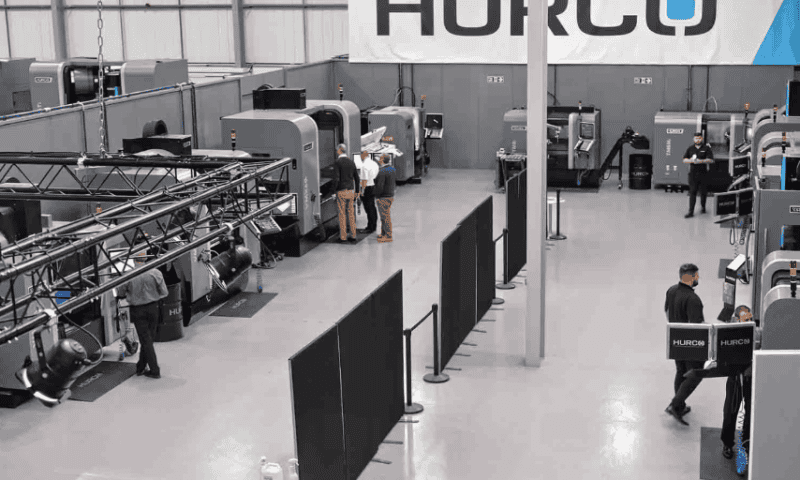

About Hurco Companies

Hurco Companies, Inc, an industrial technology company, designs, manufactures, and sells computerized machine tools to companies in the metal cutting industry worldwide. Its principal products include general-purpose computerized machine tools, including vertical and horizontal machining centers, turning centers, and toolroom machines.