This year’s rally for technology stocks hasn’t been broad-based. Analysts see opportunities among some of the software companies that have been left behind.

U.S. stocks have staged quite a rally this year, with a 17.7% return for the S&P 500, led by a 34.2% return for its information-technology sector, both with dividends reinvested. However, some companies in the tech sector have been left behind — and this may help investors looking for bargains.

You are probably aware that the S&P 500 is weighted by market capitalization and has become rather concentrated. The largest three companies by this measure — Microsoft Corp. MSFT, Apple Inc. AAPL and Nvidia Corp. NVDA — now make up 21% of the SPDR S&P 500 ETF Trust .

So far this year the S&P 500 software-industry group — made up of 18 companies, as defined by FactSet — has returned 18.8%. That is ahead of the full S&P 500 but way behind the tech sector. Microsoft had a very large weighting within this industry group as of Dec. 31: 62%. By this measure, Microsoft has contributed 15.2% of this industry group’s total return in 2024.

If we look at the 18 companies in the S&P 500 software-industry group individually, eight have returned 15% or more this year, led by CrowdStrike Holdings Inc. CRWD, with a 53% return; Oracle Corp. ORCL, up 39%; Fair Isaac Corp. FICO, up 31%; and Microsoft, with a 24% return.

The standouts among S&P 500 software companies showing declines this year have been Salesforce Inc. CRM, with a 2% decline and Adobe Inc. ADBE, down 4%.

A broader screen for software rebound stock plays

For a larger list of software companies, we looked at the S&P Composite 1500 Index , which is made up of the S&P 500, the S&P MidCap 400 Index and the S&P Small Cap 600 Index .

There are 46 companies in the S&P 1500 software-industry group, and 39 of them are covered by at least five analysts polled by FactSet, with consensus sales and earnings estimates available through 2026.

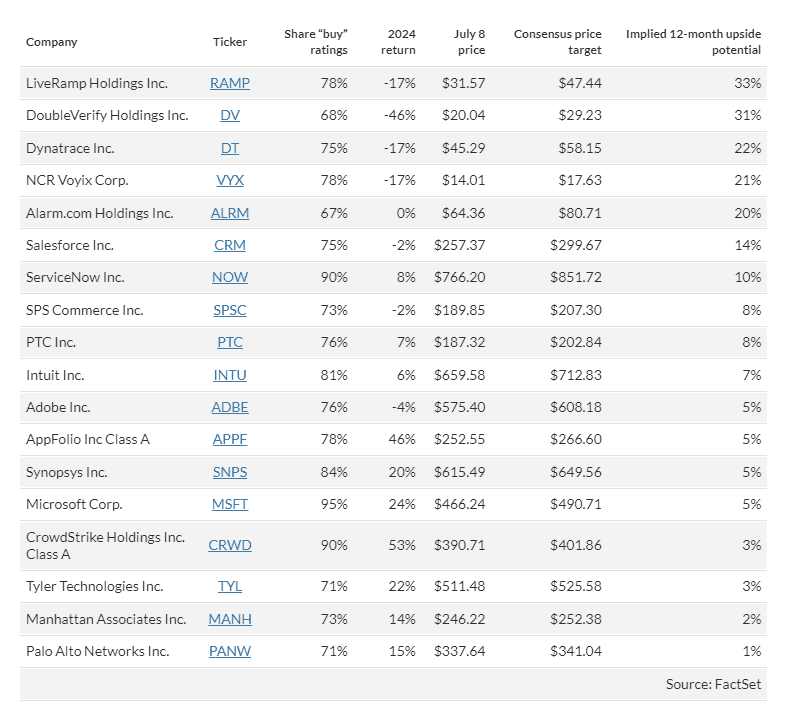

Among these 39 companies,18 are rated “buy” or its equivalent by at least two-thirds of the analysts. Here they are, sorted by the 12-month upside potential for the stocks implied by the consensus price targets:

Click the tickers for more about each company, including news coverage and financials.

Microsoft has “buy” ratings from 95% of the analysts, but the consensus price target is only 5% above Monday’s closing price.

The top four companies on the list have seen the largest declines so far this year. All are expected to bounce by double digits over the next 12 months.

Shares of Salesforce sank 20% on May 30 to close at $218.01, after the company reported earnings and provided guidance for subscription-revenue growth that was lower than analysts had expected. The company left its annual revenue forecast unchanged, which Ken Laudan, the portfolio manager of the Buffalo Large Cap Fund, said was a mistake during an interview with MarketWatch late last month.

Laudan said the decline in Salesforce’s share price had led him to consider buying more of the stock because he expected the company to grow its revenue at a pace of 8% to 10% over the next five years. The company, he said, will grow its earnings per share by “double digits.”

Through Monday, shares of Salesforce had risen to $257.37, down only 5% from their close on May 29, before the earnings report.

Adobe saw a more positive reaction when it reported quarterly results on June 13 that beat analysts’ estimates and reversed a year-to-date decline in its shares.

On June 14, Jefferies analyst Brent Thill reiterated his “Buy” rating for Adobe, with a $700 price target — 15% higher than the consensus price target for the stock. Thill wrote in a note to clients that Adobe’s price increases were turning from a headwind during the first half of 2024 to a tailwind and that it was “upselling customers to higher tiers with more AI.”

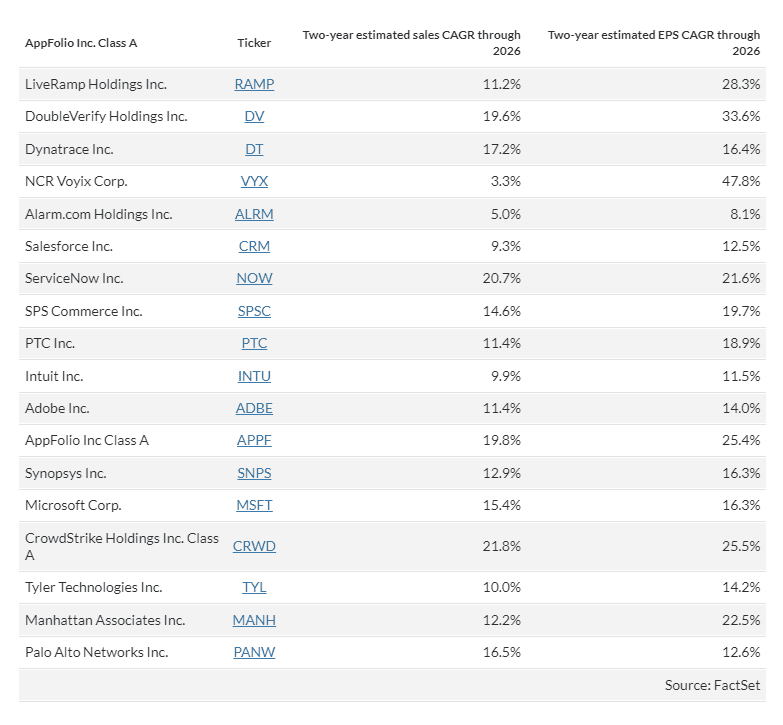

Data supplement — expected growth rates for sales and earnings per share

Starting with consensus estimates among analysts working for brokerage firms, FactSet makes adjustments to arrive at calendar-year estimates for sales and earnings per share for companies whose fiscal years don’t match the calendar.

Using the adjusted estimates and leaving the group in the same order, here are expected compound annual growth rates (CAGR) for revenue and EPS from 2024 through 2026.

In comparison, the S&P 500 is expected to show a weighted sales two-year revenue CAGR of 5.7% and an EPS CAGR of 12.9%. For the S&P 500 software-industry group, the expected two-year sales CAGR is expected to be 14.2%, with an EPS CAGR of 15.9%.