Alexander & Baldwin, Inc. (NYSE:ALEX – Get Free Report) was the target of a large growth in short interest during the month of June. As of June 15th, there was short interest totalling 623,700 shares, a growth of 41.3% from the May 31st total of 441,300 shares. Based on an average daily trading volume, of 279,900 shares, the short-interest ratio is presently 2.2 days. Currently, 0.9% of the company’s shares are short sold.

Hedge Funds Weigh In On Alexander & Baldwin

Several institutional investors have recently bought and sold shares of the company. Central Pacific Bank Trust Division purchased a new position in shares of Alexander & Baldwin in the first quarter valued at approximately $32,000. Allspring Global Investments Holdings LLC purchased a new position in Alexander & Baldwin in the 1st quarter valued at approximately $41,000. Federated Hermes Inc. grew its stake in shares of Alexander & Baldwin by 88.5% in the fourth quarter. Federated Hermes Inc. now owns 2,641 shares of the financial services provider’s stock worth $50,000 after acquiring an additional 1,240 shares in the last quarter. Quadrant Capital Group LLC grew its stake in shares of Alexander & Baldwin by 171.6% in the fourth quarter. Quadrant Capital Group LLC now owns 3,533 shares of the financial services provider’s stock worth $67,000 after acquiring an additional 2,232 shares in the last quarter. Finally, EntryPoint Capital LLC purchased a new stake in shares of Alexander & Baldwin during the first quarter worth $108,000. 91.29% of the stock is owned by institutional investors and hedge funds.

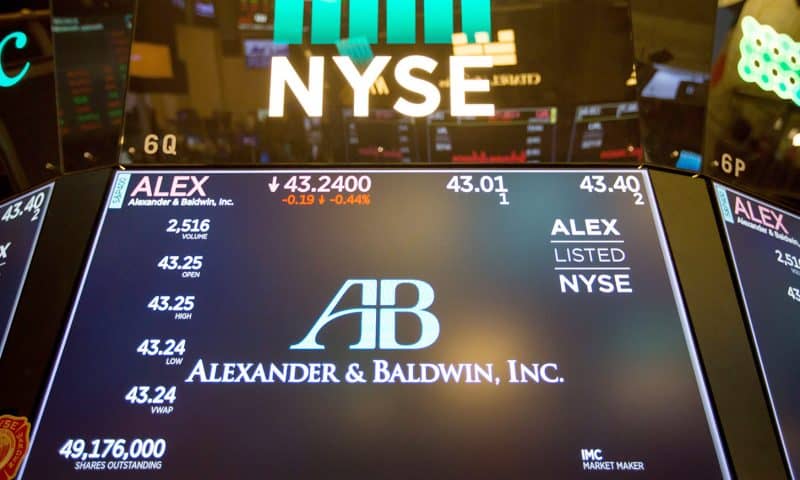

Alexander & Baldwin Trading Down 0.8 %

Shares of ALEX stock traded down $0.13 during trading hours on Monday, hitting $16.83. The company had a trading volume of 321,217 shares, compared to its average volume of 309,367. The company has a debt-to-equity ratio of 0.45, a current ratio of 0.38 and a quick ratio of 0.38. The stock has a market capitalization of $1.22 billion, a PE ratio of 27.57 and a beta of 1.26. The company’s fifty day moving average is $16.58 and its 200 day moving average is $17.00. Alexander & Baldwin has a fifty-two week low of $15.53 and a fifty-two week high of $19.99.

Alexander & Baldwin (NYSE:ALEX – Get Free Report) last announced its earnings results on Thursday, April 25th. The financial services provider reported $0.28 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of $0.25 by $0.03. Alexander & Baldwin had a return on equity of 4.76% and a net margin of 20.25%. The company had revenue of $61.20 million for the quarter, compared to analyst estimates of $51.55 million. During the same quarter in the previous year, the company earned $0.29 earnings per share. Research analysts expect that Alexander & Baldwin will post 1.15 earnings per share for the current fiscal year.

Alexander & Baldwin Cuts Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, July 8th. Investors of record on Friday, June 14th will be issued a dividend of $0.222 per share. This represents a $0.89 dividend on an annualized basis and a yield of 5.28%. The ex-dividend date is Friday, June 14th. Alexander & Baldwin’s dividend payout ratio (DPR) is 145.90%.

Analyst Ratings Changes

Separately, Piper Sandler decreased their price target on Alexander & Baldwin from $19.00 to $17.00 and set a “neutral” rating on the stock in a research note on Thursday, March 14th. Three equities research analysts have rated the stock with a hold rating and one has given a buy rating to the company’s stock. According to data from MarketBeat, the stock has an average rating of “Hold” and an average price target of $18.50.

Alexander & Baldwin Company Profile

Alexander & Baldwin, Inc NYSE: ALEX (A&B) is the only publicly-traded real estate investment trust to focus exclusively on Hawai’i commercial real estate and is the state’s largest owner of grocery-anchored, neighborhood shopping centers. A&B owns, operates and manages approximately 3.9 million square feet of commercial space in Hawai’i, including 22 retail centers, 13 industrial assets and four office properties, as well as 142.0 acres of ground lease assets.